Question: DO THIS ON EXCEL. DO NOT CREATE YOUR OWN T ACCOUNTS ONLY USE THE ONES PROVIDED IN THE TEMPLATE. DO NOT USE REVENUE, EXPENSE OR

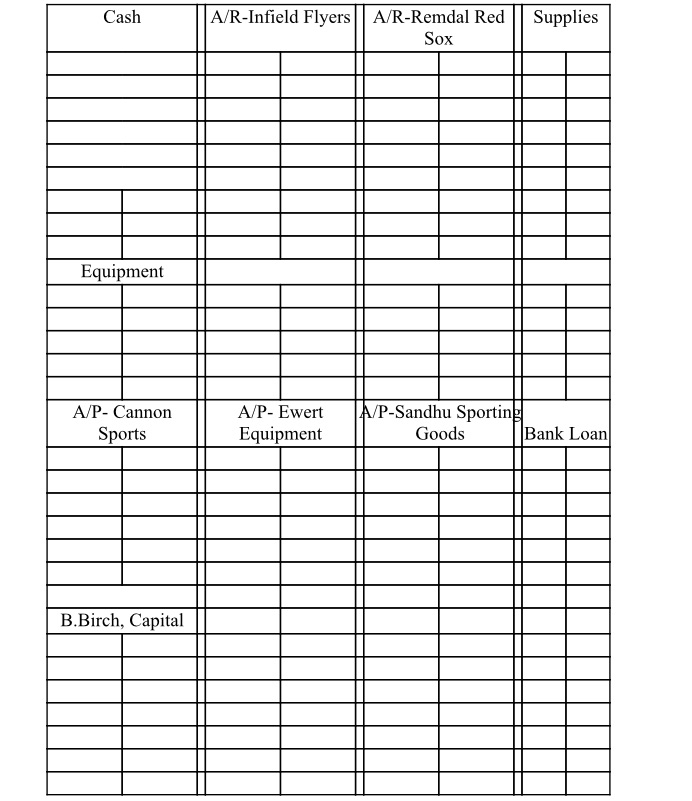

DO THIS ON EXCEL. DO NOT CREATE YOUR OWN T ACCOUNTS ONLY USE THE ONES PROVIDED IN THE TEMPLATE. DO NOT USE REVENUE, EXPENSE OR DRAWING ACCOUNTS ON TRIAL BALANCE OR T ACCOUNTS. PLEASE FOLLOW INSTRUCTIONS Bineshii Birch has the following account balances on October 31, 20--. Her business, Bineshii's Batting Cages and Softball Services, has the following assets and liabilities:Assets Liabilities Cash45000A/P-Cannon Sport11000A/R-Infield Flyers12000A/P-Ewert Equipment25000A/R-Remdal Red Sox1600A/P-Sandhu Sporting Goods1800Supplies3700Bank Loan25000Equipment30000 A. Set up Bineshii's financial position in the T-accounts provided below. Include the equity account.B. For the transactions listed below, record the accounting entries in T-accounts.C. Create a trial balance for Bineshii's Batting Cages and Softball Services 1. Bineshii Birch, the owner, invested $50 000 in the business.2. Borrowed $13 000 from the bank, which was deposited in the business' bank account.3. Purchased $41 000 worth of bats, helmets, and other sports equipment from Cannon Sports on account. The amount is due in 30 days.4. Paid $1 800 to Romeyn Properties Ltd. for the monthly rent.5. Cash sales for the month amounted to $30 000.6. Sold a one-month team membership to the Infield Flyers for $1 800 on account. The amount is to be received in 15.7. Paid $3 000 cash for monthly wages.8. Owner withdrew $1 500 for personal use.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts