Question: Does this look correct? Option #1: Proprietary Fund Provide complete answers to the following two problems: 1. Describe the differences in cash flow statements required

Does this look correct?

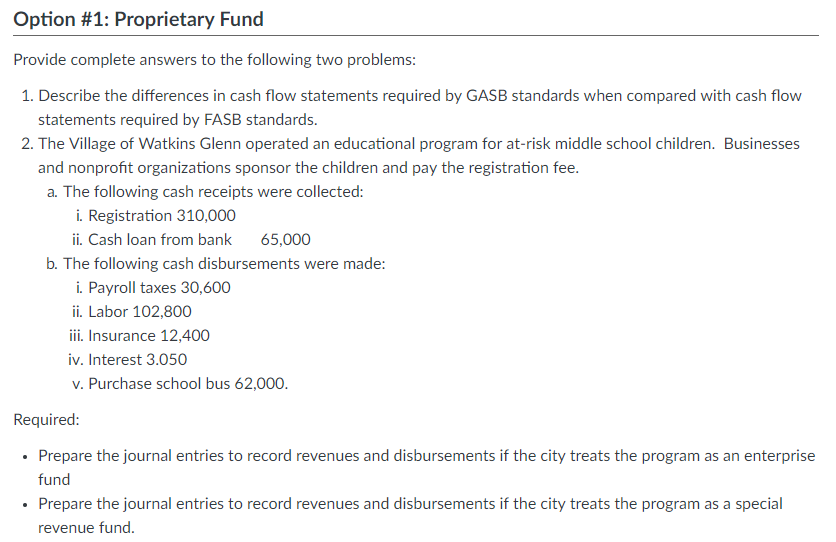

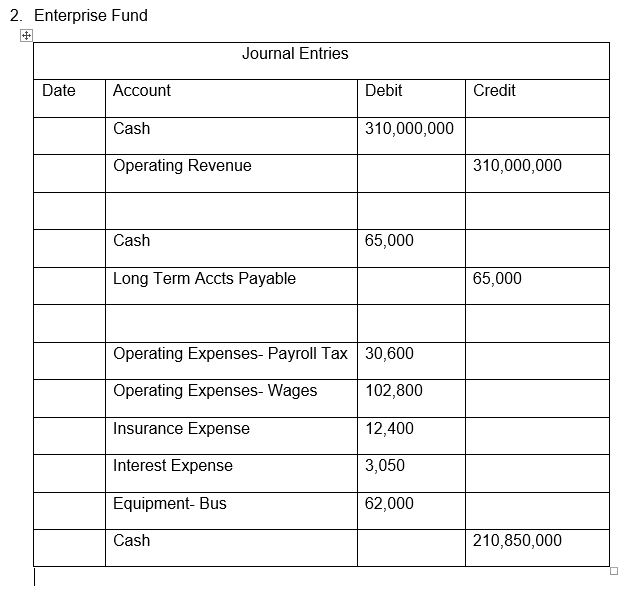

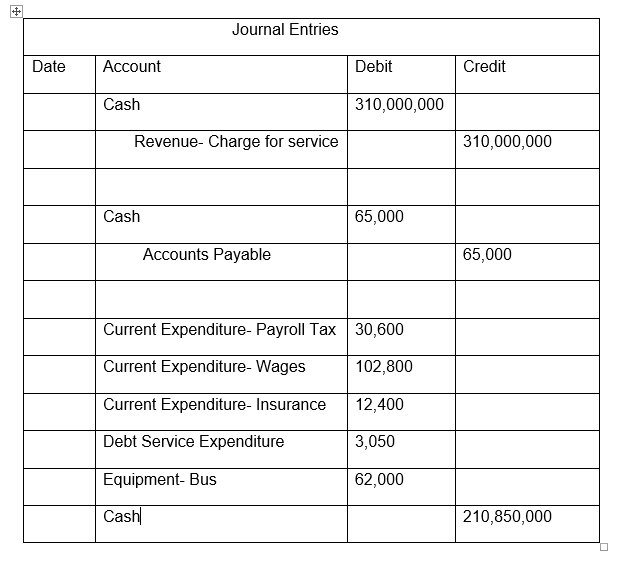

Option #1: Proprietary Fund Provide complete answers to the following two problems: 1. Describe the differences in cash flow statements required by GASB standards when compared with cash flow statements required by FASB standards. 2. The Village of Watkins Glenn operated an educational program for at-risk middle school children. Businesses and nonprofit organizations sponsor the children and pay the registration fee a. The following cash receipts were collected: i Registration 310,000 ii. Cash loan from bank 65,000 b. The following cash disbursements were made: i. Payroll taxes 30,600 ii. Labor 102,800 iii. Insurance 12,400 iv. Interest 3.050 v. Purchase school bus 62,000. Required Prepare the journal entries to record revenues and disbursements if the city treats the program as an enterprise fund Prepare the journal entries to record revenues and disbursements if the city treats the program as a special revenue fund. 2. Enterprise Fund Journal Entries Date Account Debit Credit Cash 310,000,000 Operating Revenue 310,000,000 Cash 65,000 Long Term Accts Payable 65,000 Operating Expenses- Payroll Tax 30,600 Operating Expenses- Wages 102,800 Insurance Expense Interest Expense Equipment- Bus Cash 12,400 3,050 62,000 210,850,000 Journal Entries Date Account Debit Credit Cash 310,000,000 Revenue- Charge for service 310,000,000 Cash 65,000 Accounts Payable 65,000 Current Expenditure- Payroll Tax 30,600 Current Expenditure- Wages 102,800 Current Expenditure- Insurance 12,400 Debt Service Expenditure Equipment- Bus Cash 3,050 62,000 210,850,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts