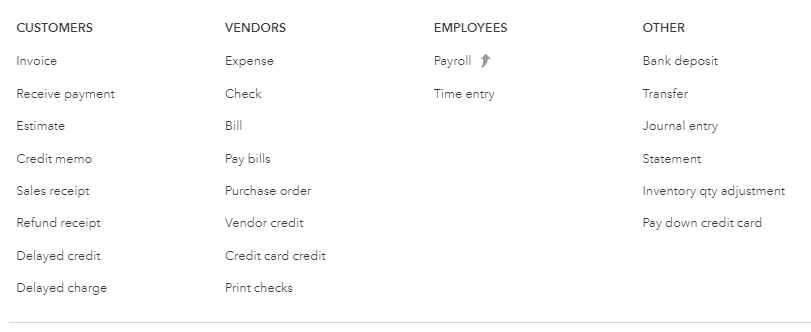

Question: Does anyone know how to accomplish the following using QuickBooks Online? CUSTOMERS VENDORS EMPLOYEES OTHER Invoice Expense Payroll Bank deposit Receive payment Check Time entry

Does anyone know how to accomplish the following using QuickBooks Online?

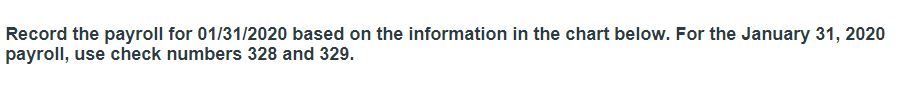

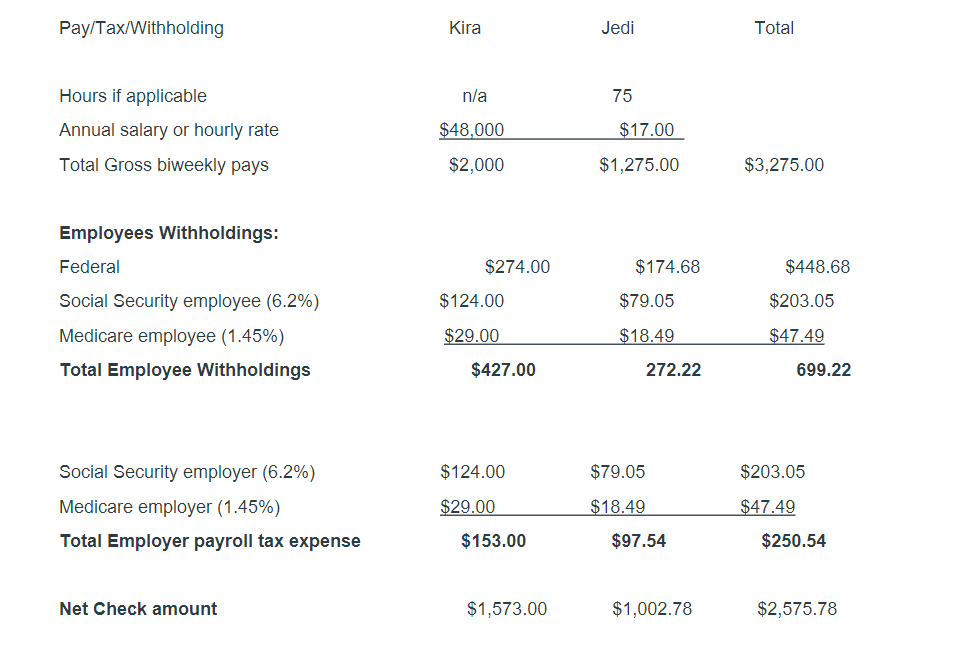

CUSTOMERS VENDORS EMPLOYEES OTHER Invoice Expense Payroll Bank deposit Receive payment Check Time entry Transfer Estimate Bill Journal entry Pay bills Statement Credit memo Sales receipt Purchase order Inventory qty adjustment Refund receipt Vendor credit Pay down credit card Delayed credit Credit card credit Delayed charge Print checks Record the payroll for 01/31/2020 based on the information in the chart below. For the January 31, 2020 payroll, use check numbers 328 and 329. Pay/Tax/Withholding Kira Jedi Total n/a 75 Hours if applicable Annual salary or hourly rate Total Gross biweekly pays $48,000 $17.00 $2,000 $1,275.00 $3,275.00 $274.00 $448.68 Employees Withholdings: Federal Social Security employee (6.2%) Medicare employee (1.45%) Total Employee Withholdings $174.68 $79.05 $124.00 $203.05 $29.00 $18.49 $47.49 699.22 $427.00 272.22 $124.00 $79.05 $203.05 Social Security employer (6.2%) Medicare employer (1.45%) Total Employer payroll tax expense $29.00 $18.49 $97.54 $47.49 $250.54 $153.00 Net Check amount $1,573.00 $1,002.78 $2,575.78 CUSTOMERS VENDORS EMPLOYEES OTHER Invoice Expense Payroll Bank deposit Receive payment Check Time entry Transfer Estimate Bill Journal entry Pay bills Statement Credit memo Sales receipt Purchase order Inventory qty adjustment Refund receipt Vendor credit Pay down credit card Delayed credit Credit card credit Delayed charge Print checks Record the payroll for 01/31/2020 based on the information in the chart below. For the January 31, 2020 payroll, use check numbers 328 and 329. Pay/Tax/Withholding Kira Jedi Total n/a 75 Hours if applicable Annual salary or hourly rate Total Gross biweekly pays $48,000 $17.00 $2,000 $1,275.00 $3,275.00 $274.00 $448.68 Employees Withholdings: Federal Social Security employee (6.2%) Medicare employee (1.45%) Total Employee Withholdings $174.68 $79.05 $124.00 $203.05 $29.00 $18.49 $47.49 699.22 $427.00 272.22 $124.00 $79.05 $203.05 Social Security employer (6.2%) Medicare employer (1.45%) Total Employer payroll tax expense $29.00 $18.49 $97.54 $47.49 $250.54 $153.00 Net Check amount $1,573.00 $1,002.78 $2,575.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts