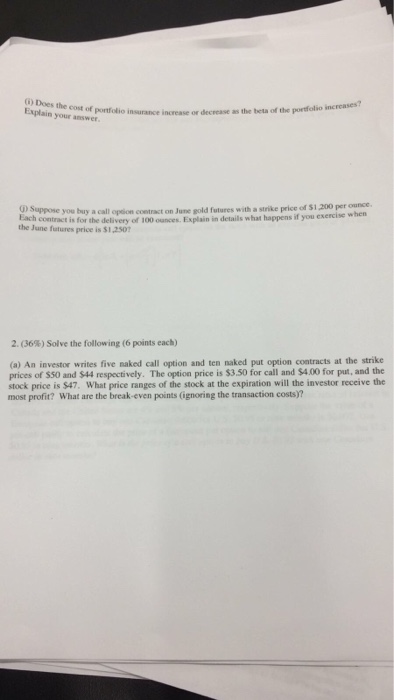

Question: Does the cost of portfolio insurance increase or decrease as the beta of the portfolio increases? Explain your answer. Suppose you buy a call option

Does the cost of portfolio insurance increase or decrease as the beta of the portfolio increases? Explain your answer. Suppose you buy a call option contract on June gold futures with a strike price of $1, 200 per Each contract is for the delivery of 100 ounces. Explain in details happens if you exercise when the June futures price is $1, 250 ?. Solve the following (a) An investor writes five naked call option and ten naked put option contracts at the strike prices of $50 and $44 respectively. The option price is $3.50 for call and $400 for put, and the stock price is $47. What price ranges of the stock at the expiration will the investor receive the most What are the break-even points (ignoring the transaction costs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts