Question: Does this look right so far? C.) If the firm were to reduce its reliance on debt financing such that interest expense were cut in

Does this look right so far?

C.) If the firm were to reduce its reliance on debt financing such that interest expense were cut in half, how would this affect your answers to parts a and b?

It would affect in part a and b

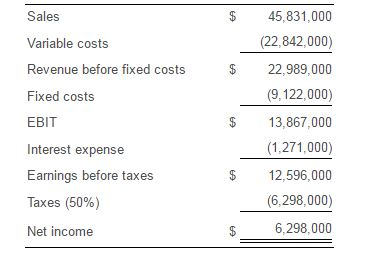

Percent would earnings before interest and taxes increase= 22,989,000*20%/13867000

Percent would earnings before interest and taxes increase = 33.16%

Percent would earnings before interest and taxes decrease= 22,989,000*20%/13867000

Percent would earnings before interest and taxes decrease = -33.16%

Percent would net income increase =( 22,989,000*20%-?/2)*(1-50%)/6298000

Percent would net income increase? = ?

Percent would net income decrease =( 22,989,000*20%+?/2)*(1-50%)/6298000

Percent would net income decrease? =?

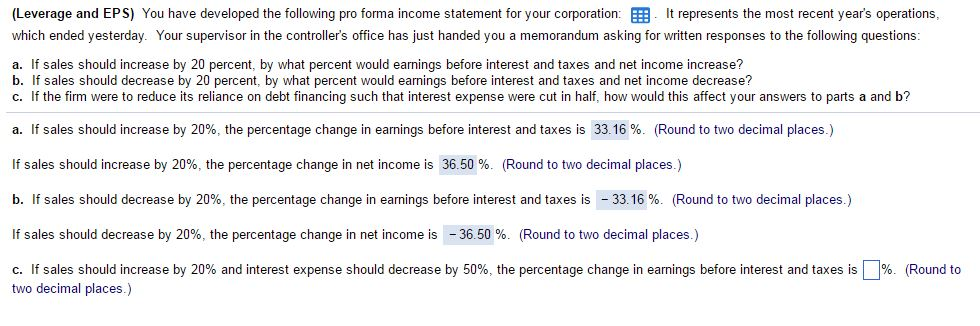

(Leverage and EPS) You have developed the following pro forma income statement for your corporation: EEB It represents the most recent year's operations, which ended yesterday. Your supervisor in the controller's office has just handed you a memorandum asking for written responses to the following questions: a. If sales should increase by 20 percent, by what percent would earnings before interest and taxes and net income increase? b. If sales should decrease by 20 percent, by what percent would earnings before interest and taxes and net income decrease? c. If the firm were to reduce its reliance on debt financing such that interest expense were cut in half, how would this affect your answers to parts a and b? a. If sales should increase by 20%, the percentage change in earnings before interest and taxes is 33.16 %. (Round to two decimal places.) If sales should increase by 20%, the percentage change in net income is 36.50 %. (Round to two decimal places.) b. If sales should decrease by 20%, the percentage change in earnings before interest and taxes is -33.16 %. (Round to two decimal places.) If sales should decrease by 20%, the percentage change in net income is -36.50 %. (Round to two decimal places ) % Round d to c. If sales should increase by 20% and interest expense should decrease by 50%, the percentage change in ear ings before interest and taxes is two decimal places.) o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts