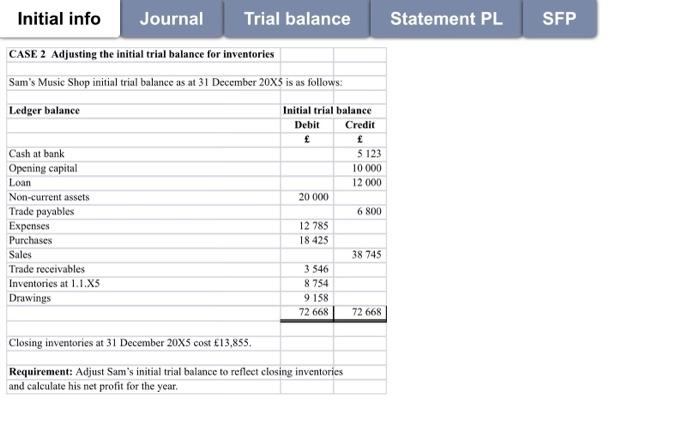

Question: Do the case study Initial info Journal Trial balance CASE 2 Adjusting the initial trial balance for inventories Sam's Music Shop initial trial balance as

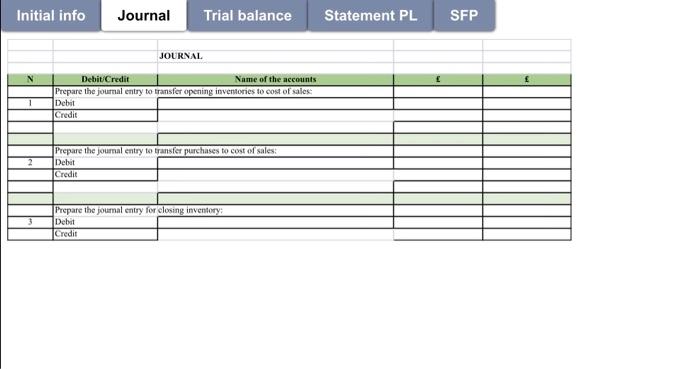

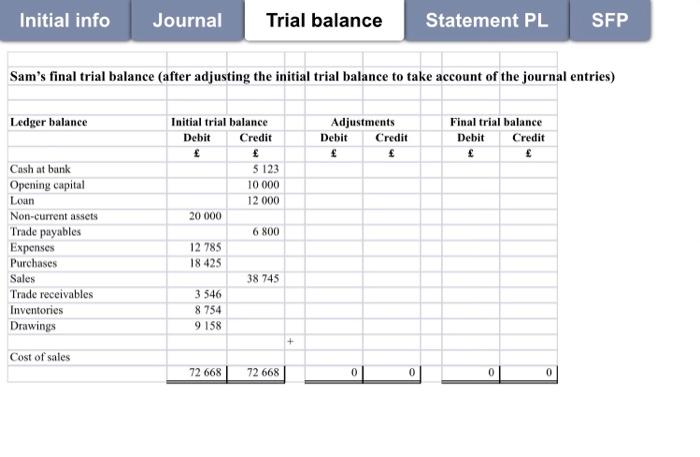

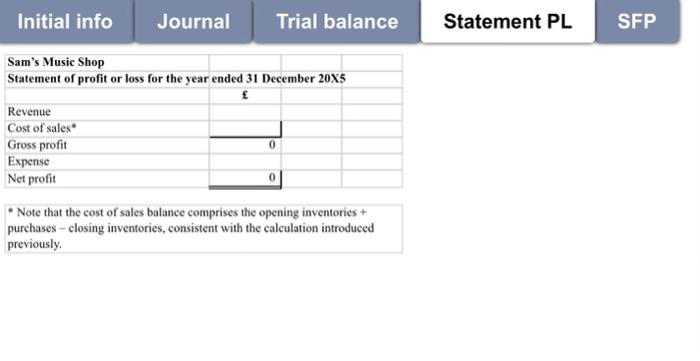

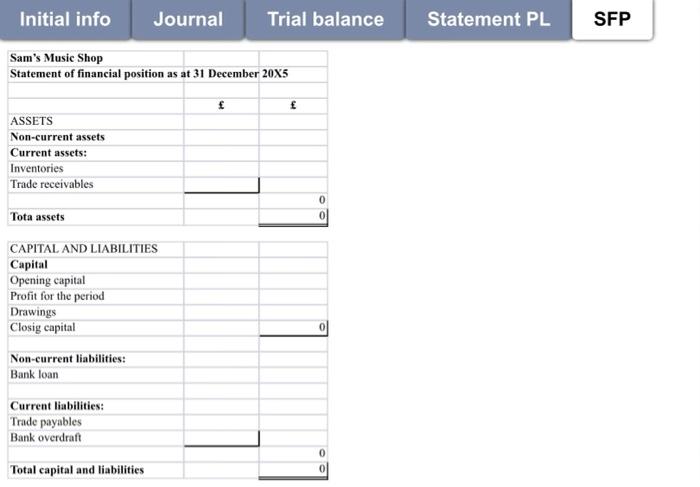

Initial info Journal Trial balance CASE 2 Adjusting the initial trial balance for inventories Sam's Music Shop initial trial balance as at 31 December 20X5 is as follows: Ledger balance Initial trial balance Debit Credit Cash at bank Opening capital Loan Non-current assets 20 000 Trade payables Expenses 12 785 Purchases 18 425 Sales Trade receivables 3546 8 754 Inventories at 1.1.XS Drawings 9158 72 668 Closing inventories at 31 December 20X5 cost 13,855. Requirement: Adjust Sam's initial trial balance to reflect closing inventories and calculate his net profit for the year. 5 123 10 000 12 000 6800 38 745 72 668 Statement PL SFP Initial info N 1 2 3 Journal Trial balance JOURNAL Debit/Credit Name of the accounts Prepare the journal entry to transfer opening inventories to cost of sales: Debit Credit Prepare the journal entry to transfer purchases to cost of sales: Debit Credit Prepare the journal entry for closing inventory: Debit Credit Statement PL SFP Initial info Journal Trial balance Statement PL SFP Sam's final trial balance (after adjusting the initial trial balance to take account of the journal entries) Ledger balance Initial trial balance i Adjustments Final trial balance Credit Debit Credit Debit Cash at bank 5 123 10 000 Opening capital Loan 12 000 Non-current assets Trade payables 6 800 Expenses Purchases Sales 38 745 Trade receivables Inventories Drawings Cost of sales 20 000 12 785 18 425 3 546 8 754 9158 72 668 72 668 + Debit 0 Credit 0 0 0 Initial info Journal Sam's Music Shop Statement of profit or loss for the year ended 31 December 20X5 Revenue Cost of sales Gross profit 0 Expense Net profit *Note that the cost of sales balance comprises the opening inventories + purchases - closing inventories, consistent with the calculation introduced previously. Trial balance Statement PL SFP Journal Sam's Music Shop Statement of financial position as at 31 December 20X5 ASSETS Non-current assets Current assets: Inventories Trade receivables Tota assets CAPITAL AND LIABILITIES Capital Opening capital Profit for the period Drawings Closig capital Non-current liabilities: Bank loan Current liabilities: Trade payables Bank overdraft Total capital and liabilities Initial info Trial balance 0 0 0 Statement PL SFP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts