Question: DO QUESTION 2 AND BONUS ONLY 1) On Aug 15th,2016, you are offered the following bond: - Face value $250 (par value) - Coupon rate

DO QUESTION 2 AND BONUS ONLY

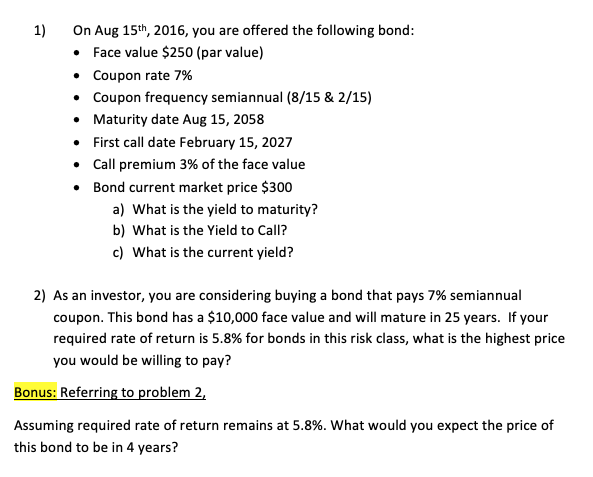

1) On Aug 15th,2016, you are offered the following bond: - Face value $250 (par value) - Coupon rate 7\% - Coupon frequency semiannual (8/15 \& 2/15) - Maturity date Aug 15, 2058 - First call date February 15, 2027 - Call premium 3% of the face value - Bond current market price $300 a) What is the yield to maturity? b) What is the Yield to Call? c) What is the current yield? 2) As an investor, you are considering buying a bond that pays 7% semiannual coupon. This bond has a $10,000 face value and will mature in 25 years. If your required rate of return is 5.8% for bonds in this risk class, what is the highest price you would be willing to pay? onus: Referring to problem 21 ssuming required rate of return remains at 5.8\%. What would you expect the price of his bond to be in 4 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts