Question: do part c please Case 3 PEACHTREE SECURITIES, INC. (B) Bond and Stock Valuation Directed Laura Donahue, the recently hired utility analyst for Peachtree Securities,

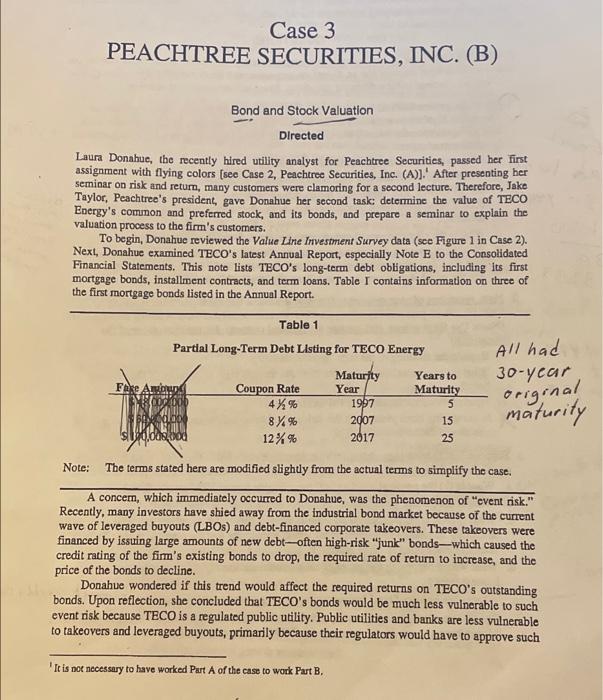

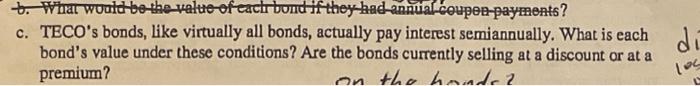

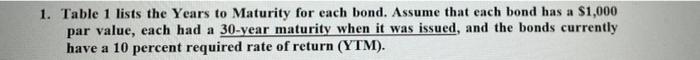

Case 3 PEACHTREE SECURITIES, INC. (B) Bond and Stock Valuation Directed Laura Donahue, the recently hired utility analyst for Peachtree Securities, passed her first assignment with flying colors (see Case 2, Peachtree Securities, Inc. (A)].' After presenting her seminar on risk and return, many customers were clamoring for a second lecture. Therefore, Jako Taylor, Peachtree's president, gave Donahue her second taskc determine the value of TECO Energy's common and preferred stock, and its bonds, and prepare a seminar to explain the valuation process to the firm's customers. To begin, Donahue reviewed the Value Line Investment Survey data (see Figure 1 in Case 2). Next, Donahue examined TECO's latest Annual Report, especially Note E to the Consolidated Financial Statements. This note lists TECO's long-term debt obligations, including its first mortgage bonds, installment contracts, and term loans. Table I contains information on three of the first mortgage bonds listed in the Annual Report. Table 1 Partial Long-Term Debt Listing for TECO Energy Faxe Arr Coupon Rate 4 %% 87% 12 %% Maturity Year 1997 2007 2017 Years to Maturity 5 15 25 All had 30-year original maturity s.ON Note: The terms stated here are modified slightly from the actual terms to simplify the case, A concern, which immediately occurred to Donahue, was the phenomenon of "event risk." Recently, many investors have shied away from the industrial bond market because of the current wave of leveraged buyouts (LBOs) and debt-financed corporate takeovers. These takeovers were financed by issuing large amounts of new debt-often high-risk "junk" bonds-which caused the credit rating of the firm's existing bonds to drop, the required rate of return to increase, and the price of the bonds to decline. Donahue wondered if this trend would affect the required returns on TECO's outstanding bonds. Upon reflection, she concluded that TECO's bonds would be much less vulnerable to such event risk because TECO is a regulated public utility. Public utilities and banks are less vulnerable to takeovers and leveraged buyouts, primarily because their regulators would have to approve such It is not necessary to have worked Part A of the case to work Part B. b. What would be the value of each bond if they had annual coupen-payments? c. TECO's bonds, like virtually all bonds, actually pay interest semiannually. What is each bond's value under these conditions? Are the bonds currently selling at a discount or at a premium? on the hounds? a log 1. Table 1 lists the Years to Maturity for each bond. Assume that each bond has a $1,000 par value, each had a 30-year maturity when it was issued, and the bonds currently have a 10 percent required rate of return (YTM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts