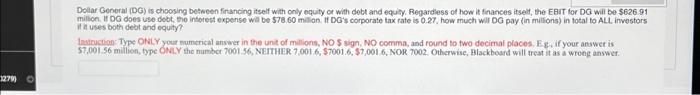

Question: Dollar General (DG) is choosing between financing itself with only equity or with debt and equity. Regardless of how it finances itself, the EBIT for

Dolar General (DG) is choosing betseen firsncing itself with only equity of with dobt and equity. Regardiess of how it finances itselt, the EBIt for DG will be \$626.91 millon. If DG does use debt tho interest expense will be 576.60 millon. It DG's corporate tax rate is 0.27 , how much wilf DG pay (in mitions) in total to ALL investors It it uses both debt and equity? 57,001.56 milion, type OWa.Y the number 7001.56, NEITHER 7,001 6, 57001.6,$7,001.6,NOR7002, Otherwise, Hlackboard will treat it as a wrong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts