Question: Document2 - Microsoft Word nces Mailings Review View 1 A CT - E * E = = = = d . > 1 Normal -

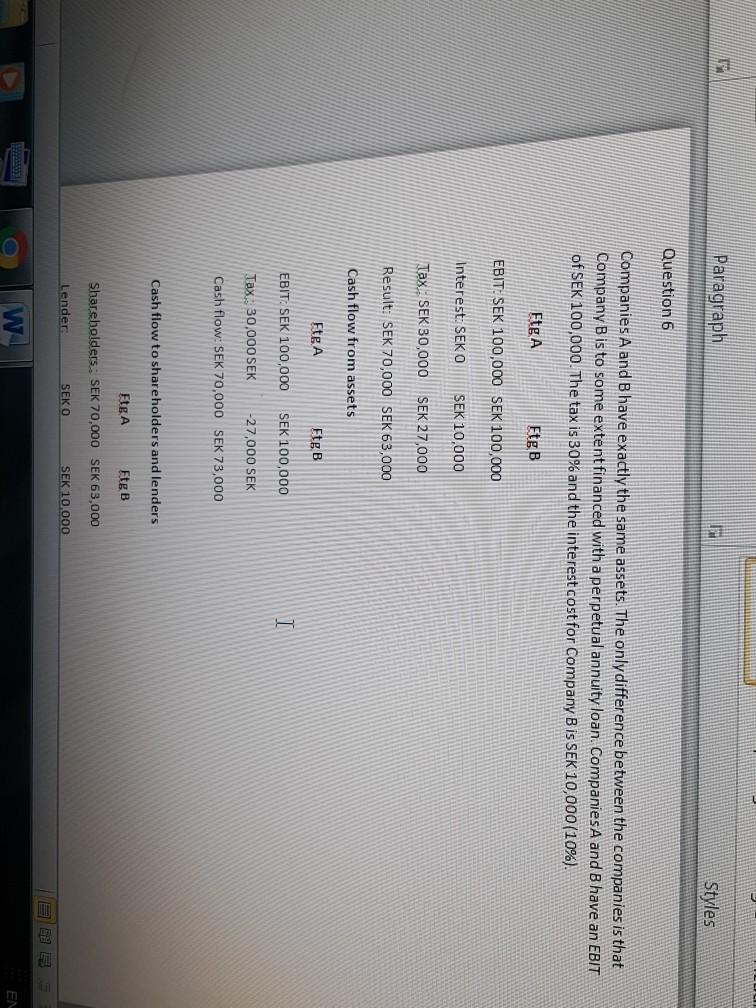

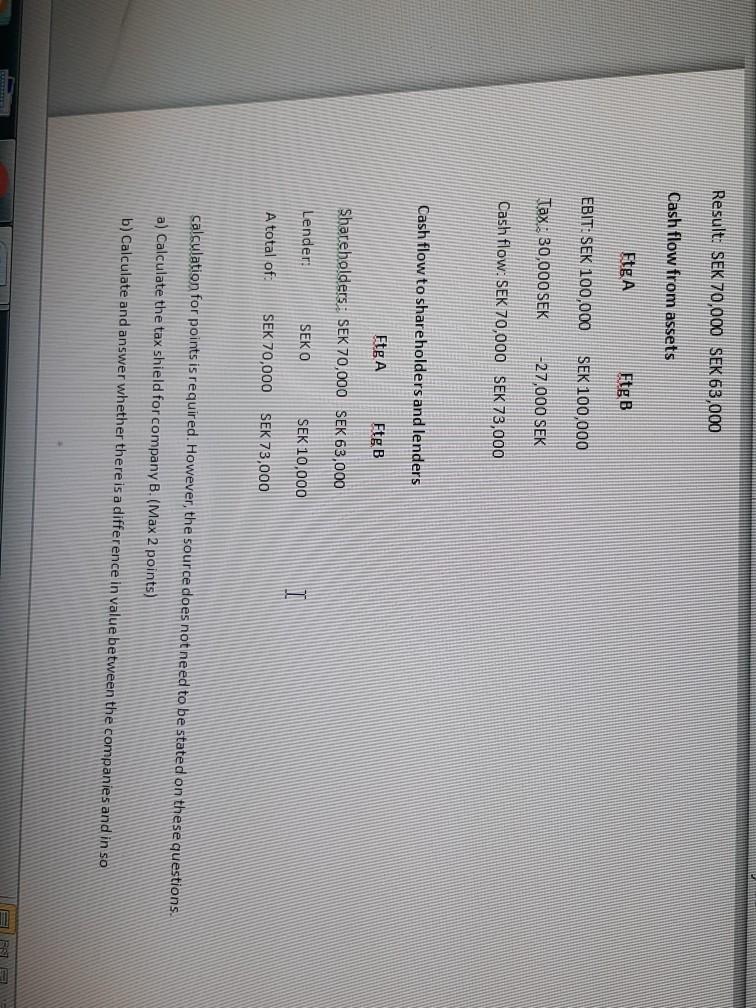

Document2 - Microsoft Word nces Mailings Review View 1 A CT - E * E = = = = d . > 1 Normal - 11 No Spacing Heading 1 Title Heading 2 Change Styles Paragraph M Styles question 5: The company CEM ABB has an equity/assets ratio of 40%. At what solvency did Modigliani & amp; Miller that the company has an optimal capital structure (provided that the market is efficient and it is not is there any tax)? How does their approach differ from the traditional approach (Trade-off)? Justification of reasoning is required for full points. I Question 6 s that Paragraph Styles Question 6 Companies A and B have exactly the same assets. The only difference between the companies is that Company B is to some extent financed with a perpetual annuity loan. Companies A and B have an EBIT of SEK 100,000. The tax is 30% and the interest cost for Company Bis SEK 10,000(10%). Etg A Ete B EBIT: SEK 100,000 SEK 100,000 Interest: SEKO SEK 10,000 Tax: SEK 30,000 SEK 27,000 Result: SEK 70,000 SEK 63,000 Cash flow from assets Fte A Ftg B EBIT: SEK 100,000 SEK 100,000 I Tax 30,000 SEK -27,000 SEK Cash flow: SEK 70,000 SEK 73,000 Cash flow to shareholders and lenders Etg A Ftg B Shareholders. SEK 70.000 SEK 63,000 Lender SEKO SEK 10,000 E E w Result: SEK 70.000 SEK 63,000 Cash flow from assets Etg A Ftg B EBIT: SEK 100,000 SEK 100,000 Tax 30,000 SEK -27,000 SEK Cash flow: SEK 70,000 SEK 73,000 Cash flow to shareholders and lenders Ftg A Ftg B Shareholders: SEK 70,000 SEK 63,000 Lender: SEKO SEK 10,000 A total of SEK 70,000 SEK 73,000 calculation for points is required. However, the source does not need to be stated on these questions. a) Calculate the tax shield for company B. (Max 2 points) b) Calculate and answer whether there is a difference in value between the companies and in so NEFNT Document2 - Microsoft Word nces Mailings Review View 1 A CT - E * E = = = = d . > 1 Normal - 11 No Spacing Heading 1 Title Heading 2 Change Styles Paragraph M Styles question 5: The company CEM ABB has an equity/assets ratio of 40%. At what solvency did Modigliani & amp; Miller that the company has an optimal capital structure (provided that the market is efficient and it is not is there any tax)? How does their approach differ from the traditional approach (Trade-off)? Justification of reasoning is required for full points. I Question 6 s that Paragraph Styles Question 6 Companies A and B have exactly the same assets. The only difference between the companies is that Company B is to some extent financed with a perpetual annuity loan. Companies A and B have an EBIT of SEK 100,000. The tax is 30% and the interest cost for Company Bis SEK 10,000(10%). Etg A Ete B EBIT: SEK 100,000 SEK 100,000 Interest: SEKO SEK 10,000 Tax: SEK 30,000 SEK 27,000 Result: SEK 70,000 SEK 63,000 Cash flow from assets Fte A Ftg B EBIT: SEK 100,000 SEK 100,000 I Tax 30,000 SEK -27,000 SEK Cash flow: SEK 70,000 SEK 73,000 Cash flow to shareholders and lenders Etg A Ftg B Shareholders. SEK 70.000 SEK 63,000 Lender SEKO SEK 10,000 E E w Result: SEK 70.000 SEK 63,000 Cash flow from assets Etg A Ftg B EBIT: SEK 100,000 SEK 100,000 Tax 30,000 SEK -27,000 SEK Cash flow: SEK 70,000 SEK 73,000 Cash flow to shareholders and lenders Ftg A Ftg B Shareholders: SEK 70,000 SEK 63,000 Lender: SEKO SEK 10,000 A total of SEK 70,000 SEK 73,000 calculation for points is required. However, the source does not need to be stated on these questions. a) Calculate the tax shield for company B. (Max 2 points) b) Calculate and answer whether there is a difference in value between the companies and in so NEFNT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts