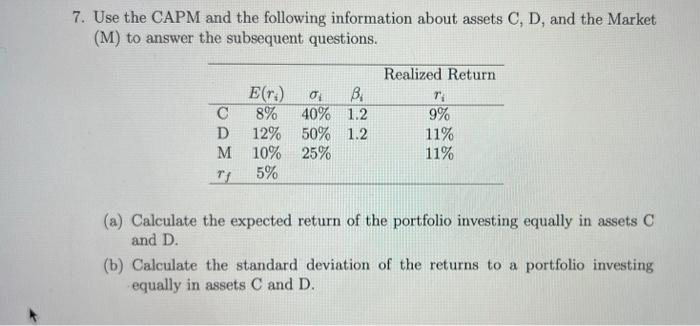

Question: does any finance tutor know how to explain this problem? Thank you so much in advance! 7. Use the CAPM and the following information about

7. Use the CAPM and the following information about assets C, D, and the Market (M) to answer the subsequent questions. D M E(r) 0 BE 8% 40% 1.2 12% 50% 1.2 10% 25% 5% Realized Return TA 9% 11% 11% (a) Calculate the expected return of the portfolio investing equally in assets C and D. (b) Calculate the standard deviation of the returns to a portfolio investing equally in assets C and D. (c) Is there a mispricing? Explain. (d) Identify the strategy that would best exploit the available mispricings. (e) Did asset C realize a higher actual return than the CAPM predicts (at the end of the year)? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts