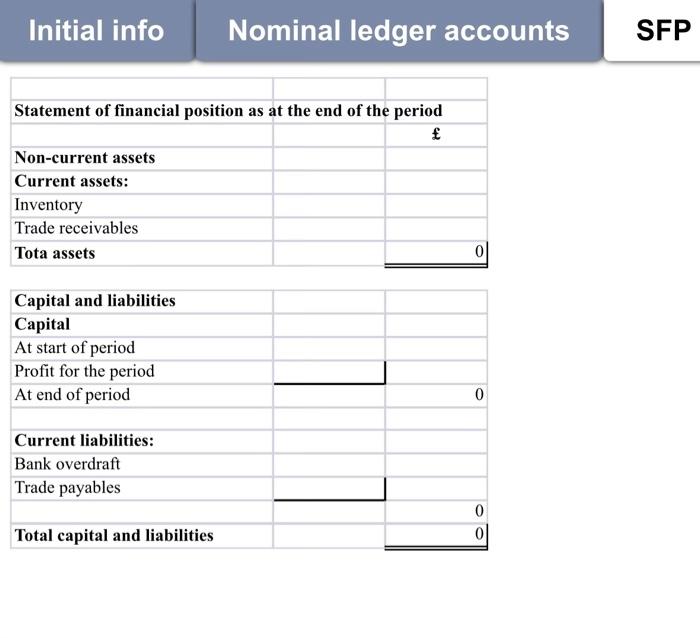

Question: Do the case study Nominal ledger accounts Initial info Statement of financial position as at the end of the period Non-current assets Current assets: Inventory

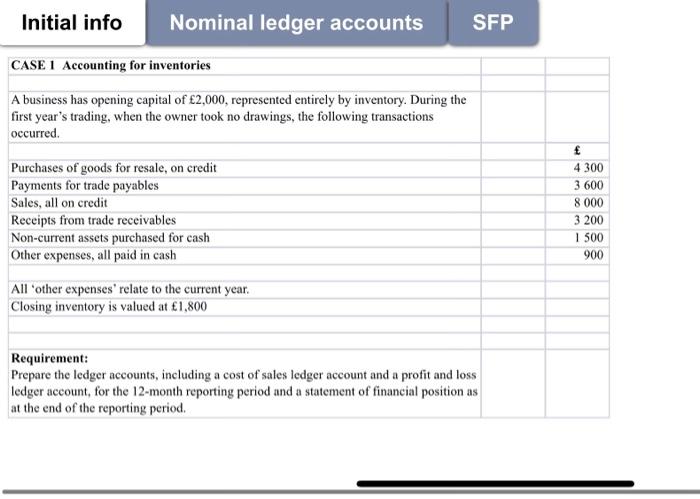

Nominal ledger accounts Initial info Statement of financial position as at the end of the period Non-current assets Current assets: Inventory Trade receivables Tota assets Capital and liabilities Capital At start of period Profit for the period At end of period Current liabilities: Bank overdraft Trade payables Total capital and liabilities 0 0 0 0 SFP Nominal ledger accounts CASH AT BANK 3200 Trade payables 2 800 Non-comenta Other expemes 6000 Balance bid Initial info nal ledger accounts Trade receivables Balance eld Balance d Trade payable Inventory (opening inventory Purchases Profit and lo 10) Cash at bank account Balance bid Cost of sales Gross profit d Other expenses Net profit (ransferred to capital account) CAPITAL 4600 Inventory Profit and loss 4600 Balance d PURCHASES ACCOUNT 4300 Cost of sales 4300 COST OF SALES 2000 Inventory (closing inventory) 4300 Profit and los 6.300 SALES 8.000 Trade receivables 8000 NON-CURRENT ASSETS 1500 Balance ed 1500 1500 PROFIT AND LOSS LEDGER ACCOUNT 4500 Sales 3500 8000 900 Gross profit bid 2600 3500 SFP 3.600 1500 900 6000 2800 2000 2600 4600 4600 300 4300 1800 4500 6300 8.000 8000 1500 1500 8000 8.000 3500 3500 Cash at bank account Balance d Sales Capital Cet of sales (long) Balance hid Cash at hank account TRADE PAYABLES 3000 Purchases Balmorbid TRADE RECEIVABLES 000C at hanka Balance d 000 INVENTORY 2000 Cost of sales topening inventory) alanceding inventory) 300 OTHER EXPENSES 900 Pot and lass 900 4300 4300 3200 4.500 000 1900 2000 400 SFP Initial info Nominal ledger accounts CASE 1 Accounting for inventories A business has opening capital of 2,000, represented entirely by inventory. During the first year's trading, when the owner took no drawings, the following transactions occurred. Purchases of goods for resale, on credit Payments for trade payables Sales, all on credit Receipts from trade receivables Non-current assets purchased for cash Other expenses, all paid in cash All 'other expenses' relate to the current year. Closing inventory is valued at 1,800 Requirement: Prepare the ledger accounts, including a cost of sales ledger account and a profit and loss ledger account, for the 12-month reporting period and a statement of financial position as at the end of the reporting period. 4 300 3.600 8.000 3 200 1 500 900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts