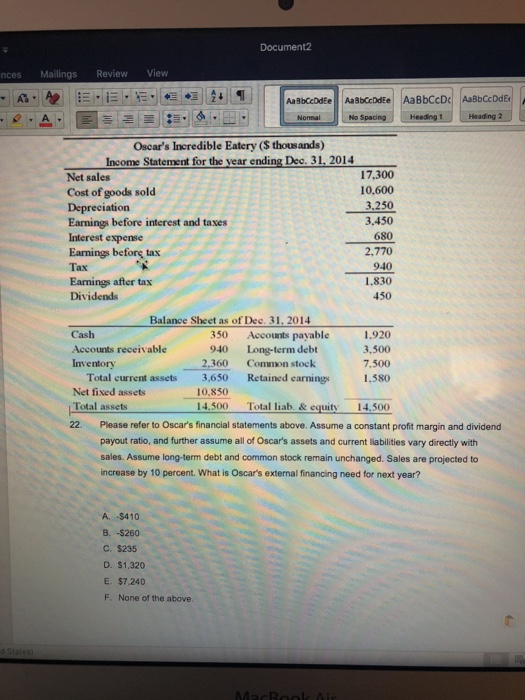

Question: Document2 nces MailingsReview View AaBbCcDdE Normal Oscar's Ineredible Eatery ($ thousands) Income Statement for the year ending Dec. 31, 2014 Net sales Cost of goods

Document2 nces MailingsReview View AaBbCcDdE Normal Oscar's Ineredible Eatery ($ thousands) Income Statement for the year ending Dec. 31, 2014 Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest expense Earnings betorg tax Tax Earnings after tax Dividends 17.300 10,600 3.250 3.450 680 2.770 940 1.830 450 Balance Sheet as of Dee. 31, 2014 Cash Accounts receivable Inventory 1,920 3,500 7,500 Total current assets 3,650 Retained earnings 580 350 Accounts payable 940 Long-term debt 360 Common stock Net fixed assets Total assets 22. Please refer to Oscar's financial statements above. Assume a constant profit margin and dividend 10,850 14.500 Total liab & equity 14500 payout ratio, and further assume all of Oscar's assets and current liabilities vary directly with sales. Assume long-term debt and common stock remain unchanged. Sales are projected to increase by 10 percent. What is Oscar's external financing need for next year? A $410 B. -$260 C. $235 D. $1,320 E. $7.240 F. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts