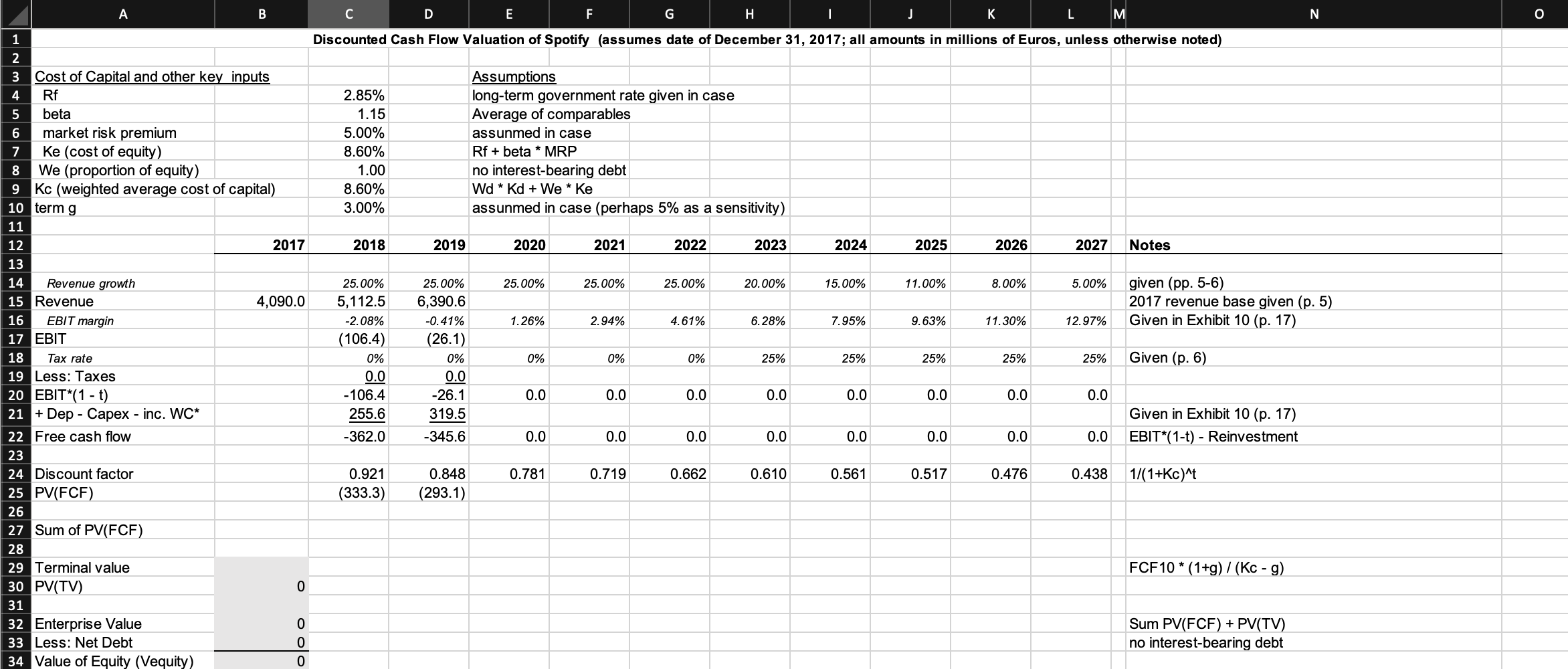

Question: Do the following valuation analysis: Complete the DCF analysis in the spreadsheet posted. What is the estimated value per share? A B D E F

- Do the following valuation analysis:

- Complete the DCF analysis in the spreadsheet posted. What is the estimated value per share?

-

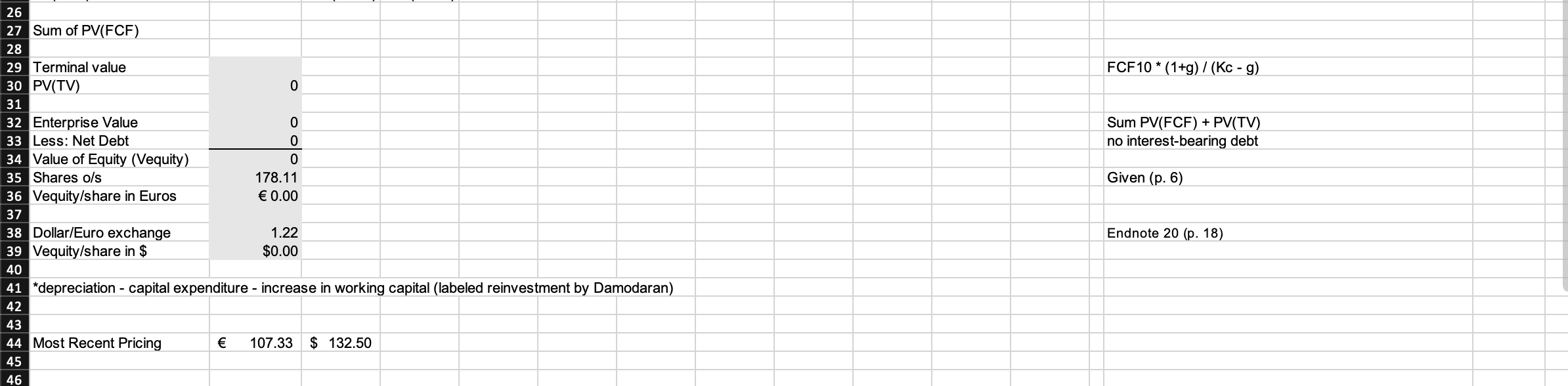

A B D E F J L M N O 3 1 Discounted Cash Flow Valuation of Spotify (assumes date of December 31, 2017; all amounts in millions of Euros, unless otherwise noted) 2 3 Cost of Capital and other key inputs Assumptions 4 Rf 2.85% long-term government rate given in case 5 beta 1.15 Average of comparables 6 market risk premium 5.00% assunmed in case 7 Ke (cost of equity) 8.60% Rf + beta * MRP 8 We (proportion of equity) 1.00 no interest-bearing debt 9 Kc (weighted average cost of capital) 8.60% Wd * Kd + We * Ke 10 term g 3.00% assunmed in case (perhaps 5% as a sensitivity) 11 12 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Notes 13 14 Revenue growth 25.00% 25.00% 25.00% 25.00% 25.00% 20.00% 15.00% 11.00% 8.00% 5.00% given (pp. 5-6) 15 Revenue 4,090.0 5,112.5 6,390.6 2017 revenue base given (p.5) 16 EBIT margin -2.08% -0.41% 1.26% 2.94% 4.61% 6.28% 7.95% 9.63% 11.30% 12.97% Given in Exhibit 10 (p. 17) 17 EBIT (106.4) (26.1) 18 Tax rate 0% 0% 0% 0% 0% 25% 25% 25% 25% 25% Given (p. 6) 19 Less: Taxes 0.0 0.0 20 EBIT*(1 - t) -106.4 -26.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 21 + Dep - Capex - inc. WC* 255.6 319.5 Given in Exhibit 10 (p. 17) 22 Free cash flow -362.0 -345.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 EBIT*(1-t) - Reinvestment 23 24 Discount factor 0.921 0.848 0.781 0.719 0.662 0.610 0.561 0.517 0.476 0.438 1/(1+Kc)^t 25 PV(FCF) (333.3) (293.1) 26 27 Sum of PV(FCF) 28 29 Terminal value FCF10 * (1+g) 7 (Kc - g) 30 PV(TV) 0 31 32 Enterprise Value Sum PV(FCF) + PV(TV) 33 Less: Net Debt no interest-bearing debt 34 Value of Equity (Vequity) FCF10 * (1+g) / (Kc- g) Sum PV(FCF) + PV(TV) no interest-bearing debt Given (p. 6) 26 27 Sum of PV(FCF) 28 29 Terminal value 30 PV(TV) 0 31 32 Enterprise Value 0 33 Less: Net Debt 0 34 Value of Equity (Vequity) 0 35 Shares o/s 178.11 36 Vequity/share in Euros 0.00 37 38 Dollar/Euro exchange 1.22 39 Vequity/share in $ $0.00 40 41 *depreciation - capital expenditure - increase in working capital (labeled reinvestment by Damodaran) 42 43 44 Most Recent Pricing 107.33 $ 132.50 45 46 Endnote 20 (p. 18) A B D E F J L M N O 3 1 Discounted Cash Flow Valuation of Spotify (assumes date of December 31, 2017; all amounts in millions of Euros, unless otherwise noted) 2 3 Cost of Capital and other key inputs Assumptions 4 Rf 2.85% long-term government rate given in case 5 beta 1.15 Average of comparables 6 market risk premium 5.00% assunmed in case 7 Ke (cost of equity) 8.60% Rf + beta * MRP 8 We (proportion of equity) 1.00 no interest-bearing debt 9 Kc (weighted average cost of capital) 8.60% Wd * Kd + We * Ke 10 term g 3.00% assunmed in case (perhaps 5% as a sensitivity) 11 12 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Notes 13 14 Revenue growth 25.00% 25.00% 25.00% 25.00% 25.00% 20.00% 15.00% 11.00% 8.00% 5.00% given (pp. 5-6) 15 Revenue 4,090.0 5,112.5 6,390.6 2017 revenue base given (p.5) 16 EBIT margin -2.08% -0.41% 1.26% 2.94% 4.61% 6.28% 7.95% 9.63% 11.30% 12.97% Given in Exhibit 10 (p. 17) 17 EBIT (106.4) (26.1) 18 Tax rate 0% 0% 0% 0% 0% 25% 25% 25% 25% 25% Given (p. 6) 19 Less: Taxes 0.0 0.0 20 EBIT*(1 - t) -106.4 -26.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 21 + Dep - Capex - inc. WC* 255.6 319.5 Given in Exhibit 10 (p. 17) 22 Free cash flow -362.0 -345.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 EBIT*(1-t) - Reinvestment 23 24 Discount factor 0.921 0.848 0.781 0.719 0.662 0.610 0.561 0.517 0.476 0.438 1/(1+Kc)^t 25 PV(FCF) (333.3) (293.1) 26 27 Sum of PV(FCF) 28 29 Terminal value FCF10 * (1+g) 7 (Kc - g) 30 PV(TV) 0 31 32 Enterprise Value Sum PV(FCF) + PV(TV) 33 Less: Net Debt no interest-bearing debt 34 Value of Equity (Vequity) FCF10 * (1+g) / (Kc- g) Sum PV(FCF) + PV(TV) no interest-bearing debt Given (p. 6) 26 27 Sum of PV(FCF) 28 29 Terminal value 30 PV(TV) 0 31 32 Enterprise Value 0 33 Less: Net Debt 0 34 Value of Equity (Vequity) 0 35 Shares o/s 178.11 36 Vequity/share in Euros 0.00 37 38 Dollar/Euro exchange 1.22 39 Vequity/share in $ $0.00 40 41 *depreciation - capital expenditure - increase in working capital (labeled reinvestment by Damodaran) 42 43 44 Most Recent Pricing 107.33 $ 132.50 45 46 Endnote 20 (p. 18)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts