Question: DOL (remain constant, decrease, increase) DFL (remain constant, decrease, increase) DCL(remain constant, decrease, increase) The most recent income statement for Tucker Manufacturing follows. Tucker is

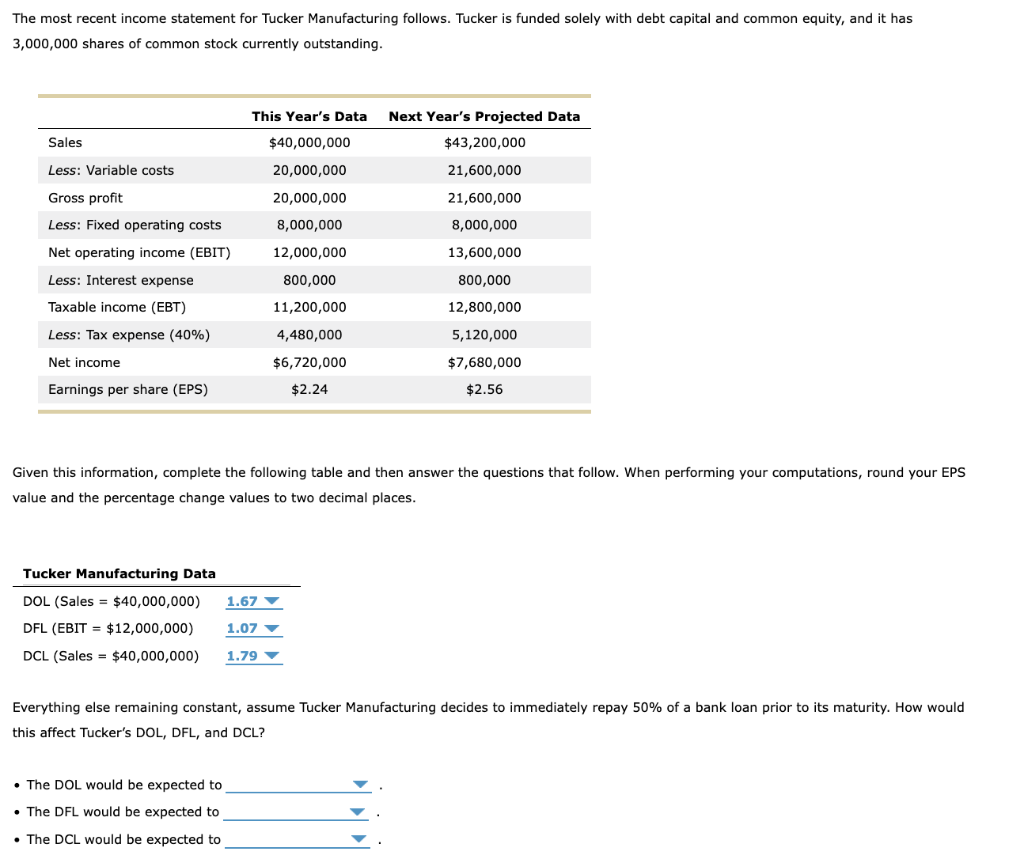

DOL (remain constant, decrease, increase)

DFL (remain constant, decrease, increase)

DCL(remain constant, decrease, increase)

The most recent income statement for Tucker Manufacturing follows. Tucker is funded solely with debt capital and common equity, and it has 3,000,000 shares of common stock currently outstanding. Given this information, complete the following table and then answer the questions that follow. When performing your computations, round your EPS value and the percentage change values to two decimal places. Everything else remaining constant, assume Tucker Manufacturing decides to immediately repay 50% of a bank loan prior to its maturity. How would this affect Tucker's DOL, DFL, and DCL? - The DOL would be expected to - The DFL would be expected to - The DCL would be expected to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts