Question: Do the Math 4 - 4 Use Tax Rate Schedule Jared Goff, of Los Angeles, determined the following tax information: gross salary, $ 9 0

Do the Math

Use Tax Rate Schedule

Jared Goff, of Los Angeles, determined the following tax information: gross salary, $; interest earned, $; IRA contribution, $; and standard deduction, $ Filing single, calculate Jared's taxable income and tax liability. Hint: Use Table Round your answer for taxable income to the nearest dollar and answer for tax liability to the nearest cent.

Taxable income

Tax liability

Jable

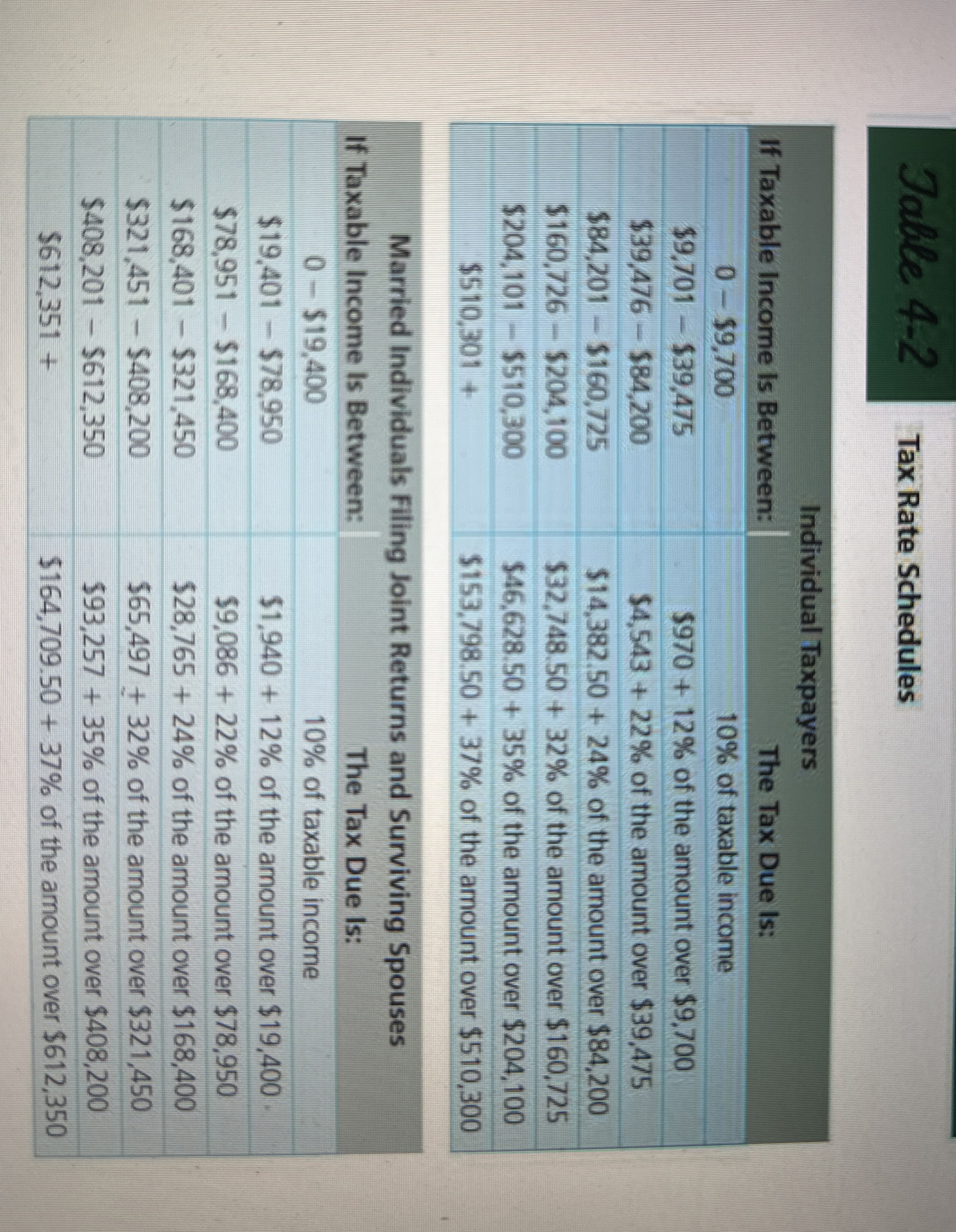

Tax Rate Schedules

tableIf Taxable Income Is Between:,tableIndividual TaxpayersThe Tax Due Is:$ of taxable income$$$ of the amount over $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock