Question: DO THIS PROBLEM USING EXCEL Southern Gas Company (SGC) is preparing to make a bid for oil and gas leasing rights in a newly

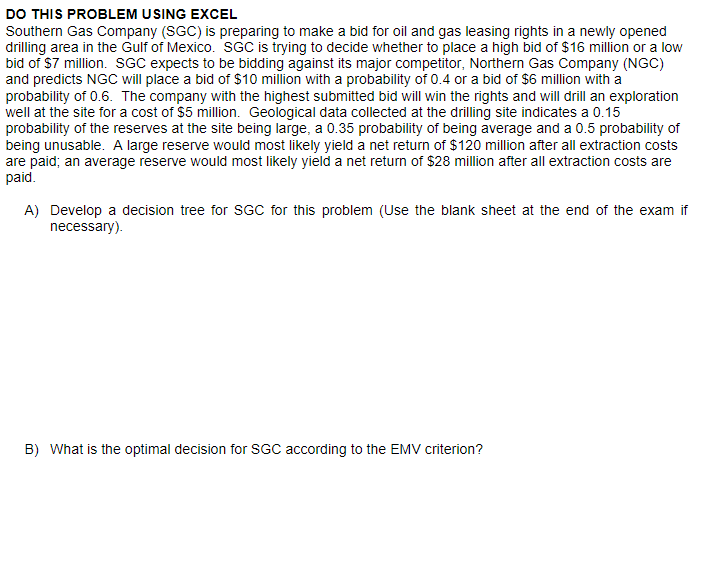

DO THIS PROBLEM USING EXCEL Southern Gas Company (SGC) is preparing to make a bid for oil and gas leasing rights in a newly opened drilling area in the Gulf of Mexico. SGC is trying to decide whether to place a high bid of $16 million or a low bid of $7 million. SGC expects to be bidding against its major competitor, Northern Gas Company (NGC) and predicts NGC will place a bid of $10 million with a probability of 0.4 or a bid of $6 million with a probability of 0.6. The company with the highest submitted bid will win the rights and will drill an exploration well at the site for a cost of $5 million. Geological data collected at the drilling site indicates a 0.15 probability of the reserves at the site being large, a 0.35 probability of being average and a 0.5 probability of being unusable. A large reserve would most likely yield a net return of $120 million after all extraction costs are paid; an average reserve would most likely yield a net return of $28 million after all extraction costs are paid. A) Develop a decision tree for SGC for this problem (Use the blank sheet at the end of the exam if necessary). B) What is the optimal decision for SGC according to the EMV criterion?

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we will develop a decision tree and calculate the Expected Monetary Value EMV ... View full answer

Get step-by-step solutions from verified subject matter experts