Question: Document2 View Acrobat ilings Review E.E. 12+ AaBhCode AaBCODE AaBbCcDd Normal No Spacing Heading 1 Maximum Word Count 1000 words (a) Discuss fully the factors

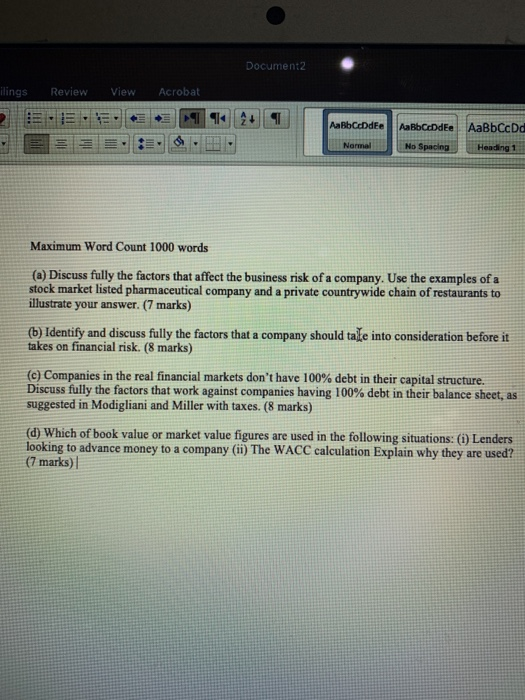

Document2 View Acrobat ilings Review E.E. 12+ AaBhCode AaBCODE AaBbCcDd Normal No Spacing Heading 1 Maximum Word Count 1000 words (a) Discuss fully the factors that affect the business risk of a company. Use the examples of a stock market listed pharmaceutical company and a private countrywide chain of restaurants to illustrate your answer. (7 marks) (b) Identify and discuss fully the factors that a company should take into consideration before it takes on financial risk. (8 marks) (c) Companies in the real financial markets don't have 100% debt in their capital structure. Discuss fully the factors that work against companies having 100% debt in their balance sheet, as suggested in Modigliani and Miller with taxes. (8 marks) (d) Which of book value or market value figures are used in the following situations: (i) Lenders looking to advance money to a company (ii) The WACC calculation Explain why they are used? (7 marks) | Document2 View Acrobat ilings Review E.E. 12+ AaBhCode AaBCODE AaBbCcDd Normal No Spacing Heading 1 Maximum Word Count 1000 words (a) Discuss fully the factors that affect the business risk of a company. Use the examples of a stock market listed pharmaceutical company and a private countrywide chain of restaurants to illustrate your answer. (7 marks) (b) Identify and discuss fully the factors that a company should take into consideration before it takes on financial risk. (8 marks) (c) Companies in the real financial markets don't have 100% debt in their capital structure. Discuss fully the factors that work against companies having 100% debt in their balance sheet, as suggested in Modigliani and Miller with taxes. (8 marks) (d) Which of book value or market value figures are used in the following situations: (i) Lenders looking to advance money to a company (ii) The WACC calculation Explain why they are used? (7 marks) |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts