Question: Do you believe the current system is fair (if not, recommend changes; Hint reconsider any expenses that are included that are not controllable by product-line

Do you believe the current system is fair (if not, recommend changes; Hint reconsider any expenses that are included that are not controllable by product-line managers as an argument can be made that one shouldn't be responsible for costs they cannot control AND consider expenses that are under their control but not included in the calculation)?

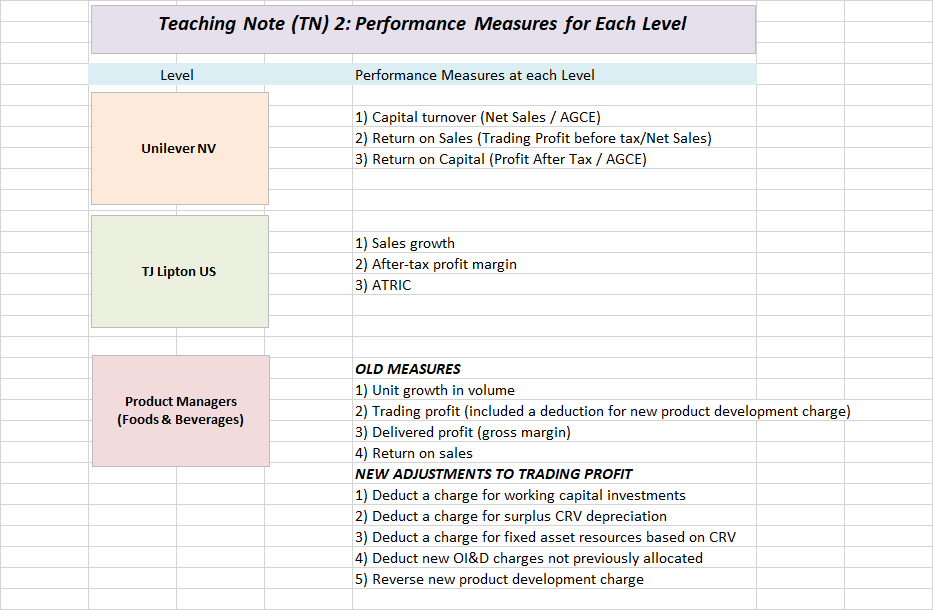

Teaching Note (TN) 2: Performance Measures for Each Level Level Unilever NV Performance Measures at each Level 1) Capital turnover (Net Sales / AGCE) 2) Return on Sales (Trading Profit before tax/Net Sales) 3) Return on Capital (Profit After Tax / AGCE) TJ Lipton US 1) Sales growth 2) After-tax profit margin 3) ATRIC Product Managers (Foods & Beverages) OLD MEASURES 1) Unit growth in volume 2) Trading profit (included a deduction for new product development charge) 3) Delivered profit (gross margin) 4) Return on sales NEW ADJUSTMENTS TO TRADING PROFIT 1) Deduct a charge for working capital investments 2) Deduct a charge for surplus CRV depreciation 3) Deduct a charge for fixed asset resources based on CRV 4) Deduct new OI&D charges not previously allocated 5) Reverse new product development charge

Step by Step Solution

There are 3 Steps involved in it

Here are my thoughts on the fairness of the current performance measurement system and potential adjustments The current system aims to measure perfor... View full answer

Get step-by-step solutions from verified subject matter experts