Question: does that look correct to you ? if not please give me the correct answer and steps wirh formulas Question 1: A bond will pay

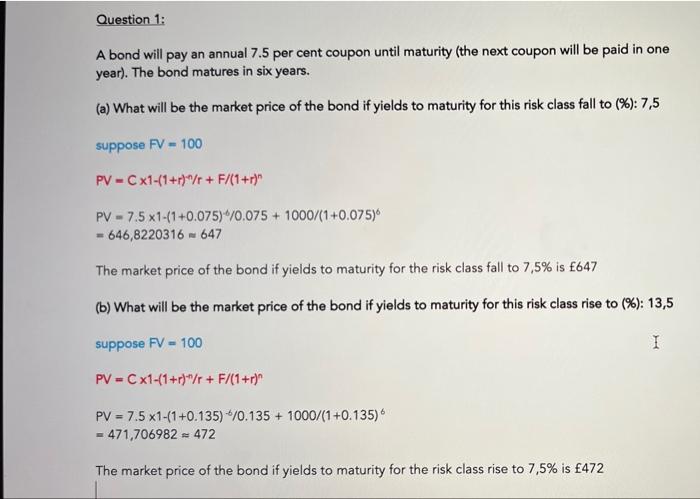

Question 1: A bond will pay an annual 7.5 per cent coupon until maturity (the next coupon will be paid in one year). The bond matures in six years. (a) What will be the market price of the bond if yields to maturity for this risk class fall to (%): 7,5 suppose FV = 100 PV - C x1-(1+)*/ + F/(1+r) PV - 7.5 x1-(1+0.075)/0.075 + 1000/(1+0.075) = 646,8220316 647 The market price of the bond if yields to maturity for the risk class fall to 7,5% is 647 (b) What will be the market price of the bond if yields to maturity for this risk class rise to (%): 13,5 suppose FV - 100 I PV - Cx1-(1+r)*%+ F/(1+r)" PV = 7.5 x1-(1+0.135)*/0.135 + 1000/(1+0.135) - 471,706982472 The market price of the bond if yields to maturity for the risk class rise to 7,5% is 472

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts