Question: Do you have to adjust the excess value every time to consolidate please note the date is 1 year after aquisition Requlred Informatlon SB McGuire

Do you have to adjust the excess value every time to consolidate

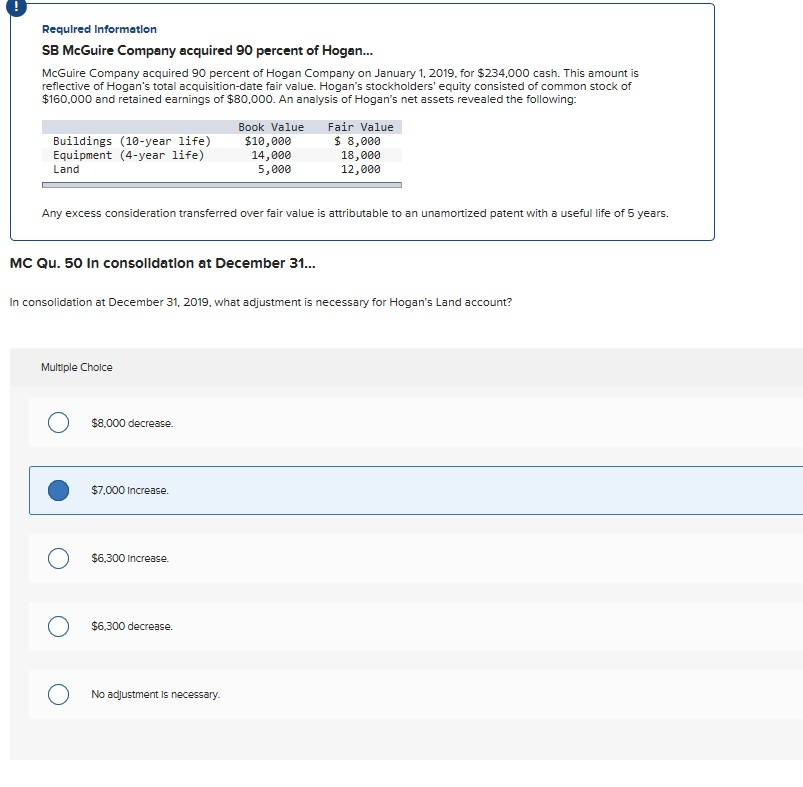

please note the date is 1 year after aquisition

Requlred Informatlon SB McGuire Company acquired 90 percent of Hogan... McGuire Company acquired 90 percent of Hogan Company on January 1, 2019, for $234,000 cash. This amount is reflective of Hogan's total acquisition-date fair value. Hogan's stockholders' equity consisted of common stock of $160.000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following: Buildings (10-year life) Equipment (4-year life) Land Book Value $10,000 14,000 5,000 Fair Value $ 8,000 18,000 12,000 Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years. MC Qu. 50 In consolidatlon at December 31.. In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Land account? Multiple Choice $8.000 decrease $7,000 Increase. $6,300 Increase. $6,300 decrease. No adjustment is necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts