Question: Do you have a question? There is only a - Please advise if further information is required. This is for a class Portfolio Management 2.

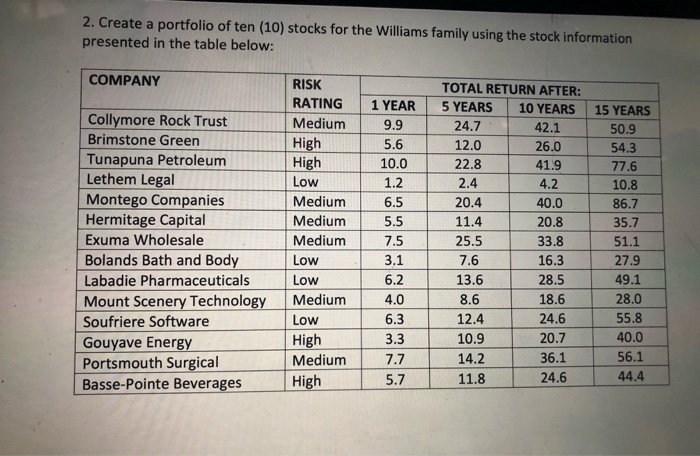

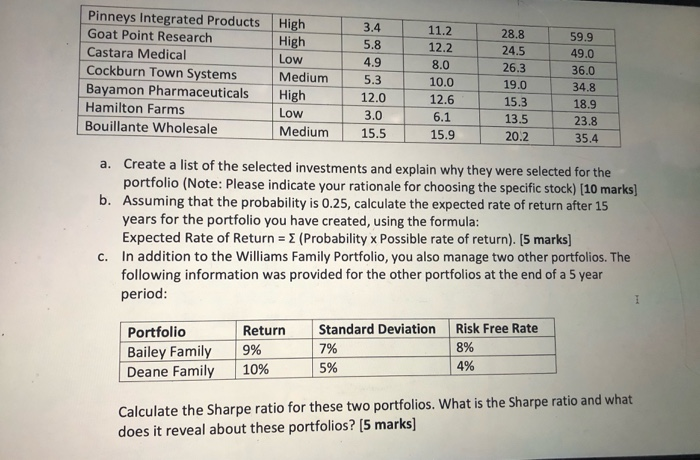

2. Create a portfolio of ten (10) stocks for the Williams family using the stock information presented in the table below: COMPANY Collymore Rock Trust Brimstone Green Tunapuna Petroleum Lethem Legal Montego Companies Hermitage Capital Exuma Wholesale Bolands Bath and Body Labadie Pharmaceuticals Mount Scenery Technology Soufriere Software Gouyave Energy Portsmouth Surgical Basse-Pointe Beverages RISK RATING Medium High High Low Medium Medium Medium Low Low Medium Low High Medium High 1 YEAR 9.9 5.6 10.0 1.2 6.5 5.5 7.5 3.1 6.2 4.0 6.3 3.3 7.7 5.7 TOTAL RETURN AFTER: 5 YEARS 10 YEARS 24.7 42.1 12.0 26.0 22.8 41.9 2.4 4.2 20.4 40.0 11.4 20.8 25.5 33.8 7.6 16.3 13.6 28.5 8.6 18.6 12.4 24.6 10.9 20.7 14.2 11.8 24.6 15 YEARS 50.9 54.3 77.6 10.8 86.7 35.7 51.1 27.9 49.1 28.0 55.8 40.0 56.1 44.4 36.1 3.4 5.8 Pinneys Integrated Products Goat Point Research Castara Medical Cockburn Town Systems Bayamon Pharmaceuticals Hamilton Farms Bouillante Wholesale High High Low Medium High Low Medium 4.9 5.3 12.0 3.0 15.5 11.2 12.2 8.0 10.0 12.6 6.1 15.9 28.8 24.5 26.3 19.0 15.3 13.5 20.2 59.9 49.0 36.0 34.8 18.9 23.8 35.4 a. Create a list of the selected investments and explain why they were selected for the portfolio (Note: Please indicate your rationale for choosing the specific stock) (10 marks) b. Assuming that the probability is 0.25, calculate the expected rate of return after 15 years for the portfolio you have created, using the formula: Expected Rate of Return = 3 (Probability x Possible rate of return). [5 marks] C. In addition to the Williams Family Portfolio, you also manage two other portfolios. The following information was provided for the other portfolios at the end of a 5 year period: - Portfolio Bailey Family Deane Family Return 9% 10% Standard Deviation 7% 5% Risk Free Rate 8% 4% Calculate the Sharpe ratio for these two portfolios. What is the Sharpe ratio and what does it reveal about these portfolios? (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts