Question: DOES ANYONE CAN HELP ME TO ANSWER THE QUESTION iii and iv ? 1. Customer approach you for RM380,000.00 housing loan with tenor of 10

DOES ANYONE CAN HELP ME TO ANSWER THE QUESTION iii and iv ?

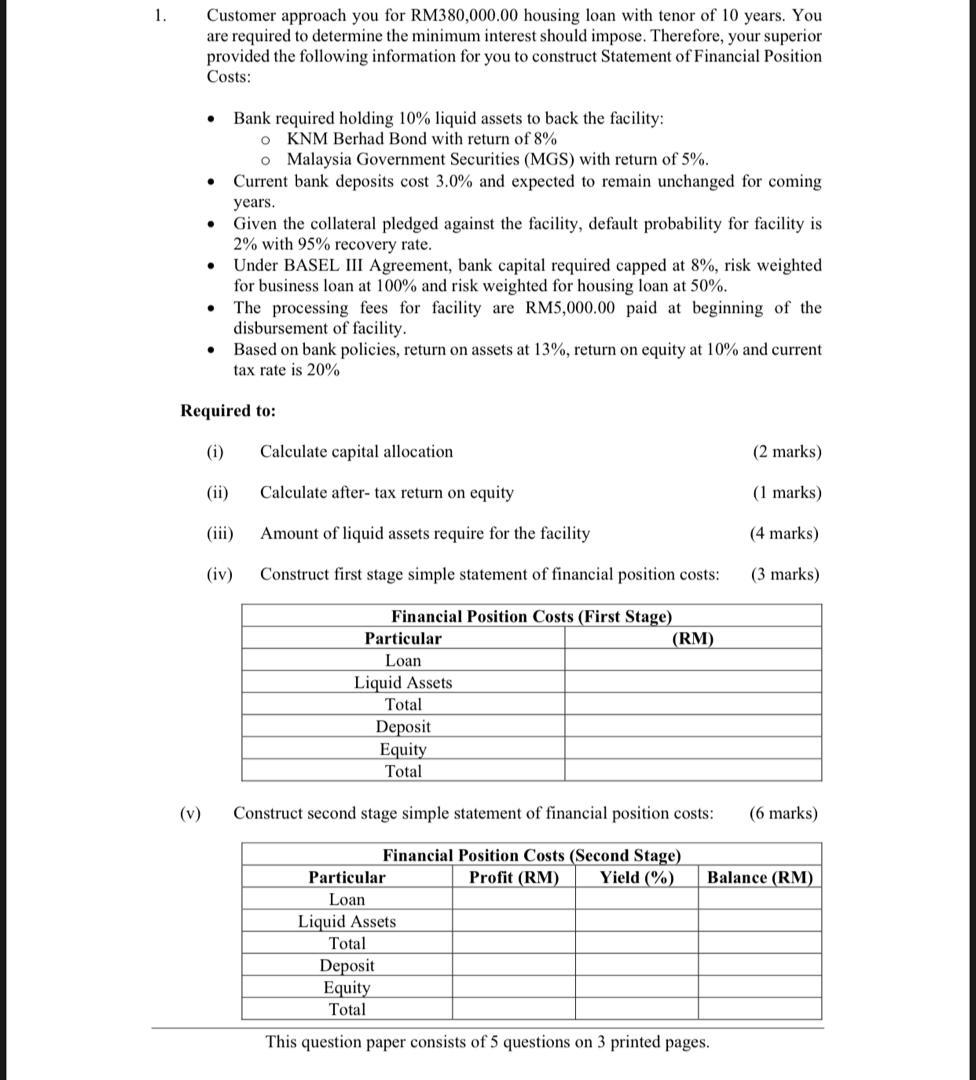

1. Customer approach you for RM380,000.00 housing loan with tenor of 10 years. You are required to determine the minimum interest should impose. Therefore, your superior provided the following information for you to construct Statement of Financial Position Costs: . . . Bank required holding 10% liquid assets to back the facility: KNM Berhad Bond with return of 8% o Malaysia Government Securities (MGS) with return of 5%. Current bank deposits cost 3.0% and expected to remain unchanged for coming years. Given the collateral pledged against the facility, default probability for facility is 2% with 95% recovery rate. Under BASEL III Agreement, bank capital required capped at 8%, risk weighted for business loan at 100% and risk weighted for housing loan at 50%. The processing fees for facility are RM5,000.00 paid at beginning of the disbursement of facility. Based on bank policies, return on assets at 13%, return on equity at 10% and current tax rate is 20% . . Required to: (i) Calculate capital allocation (2 marks) Calculate after-tax return on equity (1 marks) (iii) Amount of liquid assets require for the facility (4 marks) (iv) Construct first stage simple statement of financial position costs: (3 marks) Financial Position Costs (First Stage) Particular (RM) Loan Liquid Assets Total Deposit Equity Total (v) Construct second stage simple statement of financial position costs: (6 marks) Balance (RM) Financial Position Costs (Second Stage) Particular Profit (RM) Yield (%) Loan Liquid Assets Total Deposit Equity Total This question paper consists of 5 questions on 3 printed pages. 1. Customer approach you for RM380,000.00 housing loan with tenor of 10 years. You are required to determine the minimum interest should impose. Therefore, your superior provided the following information for you to construct Statement of Financial Position Costs: . . . Bank required holding 10% liquid assets to back the facility: KNM Berhad Bond with return of 8% o Malaysia Government Securities (MGS) with return of 5%. Current bank deposits cost 3.0% and expected to remain unchanged for coming years. Given the collateral pledged against the facility, default probability for facility is 2% with 95% recovery rate. Under BASEL III Agreement, bank capital required capped at 8%, risk weighted for business loan at 100% and risk weighted for housing loan at 50%. The processing fees for facility are RM5,000.00 paid at beginning of the disbursement of facility. Based on bank policies, return on assets at 13%, return on equity at 10% and current tax rate is 20% . . Required to: (i) Calculate capital allocation (2 marks) Calculate after-tax return on equity (1 marks) (iii) Amount of liquid assets require for the facility (4 marks) (iv) Construct first stage simple statement of financial position costs: (3 marks) Financial Position Costs (First Stage) Particular (RM) Loan Liquid Assets Total Deposit Equity Total (v) Construct second stage simple statement of financial position costs: (6 marks) Balance (RM) Financial Position Costs (Second Stage) Particular Profit (RM) Yield (%) Loan Liquid Assets Total Deposit Equity Total This question paper consists of 5 questions on 3 printed pages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts