Question: Do the Math 8-4 Rebate Versus Low Interest Rate Kyle Parker of Concord, New Hampshire, has been shopping for a new car for several weeks.

Do the Math 8-4

Do the Math 8-4

Rebate Versus Low Interest Rate

Kyle Parker of Concord, New Hampshire, has been shopping for a new car for several weeks. He has negotiated a price of $38,000 on a model that carries a choice of a $2,500 rebate or dealer financing at 2 percent APR. The dealer loan would require a $1,000 down payment and a monthly payment of $649 for 60 months. Kyle has also arranged for a loan from his bank with a 4 percent APR. Use the Run the Numbers worksheet to advise Kyle about whether he should use the dealer financing or take the rebate and use the financing from the bank. Round your answer to two decimal places.

Adjusted APR (dealer financing):______ %

Kyle should use . (the dealer financing or the financing from the bank)

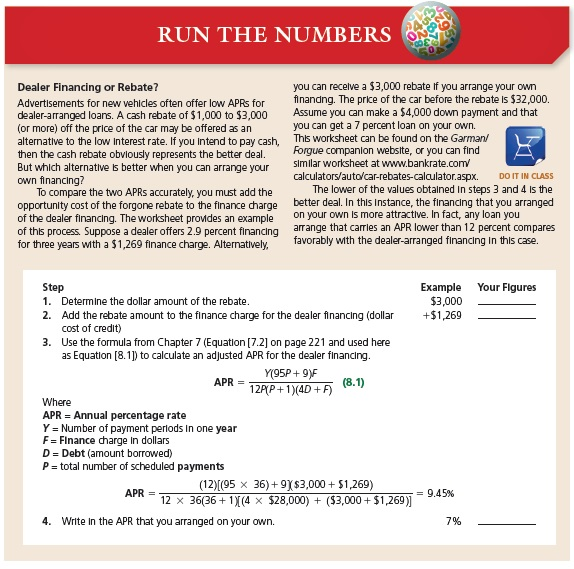

RUN THE NUMBERS you can recelve a $3,000 rebate if you arrange your own Dealer Financing or Rebate? Advertisements for new vehicles often offer low APRs for dealer-arranged loans. A cash rebate of $1,000 to $3,000 (or more) off the price of the car may be offered as an alternatlve to the low Interest rate. If you intend to pay cash, then the cash rebate obvlously represents the better deal. But which alternatve ls better when you can arrange your own financing? finandng. The prke of the car before the rebate is $32,000. Assume you can make a $4,000 down payment and that you can get a 7 percent loan on your own. This worksheet can be found on the Garman Forgue companion website, or you can find simllar worksheet at www.bankrate.com calculatorsauto/car-rebates-calaulator.aspx. DO IT IN CLASS To compare the two APRs accurately, you must add the opportunity cost of the forgone rebate to the finance charge of the dealer financing. The worksheet proMdes an example of ths process Suppose a dealer offers 2.9 percent financing arrange for three years with a $1,269 finance charge. Alternatively, The lower of the values obtalned In steps 3 and 4 Is the better deal. In this Instance, the financing that you arranged on your own is more attractive. In fact, any loan you that carries an APR lower than 12 percent compares favorably with the dealer-arranged financing in this case. Example Your Flgures Step 1. Determine the dollar amount of the rebate 2. Add the rebate amount to the finance charge for the dealer financing (dollar +1,269 $3,000 cost of credit) Use the formula from Chapter 7 (Equatlon [7.2] on page 221 and used here as Equation [8.1]) to calte an adjusted APR for the dealer financing. 3. 95P+9) p+1)(40(8.1) Where APR = Annual percentage rate Y = Number of payment periods in one year F= Finance darge in dollars D = Debt (amount borrowed) P= total number of scheduled payments (12)((95 36)+9)($3,000 + $1,269) 36(36 +1)((4 x $28,000) + ($3,000+ $1,269 APR = 12 ) = 9.45% 4. Write In the APR that you arranged on your own. 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts