Question: do the journal entry worksheet Problem 3-3A (Algo) Record adjusting entries (LO3-3) The information necessary for preparing the 2024 year-end adjusting entries for Aboud Advertising

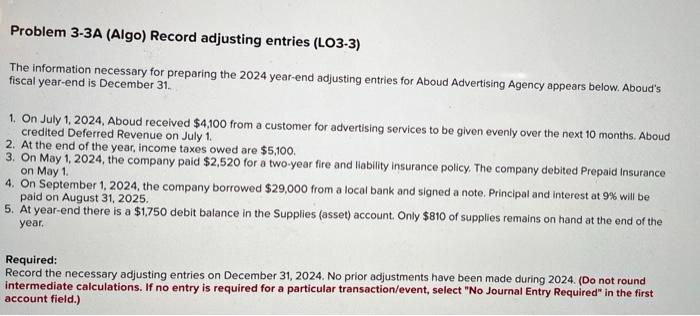

Problem 3-3A (Algo) Record adjusting entries (LO3-3) The information necessary for preparing the 2024 year-end adjusting entries for Aboud Advertising Agency appears below. Aboud's fiscal year-end is December 31. 1. On July 1, 2024. Aboud received $4,100 from a customer for advertising services to be given evenly over the next 10 months. Aboud credited Deferred Revenue on July 1. 2. At the end of the year, income taxes owed are $5,100 3. On May 1, 2024, the company paid $2,520 for a two-year fire and liability insurance policy. The company debited Prepaid Insurance on May 1 4. On September 1, 2024, the company borrowed $29,000 from a local bank and signed a note. Principal and interest at 9% will be paid on August 31, 2025. 5. At year-end there is a $1750 debit balance in the Supplies (asset) account. Only $810 of supplies remains on hand at the end of the year. Required: Record the necessary adjusting entries on December 31, 2024. No prior adjustments have been made during 2024. (Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts