Question: DOLLAR TREE Overview We are a leading operator or discount variety stores. At February 2, 2018 we operated 14,835 discount variety retail storesOur stores operate

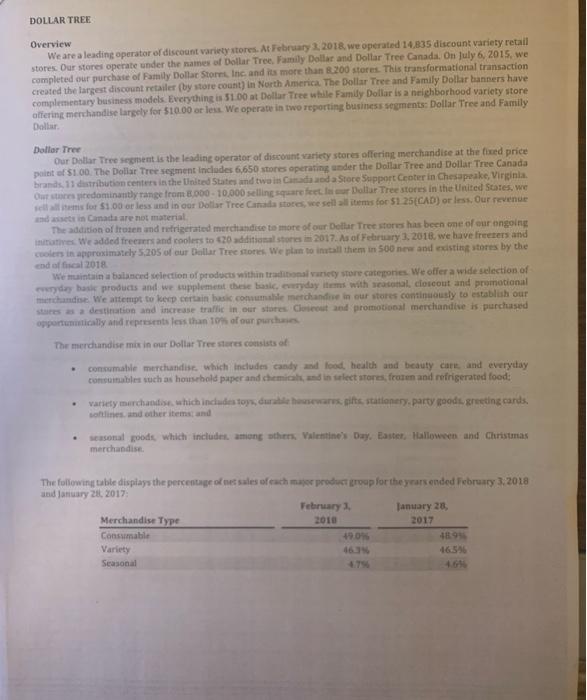

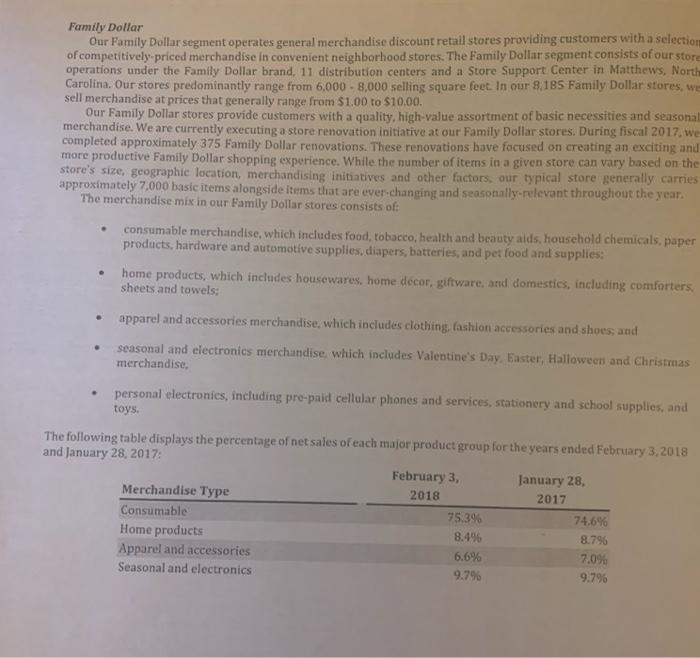

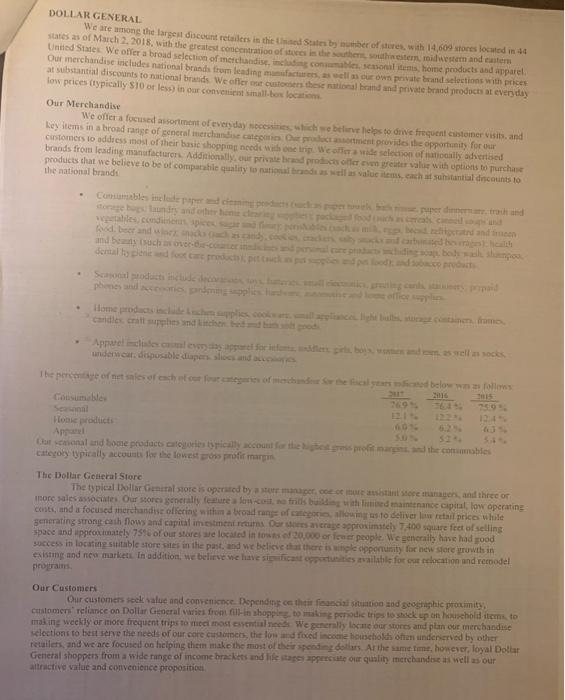

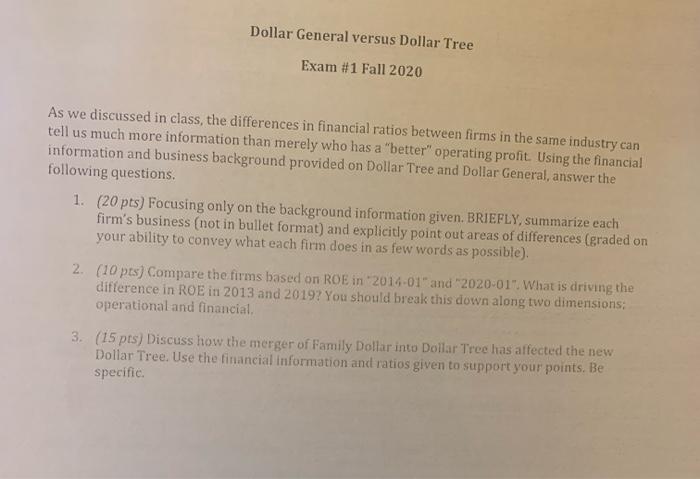

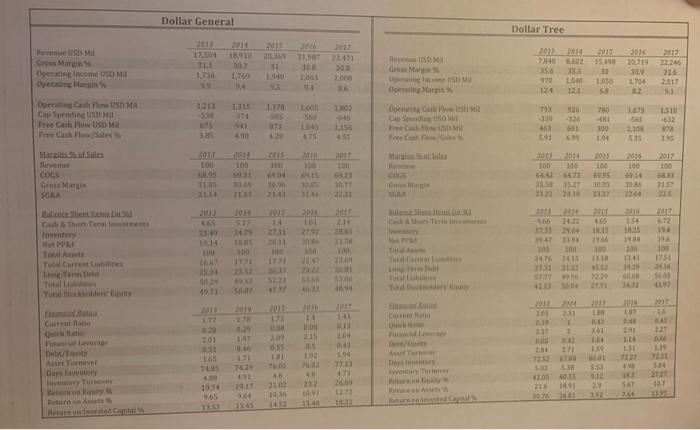

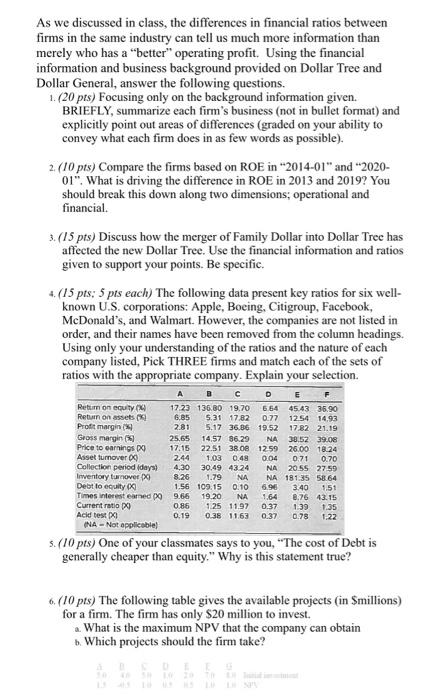

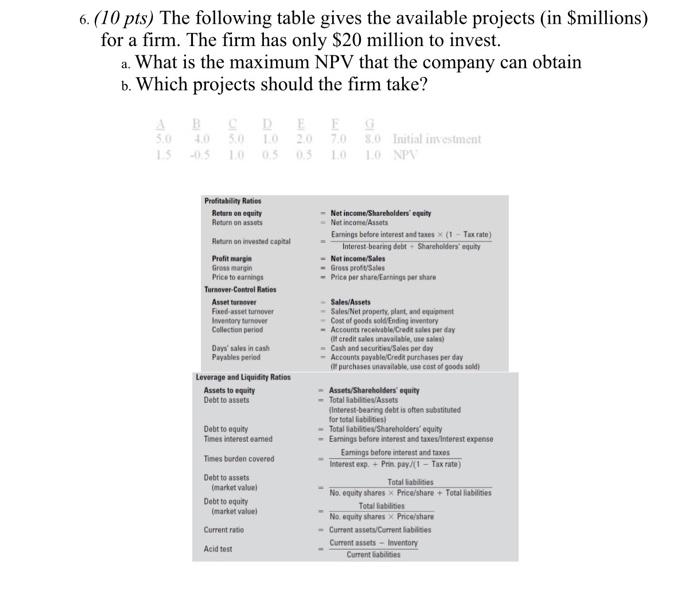

DOLLAR TREE Overview We are a leading operator or discount variety stores. At February 2, 2018 we operated 14,835 discount variety retail storesOur stores operate under the names of Dollar Tree Family Dollar and Dollar Tree Canada. On July 6, 2015, we completed our purchase of Family Dollar Store Inc. and its more than 200 stores. This transformational transaction created the largest discount retailer (by store count) in North America. The Dollar Tree and Family Dollar banners have complementary business models Everything is 51.00 at Dollar Tree while Family Dollar is a neighborhood variety store offering merchandise largely for $10.00 or les. We operate in two reporting business segments: Dollar Tree and Family Dollar Dollar Tree Our Dollar Tree segment is the leading operator of discount variety stores offering merchandise at the fixed price pultit of $1.00. The Dollar Tree segment includes 6,650 stores operating under the Dollar Tree and Dollar Tree Canada brands 11 distribution centers in the United States and two in Canada anda Store Support Center in Chesapeake, Virginia Our tres predominantly range from 8.000 - 10.000 selling square feet our Dollar Tree stores in the United States, we for $1.00 or less and in our Dollar Tree Camastore, we sell all items for 51 25(CAD) or less. Our revenue de in Canadare not material The addition of frozen und refrigerated merchandise to more of our Dollar Tree stores has been one of our ongoing natives. We added frecues and coolers to 20 dditional stones in 2017. As of February 3, 2018, we have freeters and coolers in approximately 5.205 of our Dollar Tree stones. We plan to install them in 500 new and editing stores by the and offical 2018 We maintain a balanced selection of products within traditional variety store categories. We offer a wide selection of wyday base products and we supplement the basic everyday items with Baconal closeout and promotional merchandise. We attempt to keep certain basic consumabile merchandise in our stores continuously to establish our starea destination and increase traffic in our stores Cuscout and promotional merchandise is purchased opportunistically and represents less than 10% of our purchase The mercundise mix in our Dollar Tree stres consists of consumable merchandise which includes candy and food, health and beauty care and everyday consumables such as household paper and chemicals and in select stores, frasen and refrigerated food: variety merchandise which includes toys, durable seas, its stationery, party od greeting cards, solines and other items and . . seasonal goods which includes among others, Valentine's Day Easter Halloween and Christmas merchandise The following table displays the percentageome sales of each product group for the years ended February 3, 2018 and January 21, 2017 February January 28, Merchandise Type 2010 2017 Consumabile 1909 Variety 4653 Seasonal Family Dollar Our Family Dollar segment operates general merchandise discount retail stores providing customers with a selection of competitively-priced merchandise in convenient neighborhood stores. The Family Dollar segment consists of our store operations under the Family Dollar brand, 11 distribution centers and a Store Support Center in Matthews, North Carolina. Our stores predominantly range from 6,000 - 8,000 selling square feet. In our 8.185 Family Dollar stores, we sell merchandise at prices that generally range from $1.00 to $10.00 Our Family Dollar stores provide customers with a quality, high-value assortment of basic necessities and seasonal merchandise. We are currently executing a store renovation initiative at our Family Dollar stores. During fiscal 2017, we completed approximately 375 Family Dollar renovations. These renovations have focused on creating an exciting and more productive Family Dollar shopping experience. While the number of items in a given store can vary based on the store's size, geographic location, merchandising initiatives and other factors, our typical store generally carnes approximately 7,000 basic items alongside items that are ever-changing and seasonally-relevant throughout the year. The merchandise mix in our Family Dollar stores consists of: consumable merchandise, which includes food, tobacco, health and beauty aids, household chemicals, paper products, hardware and automotive supplies, diapers, batteries, and pet food and supplies: home products, which includes housewares, home decor, giftware, and domestics, including comforters. sheets and towels: . apparel and accessories merchandise, which includes clothing, fashion accessories and shoes, and seasonal and electronics merchandise, which includes Valentine's Day. Easter, Halloween and Christmas merchandise . . personal electronics, including pre-paid cellular phones and services, stationery and school supplies, and toys. The following table displays the percentage of net sales of each major product group for the years ended February 3, 2018 and January 28, 2017: February 3, January 28, Merchandise Type 2018 2017 Consumable 75.396 74.6% Home products 8.496 8.796 Apparel and accessories 6.6% 7,096 Seasonal and electronics 9.7% 9.7% DOLLAR GENERAL We are among the largest discount retailers in the United States by number of stores, with 14,609 stores located in 44 stes as of March 2. 2018, with the greatest concentration of stories in the souther, southwestern, midwestern and easter United States. We offer a broad selection of merchandise, i consumables seasonal tumis, home products and apparel Our merchandise includes national brands from leading manufacturers, as well as our own private and selections with prices at substantial discounts to national brands We offer our customers these ima brand and private brand products at everyday low prices (typically $10 or less in our convenient small box location Our Merchandise We offer a focused assortment of every day necessities which we beline helps to drive frequent customer visits and Ley items in a broad range of general merchandicate tractament provides the opportunity for our customers to address most of their basic shopping neede weinig Wetera wide selection of nationally advertised brands from leading manufacturer. Additionally, our private band products or even greater value with options to purchase products that we believe to be of comparable quality to manda was alumeacha sastantial discounts 10 the national brands Commables include the dead ws.com der and and besuche bobo Dit Apreciadas a part of this well as socks underwear disposable dans les and The price of met alsof het oog of merched and below wolle Consumable 121 House podict 604 Anal Our cinalind home products are cally account for the song the commables Category wypically accounts for the lowestros profit marin The Dollar General Store The typical Dollar Genital store is operated by a manger comes to managers, and three or more sales associates Our Stores generally feature low-coiletrick built with lised maintenance capital, low operating costs, and is focused merchandise offering within a broad range of categories, allowing us to deliver low retail prices while generating strong cash flows and capital imestment returns Our ancrage approximately 7400 square feet of selling space and approximately 739 of our stores are located in towns of 20,000 or femer people. We generally have had good success in locating siitable store sites in the past, and we believe that there is whole opportunity for new store rowth in esisting and new market. In addition, we believe we have so fast opportunities available for our relocation and remodel program Our Customers Our customers seek value and convenience. Depending on their facial situation and geographic proximity customer reliance on Dollar General varies from fl-in shopping to making periodic trips to shock up on household items to making weekly or imore frequent trips to me most sential needs. Wepenerally locate our stores and plan our merchandise selections to best serve the needs of our core customers, the low and fixed income boucholchohin underserved by other retailers, and we are focused on helping them make the most of their spending dollars. At the same time, however, loyal Dollar General shoppers from a wide range of income brackets and life stapes preciate our quality merchandise as well as our attractive value and convenience proposition Dollar General versus Dollar Tree Exam #1 Fall 2020 As we discussed in class, the differences in financial ratios between firms in the same industry can tell us much more information than merely who has a "better" operating profit. Using the financial information and business background provided on Dollar Tree and Dollar General, answer the following questions 1. (20 pts) Focusing only on the background information given. BRIEFLY, summarize each firm's business (not in bullet format) and explicitly point out areas of differences (graded on your ability to convey what each firm does in as few words as possible). 2. (10 pts) Compare the firms based on ROE in 2014-01" and "2020-017. What is driving the difference in ROE in 2013 and 2019? You should break this down along two dimensions: operational and financial 3. (15 pts) Discuss how the merger of Family Dollar into Dollar Tree has affected the new Dollar Tree. Use the financial information and ratios given to support your points. Be specific Dollar General Dollar Tree 17.504 8.919 2013 2018 2013119 31 JO 2014 evenue USD Mil Man Operating income USD MU Operating Mari 24 30 2000 22246 2011 7,340 002 150 33 2040 124 2013 154 30 1.000 USOM Gro Mars Origt Mit Opening Stue 2018 20,719 30. 1.700 OF ZIUE 9.2 CITI DES 1.370 1.005 560 793 730 Dorm Chow DMX Cap Spelin USTY Mil Free Cash Flow USOMA Tre Cases 1.510 540 1.155 920 -124 Oil Mit Caps SUSO MI Cashot w/ 1673 565 1.100 61 ODE US 16 699 1.04 SES 1.95 2013 100 100 POL 001 TE 100 Mat Sales Heve COGS Gu Mar SGSA 2015 100 2012 207 100 100 4. 100 123 100 COGS 100 . 30 22.00 LUE 10.03 115 PIE SULA ICE WEEE LE Thor 2014 297 HT 24 70 194 266 1913 1947 TO Balance Sheets Caths Short Term Inventory Net Total Total Care Lime Term Total List Tu diniy 19 100 100 100 14. 1966 100 1 Thr TO 1418 1951 WE CE atne 12:39 utile Terry 2014 10 1. 14 Climati C Quick 1 0.00 201 217 1 20 204 16 190 LE 61 IN 0.16 111 10 USO IT 2.1 Det/ Turnver Day 104 71 D/ Auto Da Iwery 2.31 50 S'S 49 4. 12 SO VIE tout CO 19.40 w on by Furtun in In A 1036 142 LOVE 14 1272 L22 TE 114 As we discussed in class, the differences in financial ratios between firms in the same industry can tell us much more information than merely who has a better" operating profit. Using the financial information and business background provided on Dollar Tree and Dollar General, answer the following questions. 1. (20 pts) Focusing only on the background information given. BRIEFLY, summarize each firm's business (not in bullet format) and explicitly point out areas of differences (graded on your ability to convey what each firm does in as few words as possible). 2. (10 pts) Compare the firms based on ROE in "2014-01" and "2020- 01". What is driving the difference in ROE in 2013 and 2019? You should break this down along two dimensions: operational and financial 3. (15 pts) Discuss how the merger of Family Dollar into Dollar Tree has affected the new Dollar Tree. Use the financial information and ratios given to support your points. Be specific. 4. (15 pts: 5 pts each) The following data present key ratios for six well- known U.S. corporations: Apple, Boeing, Citigroup, Facebook, McDonald's, and Walmart. However, the companies are not listed in order, and their names have been removed from the column headings. Using only your understanding of the ratios and the nature of each company listed, Pick THREE firms and match each of the sets of ratios with the appropriate company. Explain your selection. 0.77 Return on equity Return on assets Profit margin Gross margin Price to earnings Asset turnover 09 Collection period (days! Inventory turnover Debt to equity Times interest earned Current ratio o Acid test INA - Not applicable) A B D E F 17.23 136.80 19.70 654 45.43 35.90 6.85 5.31 17.82 1254 14.93 2.81 5.17 36.06 19.52 17.82 21.19 25.65 14.57 86.29 NA 38.52 39.08 17.15 22.51 38.08 12.59 26.00 18.24 2.44 1.03 0.48 0.04 0.71 0.70 4,30 30.49 4324 NA 20.55 27.59 8.26 1.79 NA NA 181.35 58.64 1.56 109.15 0.10 6.96 3.40 1,51 9.66 19.20 1.64 0.76 43.15 0.86 1.25 11.97 0.37 139 1.35 0.19 0.38 11.63 0.37 0.78 NA 1.22 5. (10 pts) One of your classmates says to you, "The cost of Debt is generally cheaper than equity." Why is this statement true? 6. (10 pts) The following table gives the available projects (in Smillions) for a firm. The firm has only $20 million to invest. a. What is the maximum NPV that the company can obtain b. Which projects should the firm take? 6. (10 pts) The following table gives the available projects (in $millions) for a firm. The firm has only $20 million to invest. a. What is the maximum NPV that the company can obtain b. Which projects should the firm take? 3.0 15 D 10 20 70 8,0 Initial investment -1.5 100,5 0,5 10 10. NPN Profitability Ratios Return on equity Return ons Net income/Shareholders' equity Nat income Earnings before interest and taxes (1 Texte) Interest bearing debt. Shareholders Not income/Sales Grow proft/Sales Price per share Earning share I! Ruburn on invested capital Profit margin Gross margin Price to earnings Turnover Control Rates Assettorever Fixed assettever Inventory turnover Collection period Days' sales in cash Puyables period Sales/Assets Sales Net property, plant andet - Cost of goods soldEnding inventory - Accounts receivable Credits per day it credit sales unavailable - Cash and securities per day - Accounts payable Credit purchases per day purchases viable, use cost of goods sold) Leverage and Liquidity Ratios Assets to equity Debt to assets Debt to equity Times interesteamed Times burden covered Debt to assets market value Debt to equity market value Current rutie Assets/Shareholders' equity Total abilities Assets Interest-bearing debt is often substituted for totallibilities Total abilities/Shareholders' equity Earnings before interest and taxes interest expense Earings before interest and taxes Interest exp. + Prin pay/(1 - Tax rate) Total liabilities No equity shares Price/share+ Total abilities Total abilities No equity stres x Price/share - Current assets/Current labies Current assets - Inventory Current abilities Acid test DOLLAR TREE Overview We are a leading operator or discount variety stores. At February 2, 2018 we operated 14,835 discount variety retail storesOur stores operate under the names of Dollar Tree Family Dollar and Dollar Tree Canada. On July 6, 2015, we completed our purchase of Family Dollar Store Inc. and its more than 200 stores. This transformational transaction created the largest discount retailer (by store count) in North America. The Dollar Tree and Family Dollar banners have complementary business models Everything is 51.00 at Dollar Tree while Family Dollar is a neighborhood variety store offering merchandise largely for $10.00 or les. We operate in two reporting business segments: Dollar Tree and Family Dollar Dollar Tree Our Dollar Tree segment is the leading operator of discount variety stores offering merchandise at the fixed price pultit of $1.00. The Dollar Tree segment includes 6,650 stores operating under the Dollar Tree and Dollar Tree Canada brands 11 distribution centers in the United States and two in Canada anda Store Support Center in Chesapeake, Virginia Our tres predominantly range from 8.000 - 10.000 selling square feet our Dollar Tree stores in the United States, we for $1.00 or less and in our Dollar Tree Camastore, we sell all items for 51 25(CAD) or less. Our revenue de in Canadare not material The addition of frozen und refrigerated merchandise to more of our Dollar Tree stores has been one of our ongoing natives. We added frecues and coolers to 20 dditional stones in 2017. As of February 3, 2018, we have freeters and coolers in approximately 5.205 of our Dollar Tree stones. We plan to install them in 500 new and editing stores by the and offical 2018 We maintain a balanced selection of products within traditional variety store categories. We offer a wide selection of wyday base products and we supplement the basic everyday items with Baconal closeout and promotional merchandise. We attempt to keep certain basic consumabile merchandise in our stores continuously to establish our starea destination and increase traffic in our stores Cuscout and promotional merchandise is purchased opportunistically and represents less than 10% of our purchase The mercundise mix in our Dollar Tree stres consists of consumable merchandise which includes candy and food, health and beauty care and everyday consumables such as household paper and chemicals and in select stores, frasen and refrigerated food: variety merchandise which includes toys, durable seas, its stationery, party od greeting cards, solines and other items and . . seasonal goods which includes among others, Valentine's Day Easter Halloween and Christmas merchandise The following table displays the percentageome sales of each product group for the years ended February 3, 2018 and January 21, 2017 February January 28, Merchandise Type 2010 2017 Consumabile 1909 Variety 4653 Seasonal Family Dollar Our Family Dollar segment operates general merchandise discount retail stores providing customers with a selection of competitively-priced merchandise in convenient neighborhood stores. The Family Dollar segment consists of our store operations under the Family Dollar brand, 11 distribution centers and a Store Support Center in Matthews, North Carolina. Our stores predominantly range from 6,000 - 8,000 selling square feet. In our 8.185 Family Dollar stores, we sell merchandise at prices that generally range from $1.00 to $10.00 Our Family Dollar stores provide customers with a quality, high-value assortment of basic necessities and seasonal merchandise. We are currently executing a store renovation initiative at our Family Dollar stores. During fiscal 2017, we completed approximately 375 Family Dollar renovations. These renovations have focused on creating an exciting and more productive Family Dollar shopping experience. While the number of items in a given store can vary based on the store's size, geographic location, merchandising initiatives and other factors, our typical store generally carnes approximately 7,000 basic items alongside items that are ever-changing and seasonally-relevant throughout the year. The merchandise mix in our Family Dollar stores consists of: consumable merchandise, which includes food, tobacco, health and beauty aids, household chemicals, paper products, hardware and automotive supplies, diapers, batteries, and pet food and supplies: home products, which includes housewares, home decor, giftware, and domestics, including comforters. sheets and towels: . apparel and accessories merchandise, which includes clothing, fashion accessories and shoes, and seasonal and electronics merchandise, which includes Valentine's Day. Easter, Halloween and Christmas merchandise . . personal electronics, including pre-paid cellular phones and services, stationery and school supplies, and toys. The following table displays the percentage of net sales of each major product group for the years ended February 3, 2018 and January 28, 2017: February 3, January 28, Merchandise Type 2018 2017 Consumable 75.396 74.6% Home products 8.496 8.796 Apparel and accessories 6.6% 7,096 Seasonal and electronics 9.7% 9.7% DOLLAR GENERAL We are among the largest discount retailers in the United States by number of stores, with 14,609 stores located in 44 stes as of March 2. 2018, with the greatest concentration of stories in the souther, southwestern, midwestern and easter United States. We offer a broad selection of merchandise, i consumables seasonal tumis, home products and apparel Our merchandise includes national brands from leading manufacturers, as well as our own private and selections with prices at substantial discounts to national brands We offer our customers these ima brand and private brand products at everyday low prices (typically $10 or less in our convenient small box location Our Merchandise We offer a focused assortment of every day necessities which we beline helps to drive frequent customer visits and Ley items in a broad range of general merchandicate tractament provides the opportunity for our customers to address most of their basic shopping neede weinig Wetera wide selection of nationally advertised brands from leading manufacturer. Additionally, our private band products or even greater value with options to purchase products that we believe to be of comparable quality to manda was alumeacha sastantial discounts 10 the national brands Commables include the dead ws.com der and and besuche bobo Dit Apreciadas a part of this well as socks underwear disposable dans les and The price of met alsof het oog of merched and below wolle Consumable 121 House podict 604 Anal Our cinalind home products are cally account for the song the commables Category wypically accounts for the lowestros profit marin The Dollar General Store The typical Dollar Genital store is operated by a manger comes to managers, and three or more sales associates Our Stores generally feature low-coiletrick built with lised maintenance capital, low operating costs, and is focused merchandise offering within a broad range of categories, allowing us to deliver low retail prices while generating strong cash flows and capital imestment returns Our ancrage approximately 7400 square feet of selling space and approximately 739 of our stores are located in towns of 20,000 or femer people. We generally have had good success in locating siitable store sites in the past, and we believe that there is whole opportunity for new store rowth in esisting and new market. In addition, we believe we have so fast opportunities available for our relocation and remodel program Our Customers Our customers seek value and convenience. Depending on their facial situation and geographic proximity customer reliance on Dollar General varies from fl-in shopping to making periodic trips to shock up on household items to making weekly or imore frequent trips to me most sential needs. Wepenerally locate our stores and plan our merchandise selections to best serve the needs of our core customers, the low and fixed income boucholchohin underserved by other retailers, and we are focused on helping them make the most of their spending dollars. At the same time, however, loyal Dollar General shoppers from a wide range of income brackets and life stapes preciate our quality merchandise as well as our attractive value and convenience proposition Dollar General versus Dollar Tree Exam #1 Fall 2020 As we discussed in class, the differences in financial ratios between firms in the same industry can tell us much more information than merely who has a "better" operating profit. Using the financial information and business background provided on Dollar Tree and Dollar General, answer the following questions 1. (20 pts) Focusing only on the background information given. BRIEFLY, summarize each firm's business (not in bullet format) and explicitly point out areas of differences (graded on your ability to convey what each firm does in as few words as possible). 2. (10 pts) Compare the firms based on ROE in 2014-01" and "2020-017. What is driving the difference in ROE in 2013 and 2019? You should break this down along two dimensions: operational and financial 3. (15 pts) Discuss how the merger of Family Dollar into Dollar Tree has affected the new Dollar Tree. Use the financial information and ratios given to support your points. Be specific Dollar General Dollar Tree 17.504 8.919 2013 2018 2013119 31 JO 2014 evenue USD Mil Man Operating income USD MU Operating Mari 24 30 2000 22246 2011 7,340 002 150 33 2040 124 2013 154 30 1.000 USOM Gro Mars Origt Mit Opening Stue 2018 20,719 30. 1.700 OF ZIUE 9.2 CITI DES 1.370 1.005 560 793 730 Dorm Chow DMX Cap Spelin USTY Mil Free Cash Flow USOMA Tre Cases 1.510 540 1.155 920 -124 Oil Mit Caps SUSO MI Cashot w/ 1673 565 1.100 61 ODE US 16 699 1.04 SES 1.95 2013 100 100 POL 001 TE 100 Mat Sales Heve COGS Gu Mar SGSA 2015 100 2012 207 100 100 4. 100 123 100 COGS 100 . 30 22.00 LUE 10.03 115 PIE SULA ICE WEEE LE Thor 2014 297 HT 24 70 194 266 1913 1947 TO Balance Sheets Caths Short Term Inventory Net Total Total Care Lime Term Total List Tu diniy 19 100 100 100 14. 1966 100 1 Thr TO 1418 1951 WE CE atne 12:39 utile Terry 2014 10 1. 14 Climati C Quick 1 0.00 201 217 1 20 204 16 190 LE 61 IN 0.16 111 10 USO IT 2.1 Det/ Turnver Day 104 71 D/ Auto Da Iwery 2.31 50 S'S 49 4. 12 SO VIE tout CO 19.40 w on by Furtun in In A 1036 142 LOVE 14 1272 L22 TE 114 As we discussed in class, the differences in financial ratios between firms in the same industry can tell us much more information than merely who has a better" operating profit. Using the financial information and business background provided on Dollar Tree and Dollar General, answer the following questions. 1. (20 pts) Focusing only on the background information given. BRIEFLY, summarize each firm's business (not in bullet format) and explicitly point out areas of differences (graded on your ability to convey what each firm does in as few words as possible). 2. (10 pts) Compare the firms based on ROE in "2014-01" and "2020- 01". What is driving the difference in ROE in 2013 and 2019? You should break this down along two dimensions: operational and financial 3. (15 pts) Discuss how the merger of Family Dollar into Dollar Tree has affected the new Dollar Tree. Use the financial information and ratios given to support your points. Be specific. 4. (15 pts: 5 pts each) The following data present key ratios for six well- known U.S. corporations: Apple, Boeing, Citigroup, Facebook, McDonald's, and Walmart. However, the companies are not listed in order, and their names have been removed from the column headings. Using only your understanding of the ratios and the nature of each company listed, Pick THREE firms and match each of the sets of ratios with the appropriate company. Explain your selection. 0.77 Return on equity Return on assets Profit margin Gross margin Price to earnings Asset turnover 09 Collection period (days! Inventory turnover Debt to equity Times interest earned Current ratio o Acid test INA - Not applicable) A B D E F 17.23 136.80 19.70 654 45.43 35.90 6.85 5.31 17.82 1254 14.93 2.81 5.17 36.06 19.52 17.82 21.19 25.65 14.57 86.29 NA 38.52 39.08 17.15 22.51 38.08 12.59 26.00 18.24 2.44 1.03 0.48 0.04 0.71 0.70 4,30 30.49 4324 NA 20.55 27.59 8.26 1.79 NA NA 181.35 58.64 1.56 109.15 0.10 6.96 3.40 1,51 9.66 19.20 1.64 0.76 43.15 0.86 1.25 11.97 0.37 139 1.35 0.19 0.38 11.63 0.37 0.78 NA 1.22 5. (10 pts) One of your classmates says to you, "The cost of Debt is generally cheaper than equity." Why is this statement true? 6. (10 pts) The following table gives the available projects (in Smillions) for a firm. The firm has only $20 million to invest. a. What is the maximum NPV that the company can obtain b. Which projects should the firm take? 6. (10 pts) The following table gives the available projects (in $millions) for a firm. The firm has only $20 million to invest. a. What is the maximum NPV that the company can obtain b. Which projects should the firm take? 3.0 15 D 10 20 70 8,0 Initial investment -1.5 100,5 0,5 10 10. NPN Profitability Ratios Return on equity Return ons Net income/Shareholders' equity Nat income Earnings before interest and taxes (1 Texte) Interest bearing debt. Shareholders Not income/Sales Grow proft/Sales Price per share Earning share I! Ruburn on invested capital Profit margin Gross margin Price to earnings Turnover Control Rates Assettorever Fixed assettever Inventory turnover Collection period Days' sales in cash Puyables period Sales/Assets Sales Net property, plant andet - Cost of goods soldEnding inventory - Accounts receivable Credits per day it credit sales unavailable - Cash and securities per day - Accounts payable Credit purchases per day purchases viable, use cost of goods sold) Leverage and Liquidity Ratios Assets to equity Debt to assets Debt to equity Times interesteamed Times burden covered Debt to assets market value Debt to equity market value Current rutie Assets/Shareholders' equity Total abilities Assets Interest-bearing debt is often substituted for totallibilities Total abilities/Shareholders' equity Earnings before interest and taxes interest expense Earings before interest and taxes Interest exp. + Prin pay/(1 - Tax rate) Total liabilities No equity shares Price/share+ Total abilities Total abilities No equity stres x Price/share - Current assets/Current labies Current assets - Inventory Current abilities Acid test

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts