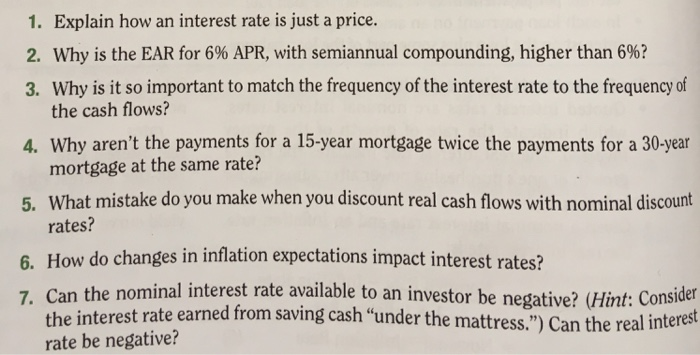

Question: Do questions 1-7 please . Well written responses 1. Explain how an interest rate is just a price. 2, Why is the EAR for 6%

1. Explain how an interest rate is just a price. 2, Why is the EAR for 6% APR, with semiannual compounding, higher than 6%? 3. Why is it so important to match the frequency of the interest rate to the frequency of 4. Why aren't the payments for a 15-year mortgage twice the payments for a 30-year 5. What mistake do you make when you discount real cash flows with nominal discount es in inflation expectations impact interest rates? t rate earned from saving cash "under the mattress.") Can t the cash flows? mortgage at the same rate? rates? 6. How do chang 7. Can the no minal interest rate available to an investor be negative? (Hint: Consider he real interest rate be negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts