Question: Do the spreadsheet from the question in the last photo. The others give the information in bonds A, B, C. 8 9 . Bond A

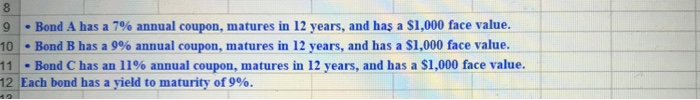

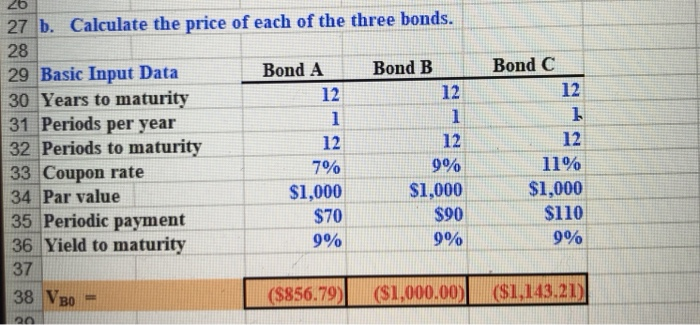

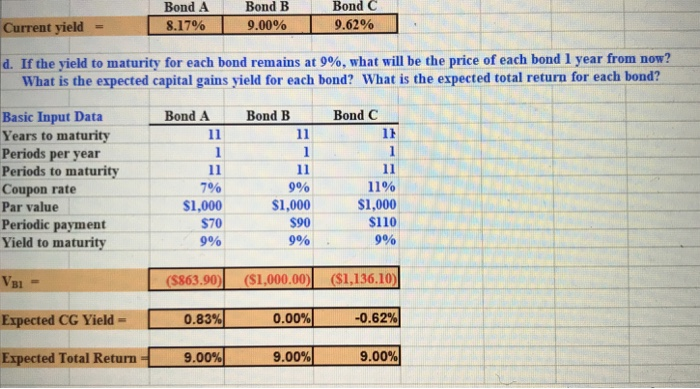

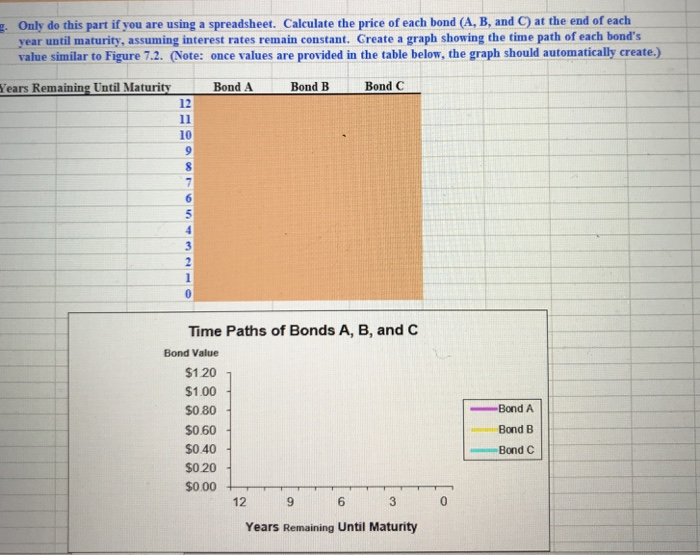

8 9 . Bond A has a 7% annual coupon, matures in 12 years, and has a SI,000 face value. 10" Bond B has a 9% annual coupon, matures in 12 years, and has a SI,000 face value. 111-Bond C has an 11% annual coupon, matures in 12 years, and has a SI,000 face value. 12Each bond has a yield to maturity of 9%. 26 27 b. Calculate the price of each of the three bonds. 28 Bond ABond B Bond C 29 Basic Input Data 12 12 12 30 Years to maturity 31 Periods per year 32 Periods to maturity 33 Coupon rate 34 Par value 35 Periodic payment 36 Yield to maturity 12 790 $1,000 $70 9% 12 900 $1,000 $90 9%| 12 11% $1,000 $110 900 37 38|V50 = ($856.79) ($1,000.00) ($1,143.21) Bond B Bond C 9.6290 Bond A 19.00% Current yield 8.17% d. If the yield to maturity for each bond remains at 9%, what will be the price of each bond 1 year from now? What is the expected capital gains yield for each bond? What is the expected total return for each bond? Bond A Bond BBond C Basic Input Data Years to maturity Periods per year Periods to maturity Coupon rate Par value Periodic payment Yield to maturity 790 $1,000 $70 9% 9% $1,000 $90 990 11% $1,000 $110 990 B1 ($863.90) ($1,000.00 ($1,136.10) Expected CG Yield- l 0.83%) 0.00%) -0.62% Expected Total Return 9.00% 9.00% 9.00% Only do this part if you are using a spreadsheet. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Create a graph showing the time path of each bond's value similar to Figure 7.2. (Note: once values are provided in the table below, the graph should automatically create.) g. Years Remaining Until Maturity Bond A Bond B Bond C 12 10 Time Paths of Bonds A, B, and C Bond Value $1 20 $1.00 S0 80 S060 S0 40 $0 20 Bond B -a-Bond C 12S9 6 3 Years Remaining Until Maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts