Question: Does the state conform to the IRC definition of a Small Business for AMT calculation purposes? Select one: O a. Yes - The state

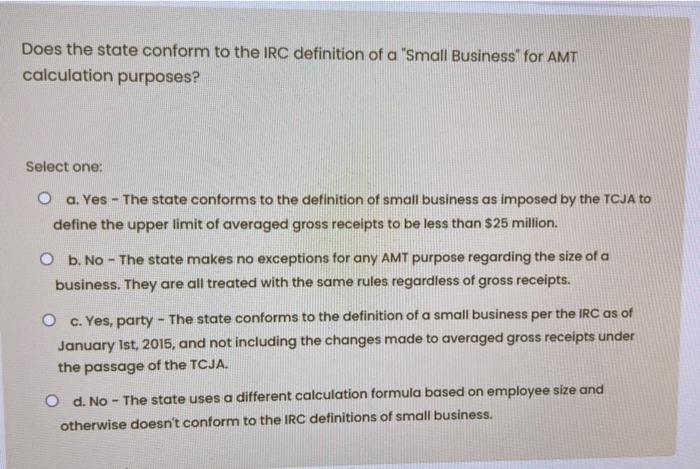

Does the state conform to the IRC definition of a "Small Business for AMT calculation purposes? Select one: O a. Yes - The state conforms to the definition of small business as imposed by the TCJA to define the upper limit of averaged gross receipts to be less than $25 million. O b. No- The state makes no exceptions for any AMT purpose regarding the size of a business. They are all treated with the same rules regardless of gross receipts. O c. Yes, party - The state conforms to the definition of a small business per the IRC as of January 1st, 2015, and not including the changes made to averaged gross receipts under the passage of the TCJA. O d. No- The state uses a different calculation formula based on employee size and otherwise doesn't conform to the IRC definitions of small business. Does the state conform to the IRC definition of a "Small Business for AMT calculation purposes? Select one: O a. Yes - The state conforms to the definition of small business as imposed by the TCJA to define the upper limit of averaged gross receipts to be less than $25 million. O b. No- The state makes no exceptions for any AMT purpose regarding the size of a business. They are all treated with the same rules regardless of gross receipts. O c. Yes, party - The state conforms to the definition of a small business per the IRC as of January 1st, 2015, and not including the changes made to averaged gross receipts under the passage of the TCJA. O d. No- The state uses a different calculation formula based on employee size and otherwise doesn't conform to the IRC definitions of small business.

Step by Step Solution

3.48 Rating (171 Votes )

There are 3 Steps involved in it

Option C is that the correct answer The state conforms to the def... View full answer

Get step-by-step solutions from verified subject matter experts