Question: Do questions 60 (tax return) and 64 (critical thinking). For the tax return, obtain Form 1040 from the IRS website (www.irs.gov) including the instructions on

Do questions 60 (tax return) and 64 (critical thinking).

For the tax return, obtain Form 1040 from the IRS website (www.irs.gov) including the instructions on how to fill this form. Use the fillable PDF form. No software to use please.

pg 64

pg 64 pg 60

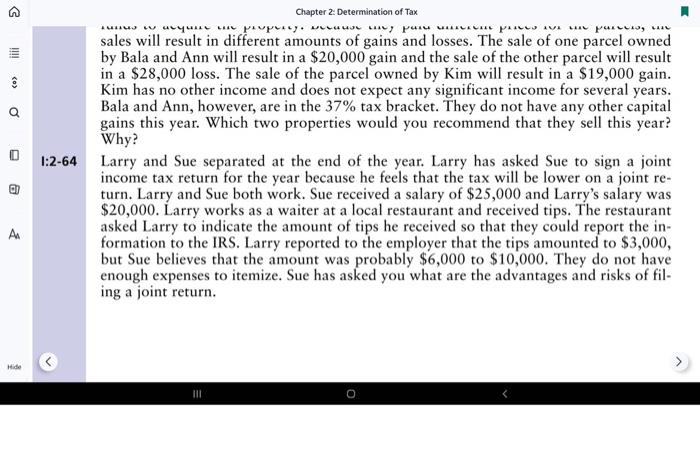

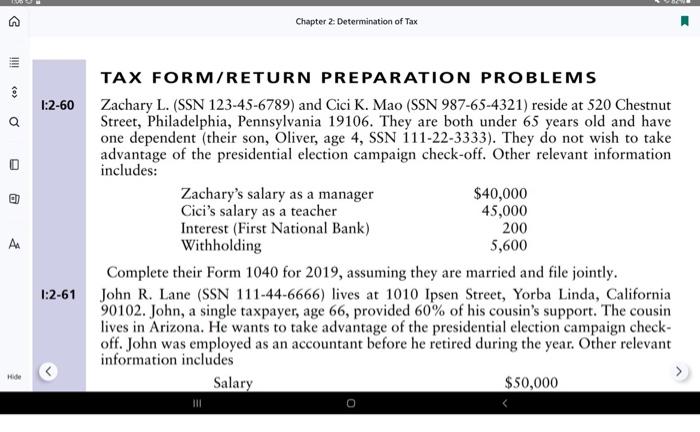

pg 60A III a D Chapter 2: Determination of Tax unus w ury povpray cu .., paru VI. p. v ... purus, sales will result in different amounts of gains and losses. The sale of one parcel owned by Bala and Ann will result in a $20,000 gain and the sale of the other parcel will result in a $28,000 loss. The sale of the parcel owned by Kim will result in a $19,000 gain. Kim has no other income and does not expect any significant income for several years. Bala and Ann, however, are in the 37% tax bracket. They do not have any other capital gains this year. Which two properties would you recommend that they sell this year? Why? 1:2-64 Larry and Sue separated at the end of the year. Larry has asked Sue to sign a joint income tax return for the year because he feels that the tax will be lower on a joint re- turn. Larry and Sue both work. Sue received a salary of $25,000 and Larry's salary was $20,000. Larry works as a waiter at a local restaurant and received tips. The restaurant asked Larry to indicate the amount of tips he received so that they could report the in- formation to the IRS. Larry reported to the employer that the tips amounted to $3,000, but Sue believes that the amount was probably $6,000 to $10,000. They do not have enough expenses to itemize. Sue has asked you what are the advantages and risks of fil- ing a joint return. OI AM Hide A Chapter 2 Determination of Tax II!! D @i TAX FORM/RETURN PREPARATION PROBLEMS 1:2-60 Zachary L. (SSN 123-45-6789) and Cici K. Mao (SSN 987-65-4321) reside at 520 Chestnut Street, Philadelphia, Pennsylvania 19106. They are both under 65 years old and have one dependent (their son, Oliver, age 4, SSN 111-22-3333). They do not wish to take advantage of the presidential election campaign check-off. Other relevant information includes: Zachary's salary as a manager $40,000 Cici's salary as a teacher 45,000 Interest (First National Bank) 200 Withholding 5,600 Complete their Form 1040 for 2019, assuming they are married and file jointly. 1:2-61 John R. Lane (SSN 111-44-6666) lives at 1010 Ipsen Street, Yorba Linda, California 90102. John, a single taxpayer, age 66, provided 60% of his cousin's support. The cousin lives in Arizona. He wants to take advantage of the presidential election campaign check- off. John was employed as an accountant before he retired during the year. Other relevant information includes Salary $50,000 AA Hide A III a D Chapter 2: Determination of Tax unus w ury povpray cu .., paru VI. p. v ... purus, sales will result in different amounts of gains and losses. The sale of one parcel owned by Bala and Ann will result in a $20,000 gain and the sale of the other parcel will result in a $28,000 loss. The sale of the parcel owned by Kim will result in a $19,000 gain. Kim has no other income and does not expect any significant income for several years. Bala and Ann, however, are in the 37% tax bracket. They do not have any other capital gains this year. Which two properties would you recommend that they sell this year? Why? 1:2-64 Larry and Sue separated at the end of the year. Larry has asked Sue to sign a joint income tax return for the year because he feels that the tax will be lower on a joint re- turn. Larry and Sue both work. Sue received a salary of $25,000 and Larry's salary was $20,000. Larry works as a waiter at a local restaurant and received tips. The restaurant asked Larry to indicate the amount of tips he received so that they could report the in- formation to the IRS. Larry reported to the employer that the tips amounted to $3,000, but Sue believes that the amount was probably $6,000 to $10,000. They do not have enough expenses to itemize. Sue has asked you what are the advantages and risks of fil- ing a joint return. OI AM Hide A Chapter 2 Determination of Tax II!! D @i TAX FORM/RETURN PREPARATION PROBLEMS 1:2-60 Zachary L. (SSN 123-45-6789) and Cici K. Mao (SSN 987-65-4321) reside at 520 Chestnut Street, Philadelphia, Pennsylvania 19106. They are both under 65 years old and have one dependent (their son, Oliver, age 4, SSN 111-22-3333). They do not wish to take advantage of the presidential election campaign check-off. Other relevant information includes: Zachary's salary as a manager $40,000 Cici's salary as a teacher 45,000 Interest (First National Bank) 200 Withholding 5,600 Complete their Form 1040 for 2019, assuming they are married and file jointly. 1:2-61 John R. Lane (SSN 111-44-6666) lives at 1010 Ipsen Street, Yorba Linda, California 90102. John, a single taxpayer, age 66, provided 60% of his cousin's support. The cousin lives in Arizona. He wants to take advantage of the presidential election campaign check- off. John was employed as an accountant before he retired during the year. Other relevant information includes Salary $50,000 AA Hide

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts