Question: Do you agree with Prediction 25? Why or why not? Five complete sentences or less. Please reference sections in the Whitepaper or discussions from class

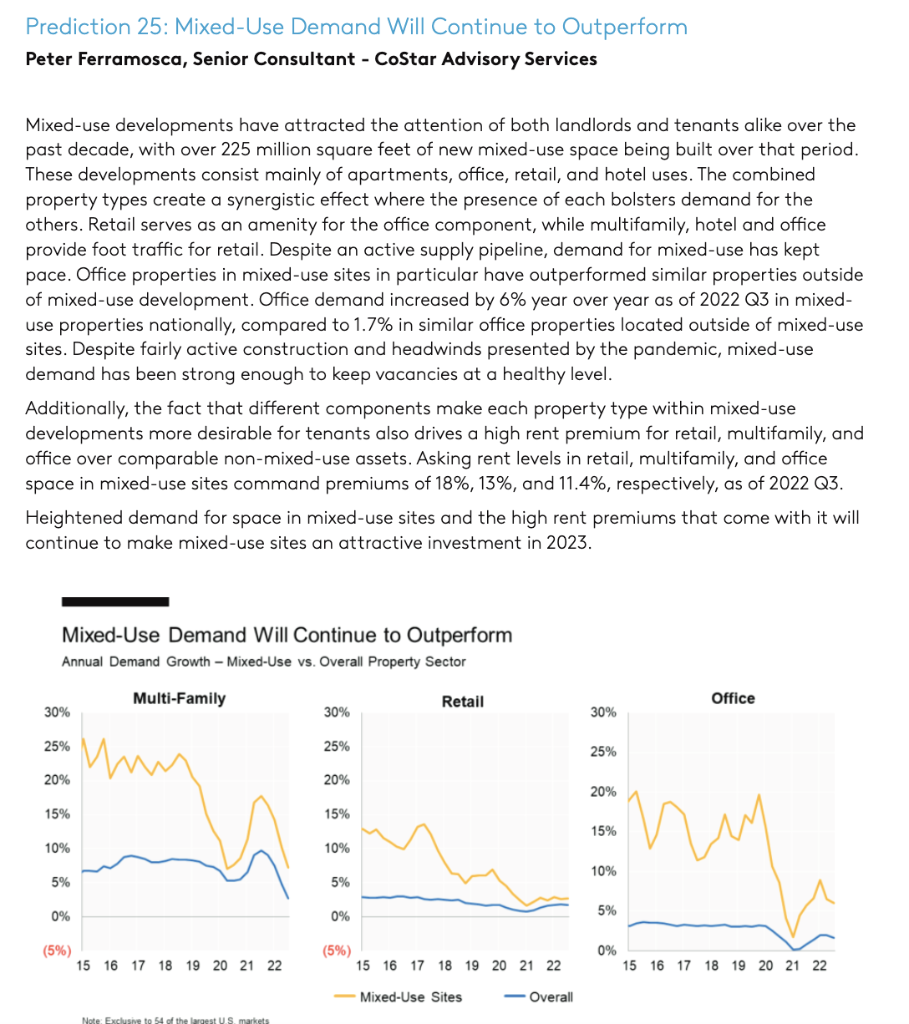

Do you agree with Prediction 25? Why or why not? Five complete sentences or less. Please reference sections in the Whitepaper or discussions from class that support your answer. Mixed-use developments have attracted the attention of both landlords and tenants alike over the past decade, with over 225 million square feet of new mixed-use space being built over that period. These developments consist mainly of apartments, office, retail, and hotel uses. The combined property types create a synergistic effect where the presence of each bolsters demand for the others. Retail serves as an amenity for the office component, while multifamily, hotel and office provide foot traffic for retail. Despite an active supply pipeline, demand for mixed-use has kept pace. Office properties in mixed-use sites in particular have outperformed similar properties outside of mixed-use development. Office demand increased by 6% year over year as of 2022 Q3 in mixeduse properties nationally, compared to 1.7% in similar office properties located outside of mixed-use sites. Despite fairly active construction and headwinds presented by the pandemic, mixed-use demand has been strong enough to keep vacancies at a healthy level. Additionally, the fact that different components make each property type within mixed-use developments more desirable for tenants also drives a high rent premium for retail, multifamily, and office over comparable non-mixed-use assets. Asking rent levels in retail, multifamily, and office space in mixed-use sites command premiums of 18%,13%, and 11.4%, respectively, as of 2022Q3. Heightened demand for space in mixed-use sites and the high rent premiums that come with it will continue to make mixed-use sites an attractive investment in 2023. Mixed-Use Demand Will Continue to Outperform Annual Demand Growth - Mixed-Use vs. Overall Property Sector Do you agree with Prediction 25? Why or why not? Five complete sentences or less. Please reference sections in the Whitepaper or discussions from class that support your answer. Mixed-use developments have attracted the attention of both landlords and tenants alike over the past decade, with over 225 million square feet of new mixed-use space being built over that period. These developments consist mainly of apartments, office, retail, and hotel uses. The combined property types create a synergistic effect where the presence of each bolsters demand for the others. Retail serves as an amenity for the office component, while multifamily, hotel and office provide foot traffic for retail. Despite an active supply pipeline, demand for mixed-use has kept pace. Office properties in mixed-use sites in particular have outperformed similar properties outside of mixed-use development. Office demand increased by 6% year over year as of 2022 Q3 in mixeduse properties nationally, compared to 1.7% in similar office properties located outside of mixed-use sites. Despite fairly active construction and headwinds presented by the pandemic, mixed-use demand has been strong enough to keep vacancies at a healthy level. Additionally, the fact that different components make each property type within mixed-use developments more desirable for tenants also drives a high rent premium for retail, multifamily, and office over comparable non-mixed-use assets. Asking rent levels in retail, multifamily, and office space in mixed-use sites command premiums of 18%,13%, and 11.4%, respectively, as of 2022Q3. Heightened demand for space in mixed-use sites and the high rent premiums that come with it will continue to make mixed-use sites an attractive investment in 2023. Mixed-Use Demand Will Continue to Outperform Annual Demand Growth - Mixed-Use vs. Overall Property Sector

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts