Question: Dollar Value LIFO Method Rachmaninoff Inc. uses the Dollar Value LIFO method to calculate ending inventory costs for their balance sheet. Using this method, determine

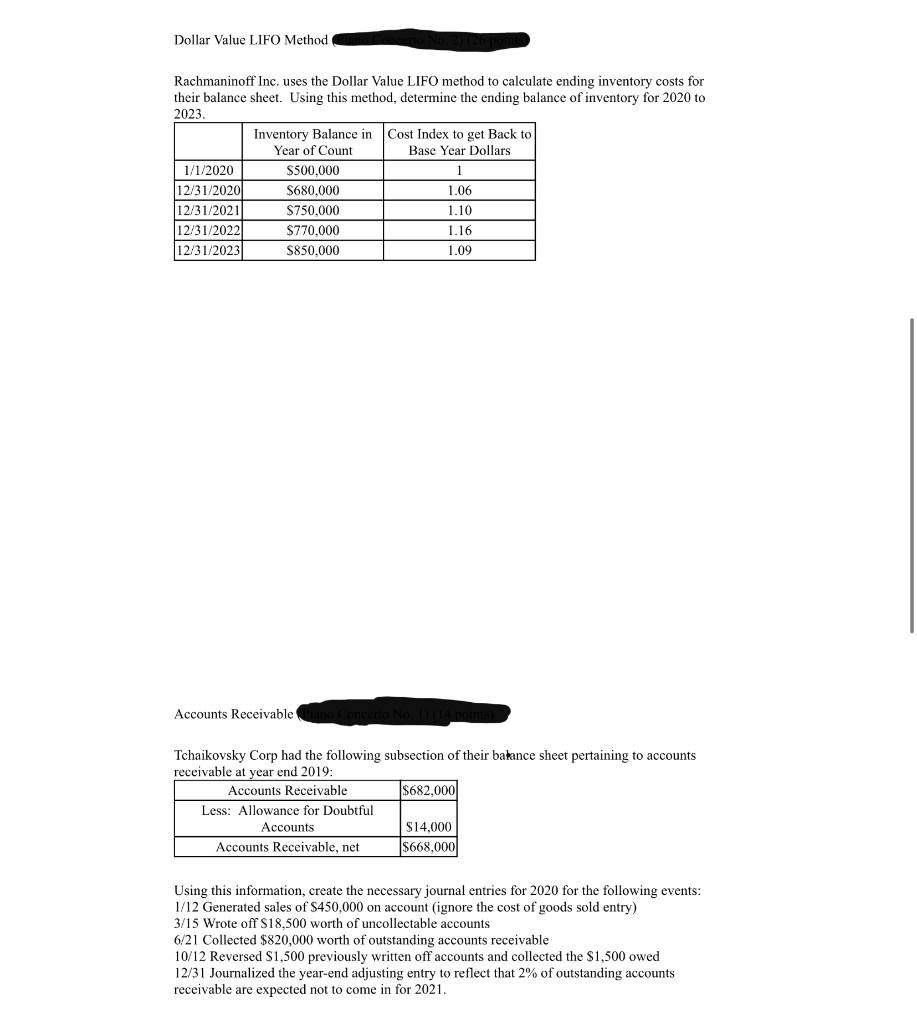

Dollar Value LIFO Method Rachmaninoff Inc. uses the Dollar Value LIFO method to calculate ending inventory costs for their balance sheet. Using this method, determine the ending balance of inventory for 2020 to 2023. Inventory Balance in Cost Index to get back to Year of Count Base Year Dollars 1/1/2020 $500,000 12/31/2020 S680,000 1.06 12/31/2021 $750,000 1.10 12/31/2022 $770,000 1.16 12/31/2023 S850,000 1.09 Accounts Receivable Piano Concerto No. 14 per Tchaikovsky Corp had the following subsection of their balance sheet pertaining to accounts receivable at year end 2019: Accounts Receivable $682,000 Less: Allowance for Doubtful Accounts $14,000 Accounts Receivable, net $668,000 Using this information, create the necessary journal entries for 2020 for the following events: 1/12 Generated sales of $450,000 on account (ignore the cost of goods sold entry) 3/15 Wrote off $18,500 worth of uncollectable accounts 6/21 Collected $820,000 worth of outstanding accounts receivable 10/12 Reversed $1,500 previously written off accounts and collected the $1,500 owed 12/31 Journalized the year-end adjusting entry to reflect that 2% of outstanding accounts receivable are expected not to come in for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts