Question: does someone know how to run the code in R? would be great if someone could help me please! also if you do, would be

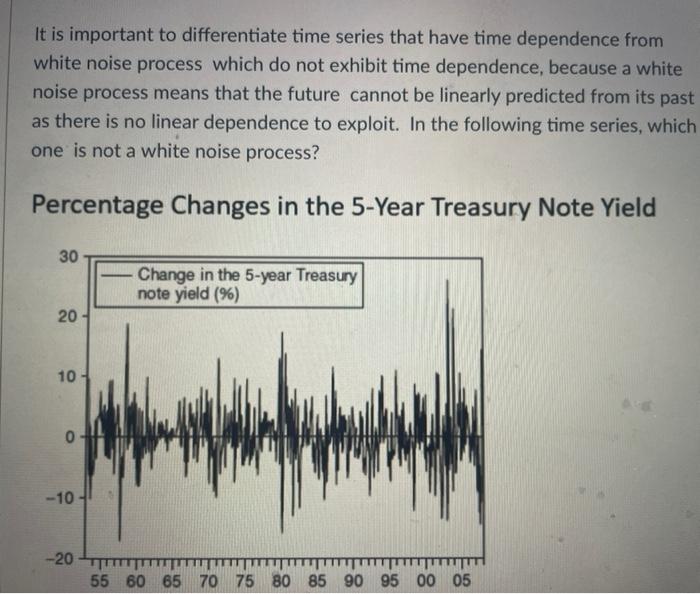

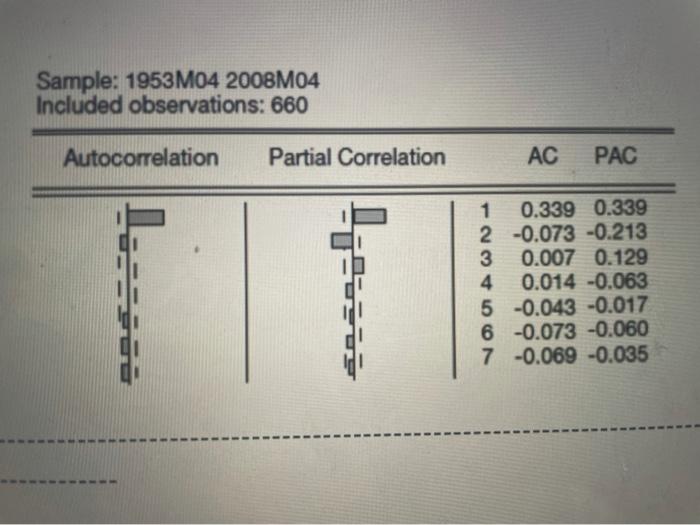

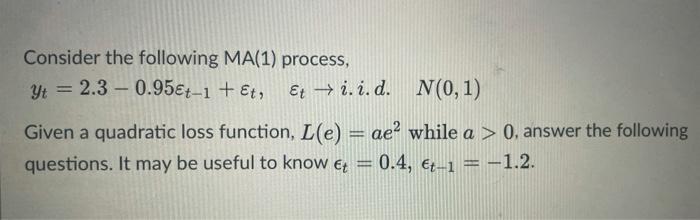

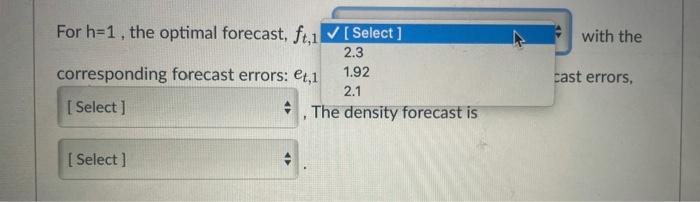

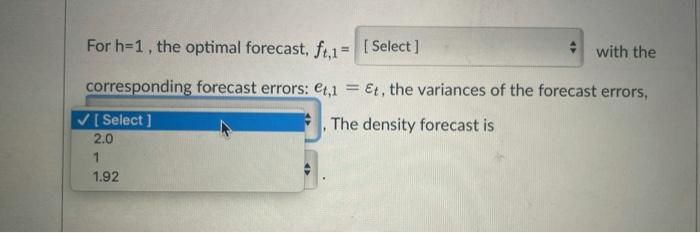

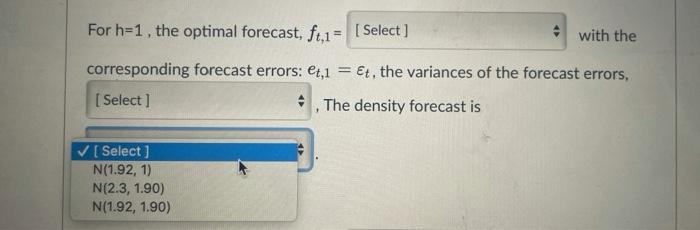

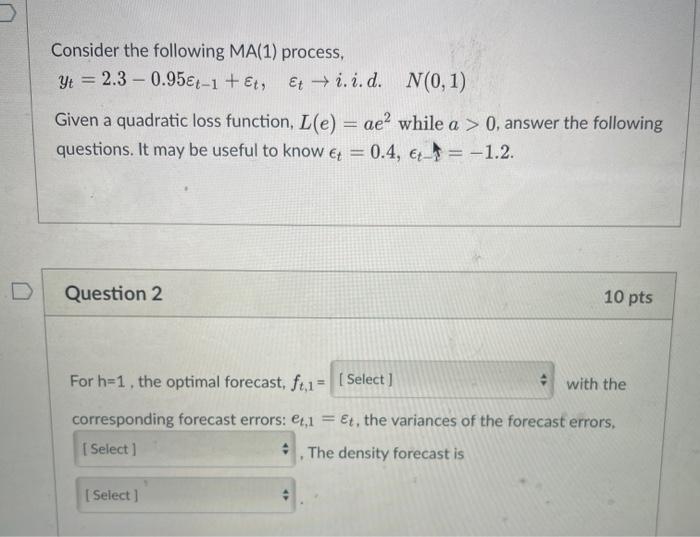

It is important to differentiate time series that have time dependence from white noise process which do not exhibit time dependence, because a white noise process means that the future cannot be linearly predicted from its past as there is no linear dependence to exploit. In the following time series, which one is not a white noise process? Percentage Changes in the 5-Year Treasury Note Yield 30 Change in the 5-year Treasury note yield (%) 20 10 - 0 -10 -20 55 60 65 70 75 80 85 90 95 00 05 Sample: 1953M04 2008M04 Included observations: 660 Autocorrelation Partial Correlation AC PAC 1 0.339 0.339 2 -0.073 -0.213 3 0.007 0.129 4 0.014 -0.063 5 -0.043 -0.017 6 -0.073 -0.060 7 -0.069 -0.035 Consider the following MA(1) process, yt = 2.3 - 0.95-1 + Et, Et i.i.d. N(0,1) Given a quadratic loss function, L(e) = ae? while a > 0, answer the following questions. It may be useful to know t = 0.4, -1 = -1.2. with the For h=1, the optimal forecast, ft,1 V [ Select] 2.3 corresponding forecast errors: et,1 1.92 2.1 [ Select ] ..The density forecast is cast errors, [ Select] For h=1, the optimal forecast, f1,1= [ Select] o with the corresponding forecast errors: et,1 = Et, the variances of the forecast errors, [ Select] The density forecast is 2.0 1.92 For h=1, the optimal forecast, ft,1 = [Select] with the corresponding forecast errors: et,1 = Et, the variances of the forecast errors, [Select ] The density forecast is [ Select ] N(1.92, 1) N(2.3, 1.90) N(1.92, 1.90) Consider the following MA(1) process, Y = 2.3 - 0.95t-1 + Et, Et i.i.d. N(0,1) Given a quadratic loss function, L(e) = ae? while a > 0, answer the following questions. It may be useful to know t = 0.4, Ex = -1.2. Question 2 10 pts For h=1. the optimal forecast, ft,1= [Select] with the corresponding forecast errors: et, 1 = et, the variances of the forecast errors, [ Select . . The density forecast is [Select]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts