Question: Document2 - Word Br Layout References Mailings Review View Help Search - A Aar A 211 ADA 1 Normal 1 No Spac... Heading 1 Heading

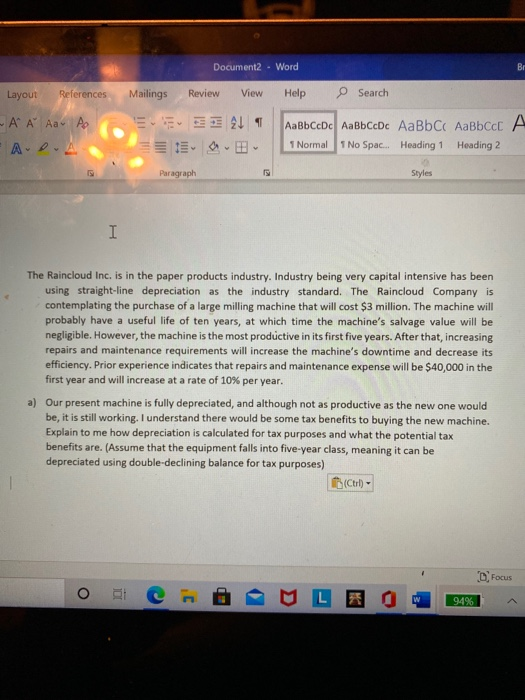

Document2 - Word Br Layout References Mailings Review View Help Search - A Aar A 211 ADA 1 Normal 1 No Spac... Heading 1 Heading 2 Paragraph Styles I The Raincloud Inc. is in the paper products industry. Industry being very capital intensive has been using straight-line depreciation as the industry standard. The Raincloud Company is contemplating the purchase of a large milling machine that will cost $3 million. The machine will probably have a useful life of ten years, at which time the machine's salvage value will be negligible. However, the machine is the most productive in its first five years. After that increasing repairs and maintenance requirements will increase the machine's downtime and decrease its efficiency. Prior experience indicates that repairs and maintenance expense will be $40,000 in the first year and will increase at a rate of 10% per year. a) Our present machine is fully depreciated, and although not as productive as the new one would be, it is still working. I understand there would be some tax benefits to buying the new machine. Explain to me how depreciation is calculated for tax purposes and what the potential tax benefits are. (Assume that the equipment falls into five-year class, meaning it can be depreciated using double-declining balance for tax purposes) (Ctrl) - 1 Focus O 94%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts