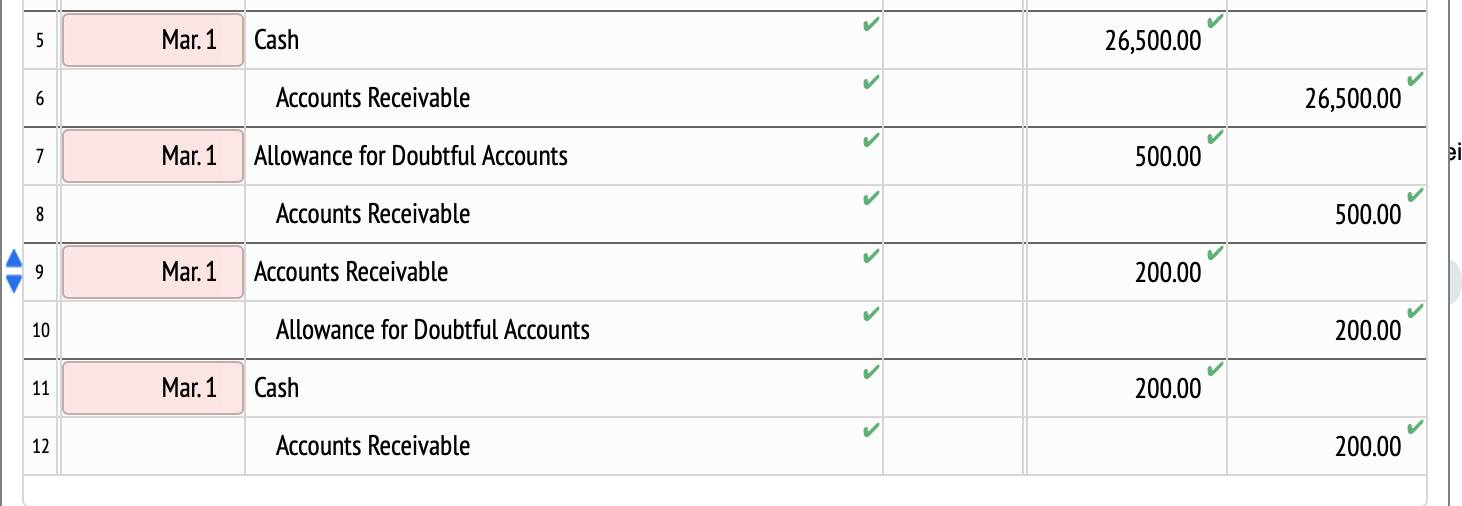

Question: Does anyone know what correct dates I should be using for these? I have tried Feb1, Feb 28, and Mar 1. 5 Mar. 1 Cash

Does anyone know what correct dates I should be using for these? I have tried Feb1, Feb 28, and Mar 1.

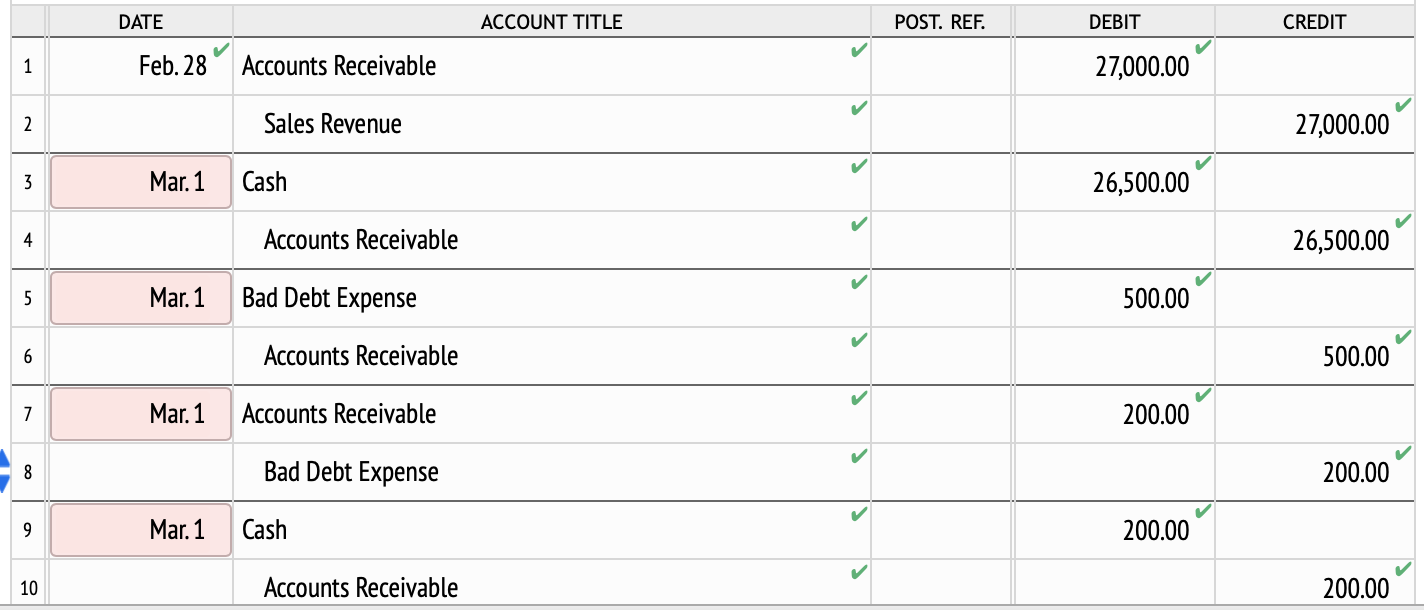

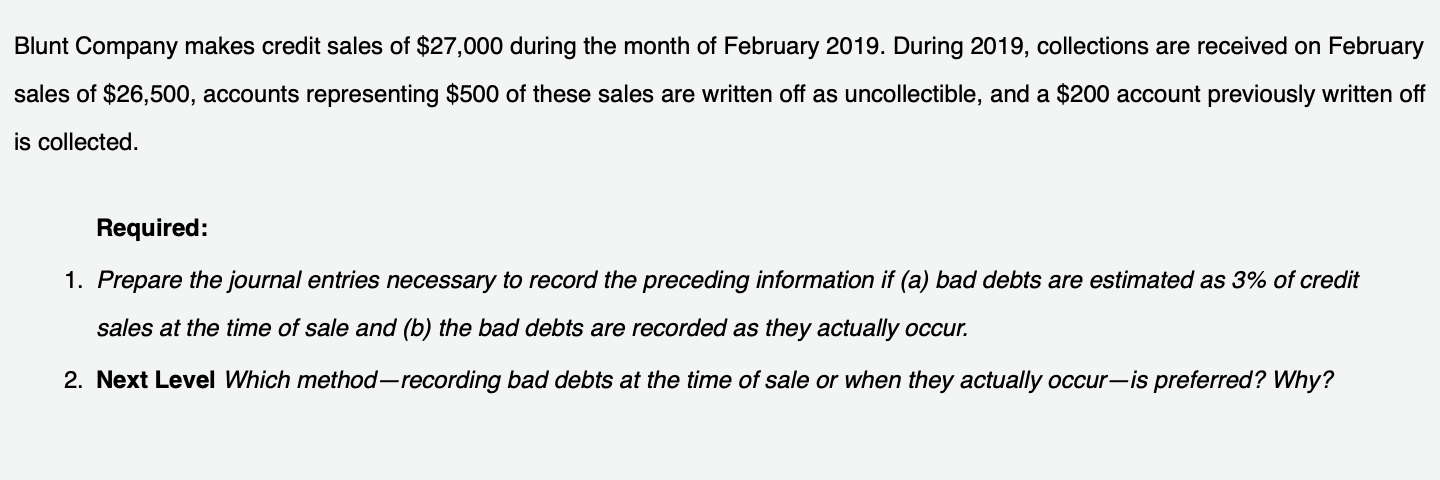

5 Mar. 1 Cash 26,500.00 6 Accounts Receivable 26,500.00 7 Mar. 1 Allowance for Doubtful Accounts 500.00 ei 8 Accounts Receivable 500.00 9 Mar. 1 Accounts Receivable 200.00 10 Allowance for Doubtful Accounts 200.00 11 Mar. 1 Cash 200.00 12 Accounts Receivable 200.00 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 Feb. 28 Accounts Receivable 27,000.00 2 Sales Revenue 27,000.00 3 Mar. 1 Cash 26,500.00 4 Accounts Receivable 26,500.00 5 Mar. 1 Bad Debt Expense 500.00 6 Accounts Receivable 500.00 7 Mar. 1 Accounts Receivable 200.00 8 Bad Debt Expense 200.00 9 Mar. 1 Cash 200.00 10 Accounts Receivable 200.00 Blunt Company makes credit sales of $27,000 during the month of February 2019. During 2019, collections are received on February sales of $26,500, accounts representing $500 of these sales are written off as uncollectible, and a $200 account previously written off is collected. Required: 1. Prepare the journal entries necessary to record the preceding information if (a) bad debts are estimated as 3% of credit sales at the time of sale and (b) the bad debts are recorded as they actually occur. 2. Next Level Which method-recording bad debts at the time of sale or when they actually occuris preferred? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts