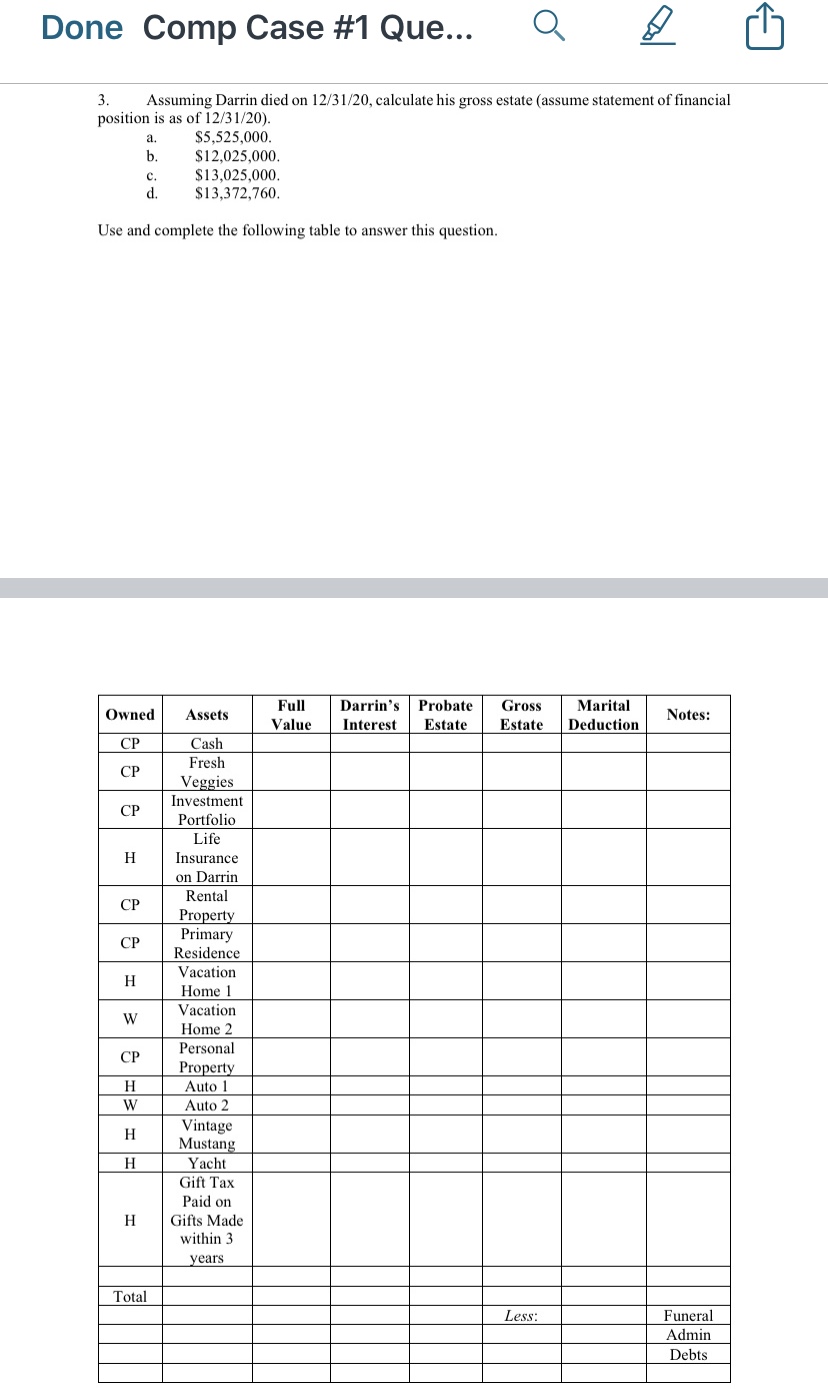

Question: Done Comp Case #1 Que... O 3. Assuming Darrin died on 12/31/20, calculate his gross estate (assume statement of financial position is as of 12/31/20)

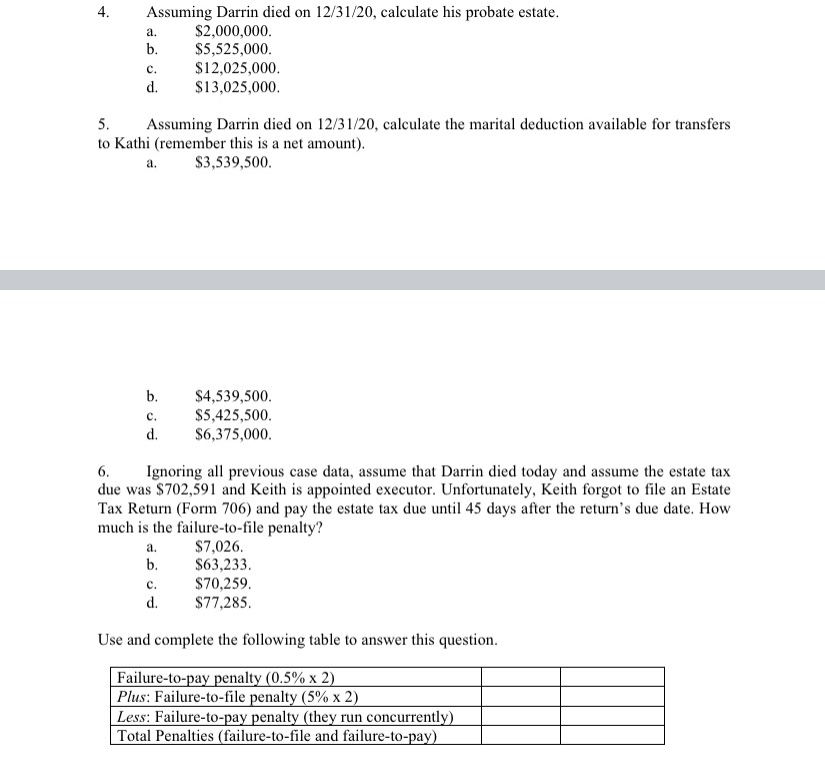

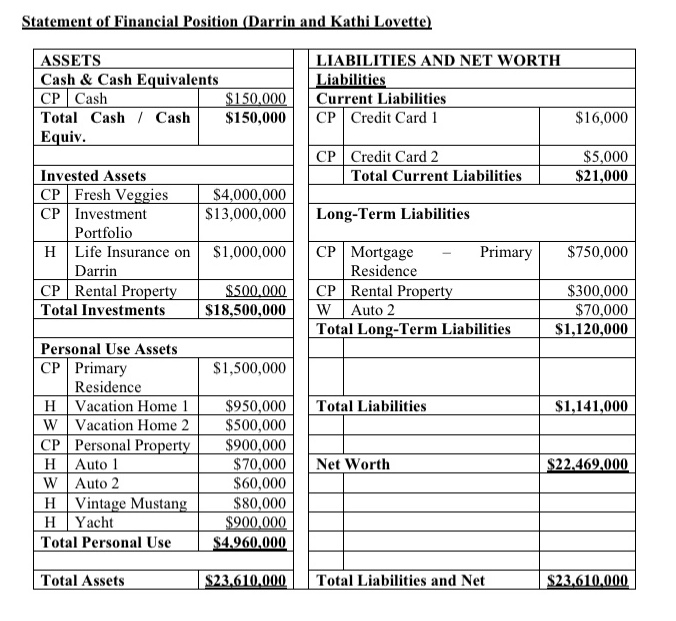

Done Comp Case #1 Que... O 3. Assuming Darrin died on 12/31/20, calculate his gross estate (assume statement of financial position is as of 12/31/20) $5,525,000. $12,025,000. $13,025,000 $13,372,760. Use and complete the following table to answer this question. Full Darrin's Probate Gross Marital Owned Assets Value Interest Estate Estate Notes: Deduction CP Cash CP Fresh Veggies Investment CP Portfolio Life H Insurance on Darrin CP Rental Property CP Primary Residence Vacation H Home 1 W Vacation Home 2 CP Personal Property H Auto W Auto 2 H Vintage Mustang H Yacht Gift Tax Paid on H Gifts Made within 3 years Total Less: Funeral Admin Debts4. Assuming Darrin died on 12/31/20, calculate his probate estate. $2,000,000. $5,525,000. $12,025,000. $13,025,000. 5. Assuming Darrin died on 12/31/20, calculate the marital deduction available for transfers to Kathi (remember this is a net amount). a. $3,539,500. $4,539,500. $5,425,500. $6,375,000. 6. Ignoring all previous case data, assume that Darrin died today and assume the estate tax due was $702,591 and Keith is appointed executor. Unfortunately, Keith forgot to file an Estate Tax Return (Form 706) and pay the estate tax due until 45 days after the return's due date. How much is the failure-to-file penalty? a $7,026. $63,233. $70,259. $77,285. Use and complete the following table to answer this question. Failure-to-pay penalty (0.5% x 2) Plus: Failure-to-file penalty (5% x 2) Less: Failure-to-pay penalty (they run concurrently) Total Penalties (failure-to-file and failure-to-pay)Statement of Financial Position (Darrin and Kathi Lovette) ASSETS LIABILITIES AND NET WORTH Cash & Cash Equivalents Liabilities CP Cash $150,000 Current Liabilities Total Cash / Cash $150,000 CP Credit Card 1 $16,000 Equiv. CP Credit Card 2 $5,000 Invested Assets Total Current Liabilities $21,000 CP Fresh Veggies $4,000,000 CP Investment $13,000,000 Long-Term Liabilities Portfolio H Life Insurance on $1,000,000 CP Mortgage Primary $750,000 Darrin Residence CP | Rental Property $500,000 CP Rental Property $300,000 Total Investments $18,500,000 W Auto 2 $70,000 Total Long-Term Liabilities $1,120,000 Personal Use Assets CP Primary $1,500,000 Residence H Vacation Home 1 $950,000 Total Liabilities $1,141,000 W Vacation Home 2 $500,000 CP | Personal Property $900,000 H Auto 1 $70,000 Net Worth $22.469,000 W Auto 2 $60,000 H Vintage Mustang $80,000 H Yacht $900,000 Total Personal Use $4.960,000 Total Assets $23.610.000 Total Liabilities and Net $23.610.000