Question: Doc Tom is preparing a presentation that analyzes the valuation of the common stock of Dante Corporation. Tom has prepared preliminary valuations of Dante using

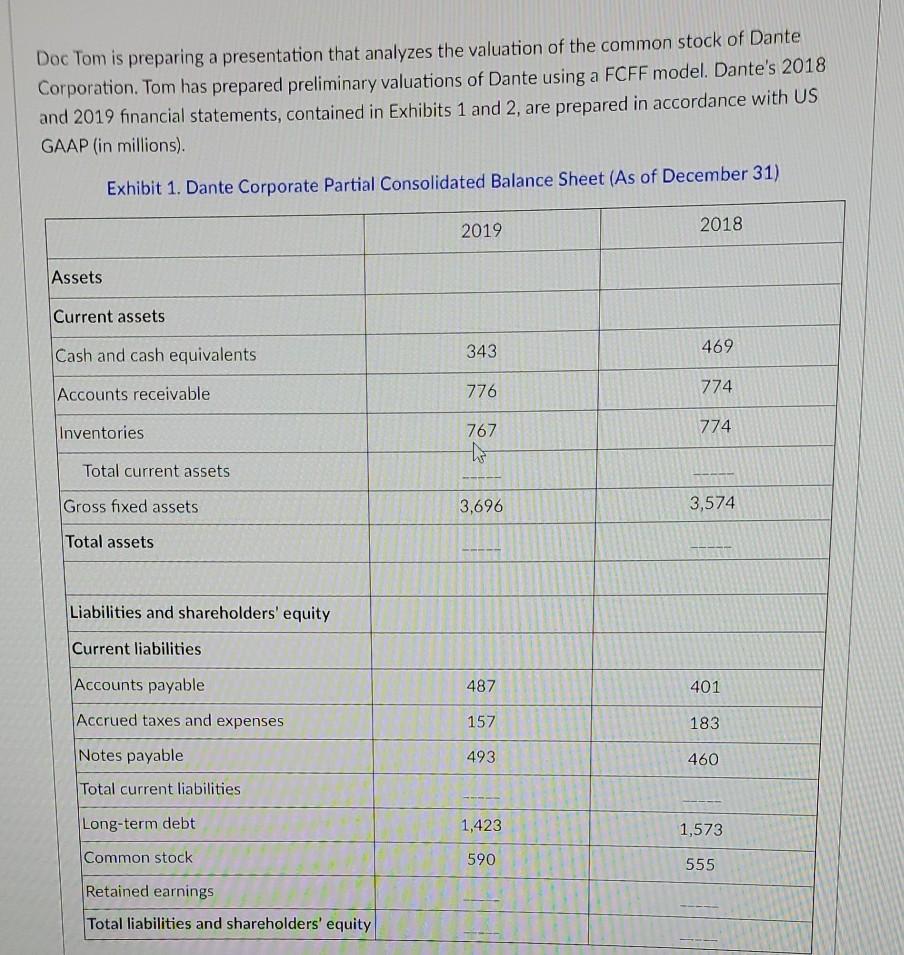

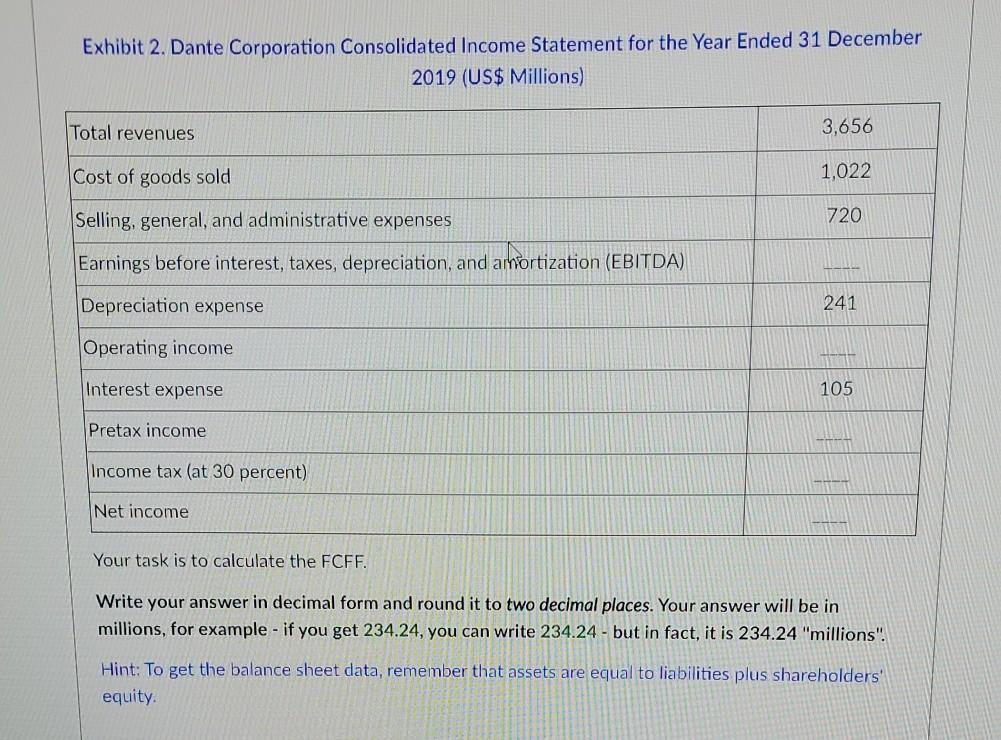

Doc Tom is preparing a presentation that analyzes the valuation of the common stock of Dante Corporation. Tom has prepared preliminary valuations of Dante using a FCFF model. Dante's 2018 and 2019 financial statements, contained in Exhibits 1 and 2, are prepared in accordance with US GAAP (in millions) Exhibit 1. Dante Corporate Partial Consolidated Balance Sheet (As of December 31) 2019 2018 Assets Current assets Cash and cash equivalents 343 469 Accounts receivable 776 774 Inventories 774 767 - he Total current assets Gross fixed assets 3,696 3,574 Total assets Liabilities and shareholders' equity Current liabilities Accounts payable 487 401 Accrued taxes and expenses 157 183 Notes payable 493 460 Total current liabilities Long-term debt 1,423 1,573 Common stock 590 555 Retained earnings Total liabilities and shareholders' equity Exhibit 2. Dante Corporation Consolidated Income Statement for the Year Ended 31 December 2019 (US$ Millions) Total revenues 3,656 Cost of goods sold 1,022 Selling, general, and administrative expenses 720 Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation expense 241 Operating income Interest expense 105 Pretax income TTT Income tax (at 30 percent) Net income Your task is to calculate the FCFF. Write your answer in decimal form and round it to two decimal places. Your answer will be in millions, for example - if you get 234.24, you can write 234.24 - but in fact, it is 234.24 "millions". Hint: To get the balance sheet data, remember that assets are equal to liabilities plus shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts