Question: Do this by 6th april 2022, try to do this in word document, 1st question (1 to 10) are True/False and also mention how to

Do this by 6th april 2022, try to do this in word document, 1st question (1 to 10) are True/False and also mention how to correct false statement, answer all the questions (1 to 4) in full fledge manner please.

Note- (2nd, 3rd and 4th part is in the photo) at the bottom. First part is here Question 1 (10 marks) Required. Identify each statement as True or False, indicate how to correct the statement.

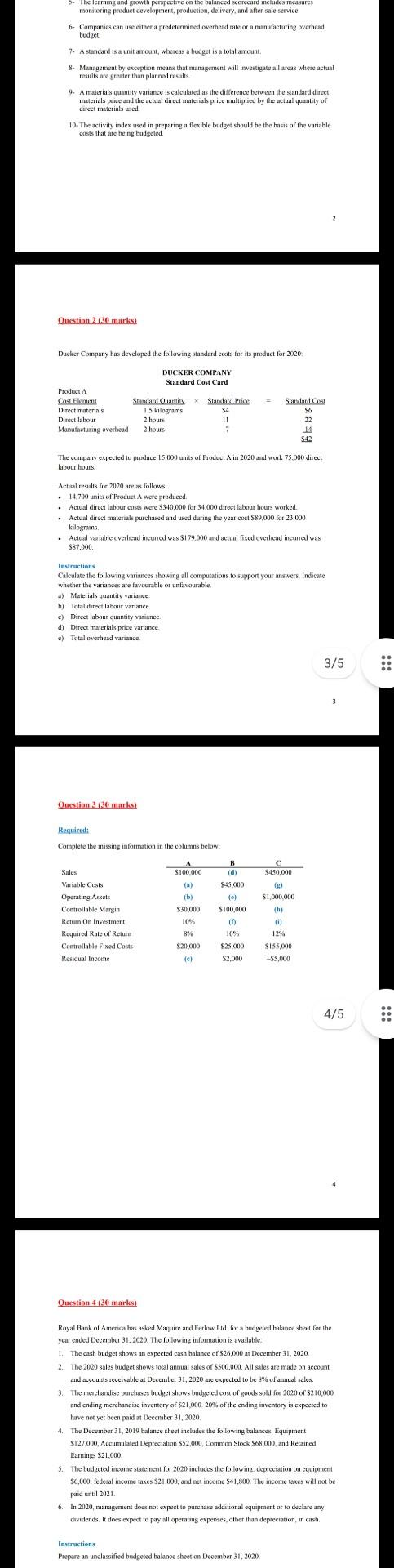

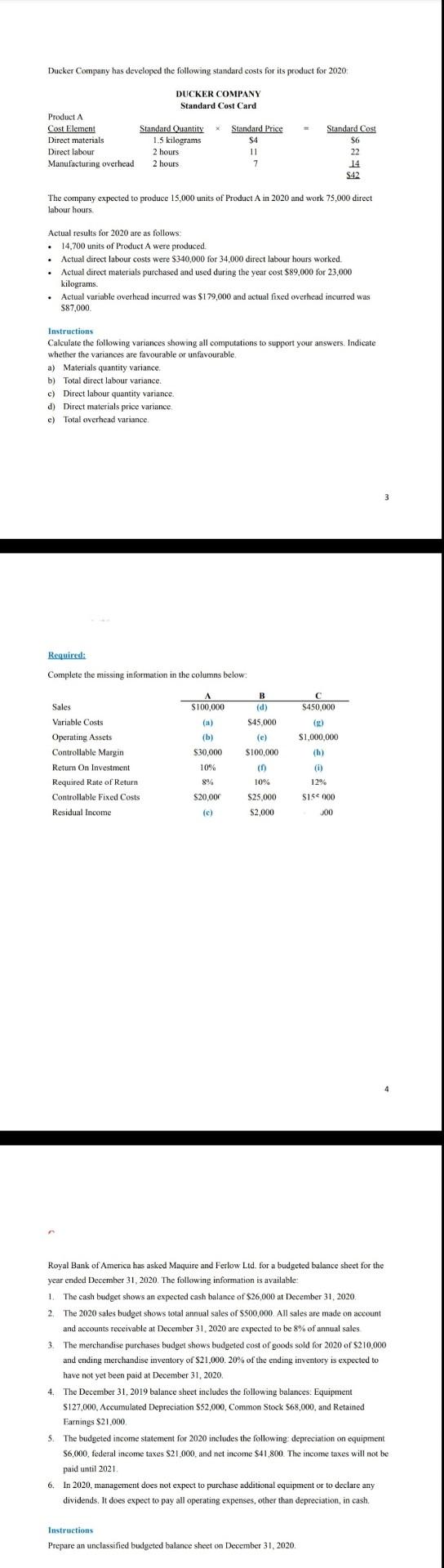

1- Standard cost is the industry average cost for a product or service. 2- A sales budget should be prepared before the production budget. 3- A merchandiser has a merchandise purchases budget, and a manufacturer has a materials purchases budget. 4- Evaluating a manager's performance in controlling variable casts is effectively achieved using a static budget. 5- The learning and growth perspective on the balanced scorecard includes measures monitoring product development, production, delivery, and after-sale service. 6- Companies can use either a predetermined overhead rate or a manufacturing overhead budget. 7- A standard is a unit amount, whereas a budget is a total amount. 8- Management by exception means that management will investigate all areas where actual results are greater than planned results. 9- A materials quantity variance is calculated as the difference between the standard direct materials price and the actual direct materials price multiplied by the actual quantity of direct materials used. 10-The activity index used in preparing a flexible budget should be the basis of the variable costs that are being budgeted.

2nd, 3rd & 4th part is here in photo

3. The learning and growth perspective on the balanced Scorecard mcludes measures monitoring product development, production, delivery, and after-sale service 6- Companies can use either a predetermined overhead rate or a manufacturing overhead a budget 7- 7. A standard is a unit amount, whereas a budget is a total amount 8. Management by exception means that management will investigate all areas where actual results are greater than planned results 9. A materials quantity variance is calculated as the difference between the standard direct materials price and the actual direct materials price multiplied by the actual quantity of direct materials used 10- The activity index used in preparing a flexible budget should be the basis of the variable costs that are being budgeted. 2 Question 2 (30 marks) Ducker Company has developed the following standard costs for its product 2020 DUCKER COMPANY Standard Cost Card Product Cost Element Direct materials Direct labour Manufacturing overhead Standard Quantity Standard Price * 1.5 kilograms $4 2 hours 11 2 hours 7 Standard Cost 56 22 14 542 The company expected to produce 15,000 units of Product A in 2020 and wirk 75.000 direct labour hours. Actual results for 2020 are as follows. 14,700 units of Product A were produced Actual direct labour costs were $340,000 for 34,000 direct labour hours worked. Actual direct materials purchased and used during the year cost $89.000 for 23,000 kilograms Actual varinble overhead incurred was $129,000 and actunl fixed overhead incurred was $ $87,000 Instructions Calculate the following variances showing all computations to support your answers Indicate whether the variances are favourable or unfavourable. a) Materials quantity variance bi Total direct labour variance c) Direct labour quantity variance d) Direct materials price variance c) Total overhead variance 3/5 Ouestion 3 (30 marks) Required: : Complete the missing information in the columns below: A B (d) $100,000 (a) Sales Variable costs Operating Assets Controllable Marin Retum On Investment Required Rate of Return Controllable Fixed Costs Residual Income (b) 530,000 10% 8% $20.000 (c) $45.000 (e) $100,000 0 10% $25.000 $2.000 $450,000 (2) $1,000,000 th) 00 1294 SISS000 -$5.000 4/5 Question 4 (30 marks) Royal Bank of America has asked Magure and Ferlow Lid. for a budgeted balance sheet for the year ended December 31, 2020. The following information is available: 1. The cash budget shows an expected cash balance of $26.000 at December 31, 2020 2. The 2020 sales budget shows total annual sales of SS00,001. All sales are made on account and accounts receivable at December 31, 2020 are expected to be 8% of annual sales. 3. The merchandise purchases budget shows budgeted cost of goods sold for 2020 of $210,000 and ending merchandise inventory of $21.000 20% of the ending inventory is expected to have not yet been paidat December 31, 2020 4. The December 31, 2019 balance sheet includes the following balances: Equipment S127,000, Accumulated Depreciation $52,000, Common Stock $68,000, and Retained Earnings $21.000 5. The budgeted income statement for 2020 includes the following depreciation on equipment $6,000, federal income taxes $21,000, and net income $41.800. The income taxes will not be paid until 2021 6. In 2020, management does not expect to purchase additional equipment or to declare any dividends. It does expect to pay all operating expenses, other than depreciation in cash Instructions Prepare an unclassified budgeted balance sheet on December 31, 2020, , Ducker Company has developed the following standard costs for its product for 2020 DUCKER COMPANY Standard Cost Card Product A A Cost Element Direct materials Direct labour Manufacturing overhead Standard Quantity 1.5 kilograms 2 hours 2 hours Standard Price $4 11 7 Standard Cost $6 6 22 14 S42 The company expected to produce 15,000 units of Product A in 2020 and work 75,000 direct labour hours Actual results for 2020 are as follows: 14.700 units of Product A were produced. Actual direct labour costs were $340,000 for 34.000 direct labour bours worked. Actual direct materials purchased and used during the year cost $89,000 for 23,000 kilograms. Actual variable overhead incurred was $179,000 and actual fixed overhead incurred was $87,000 Instructions Calculate the following variances showing all computations to support your answers. Indicate whether the variances are favourable or unfavourable a) Materials quantity variance. b) Total direct labour variance. c) Direct labour quantity variance. d) Direct materials price variance c) Total overhead variance 3 Required: Complete the missing information in the columns below: $100,000 (1) $450,000 (9) $1,000,000 (b) Sales Variable Costs Operating Assets Controllable Margin Return On Investment Required Rate of Return Controllable Fixed Costs Residual Income B (d) S45,000 (e) $100,000 in 10% $25,000 $ $2,000 $ (b) $30,000 10% (1) 12% 89 $20.000 SIS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts