Question: Docs supplier is also considering offering him a buyback contract with the same wholesale price a) What is the optimal buyback amount (i.e., b )?

Docs supplier is also considering offering him a buyback contract with the same wholesale price

a) What is the optimal buyback amount (i.e., b)?

b) What is Docs expected profit with the buyback contract?

c) What is the suppliers expected profit with the buyback contract?

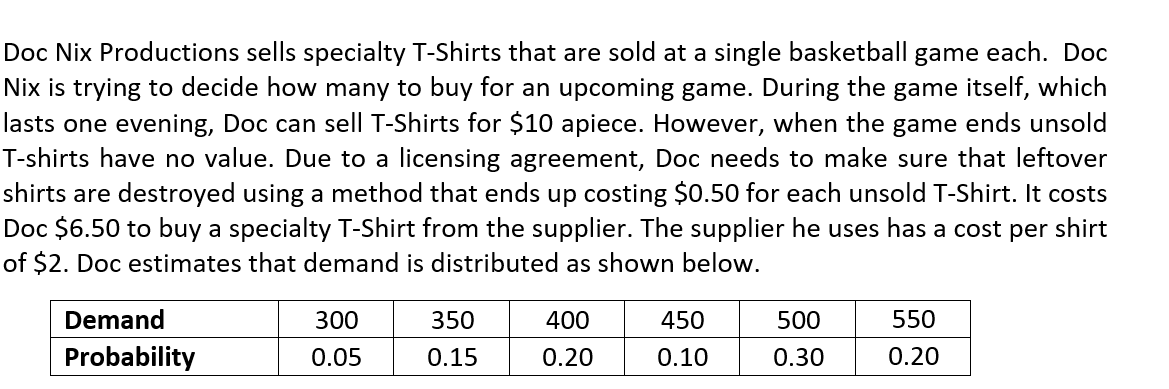

Doc Nix Productions sells specialty T-Shirts that are sold at a single basketball game each. Doc Nix is trying to decide how many to buy for an upcoming game. During the game itself, which lasts one evening, Doc can sell T-Shirts for $10 apiece. However, when the game ends unsold T-shirts have no value. Due to a licensing agreement, Doc needs to make sure that leftover shirts are destroyed using a method that ends up costing $0.50 for each unsold T-Shirt. It costs Doc $6.50 to buy a specialty T-Shirt from the supplier. The supplier he uses has a cost per shirt of $2. Doc estimates that demand is distributed as shown below. 350 400 450 500 550 Demand Probability 300 0.05 0.15 0.20 0.10 0.30 0.20Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts