Question: Do the question which i signed with cirlce one, should in hand written Solutions Incorporated produced Job 121 using of direct materials and $3, 945

Do the question which i signed with cirlce one, should in hand written

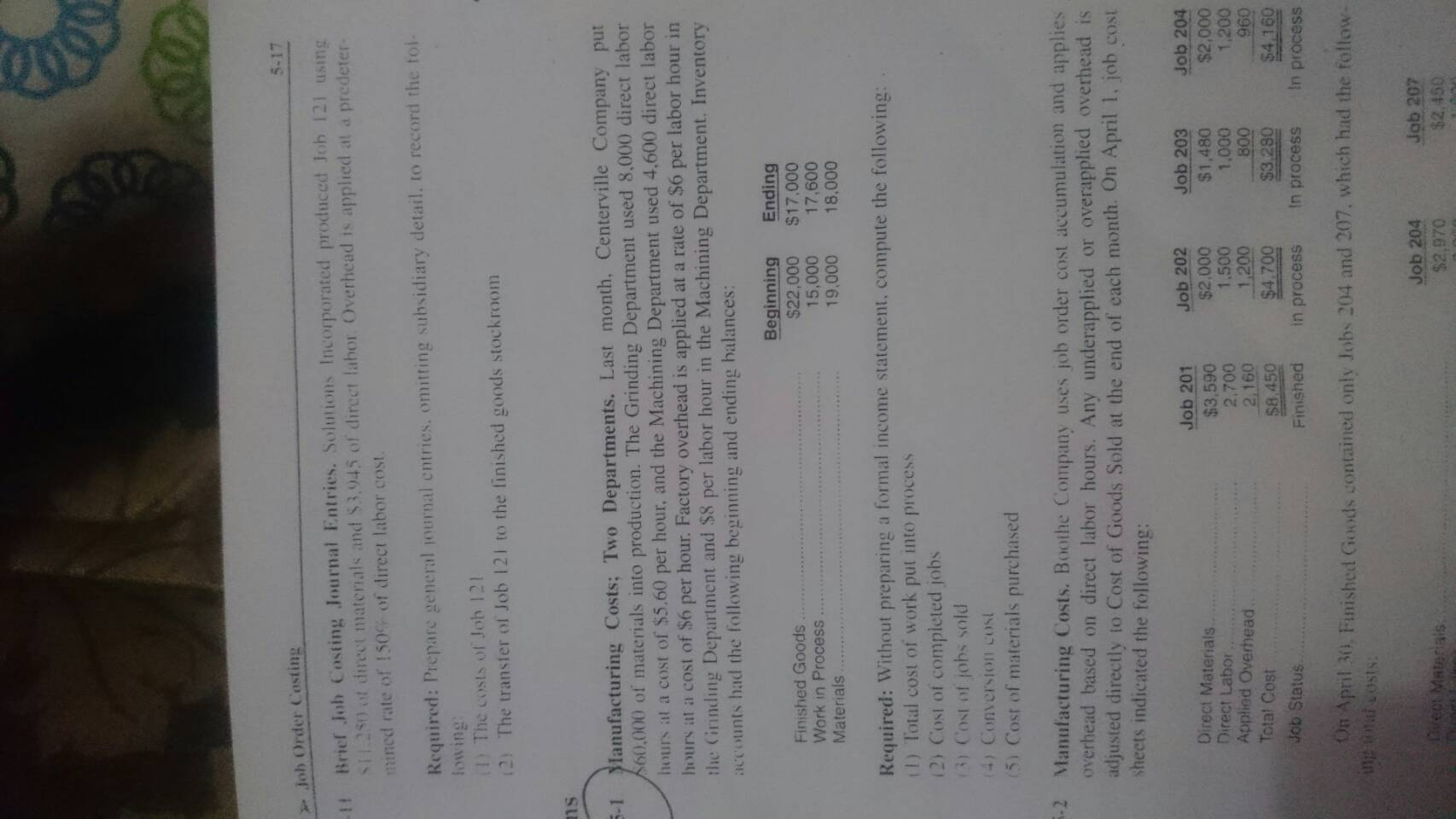

Solutions Incorporated produced Job 121 using of direct materials and $3, 945 of direct labor. Overhead is applied at a predetermined rate of 150% of direct labor cost. Prepare general journal entries, omitting subsidiary detail, to record the following: The costs of Job 121 The transfer of Job 121 to the finished goods stockroom Last month, Centerville Company put $60,000 of materials into production. The Grinding Department used 8,000 direct labor hours at a cost of $5.60 per hour, and the Machining Department used 4, 600 direct labor hours at a cost of $6 per hour. Factory overhead is applied at a rate of $6 per labor hour in the Grinding Department and $8 per labor hour in the Machining Department. Inventory accounts had the following beginning and ending balances: Without preparing a formal income statement, compute the following: Total cost of work put into process Cost of completed jobs Cost of jobs sold Conversion cost Cost of materials purchased Boothe Company uses job order cost accumulation and applies overhead based on direct labor hours. Any underapplied or overapplied overhead is adjusted directly to Cost of Goods. Sold at the end of each month. On April 1, job cost sheets indicated the following: On April 30, Finished Goods contained only Jobs 204 and 207, which had the following total costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts