Question: dono.com/secureditlockdown Aetna session Colnectio Dendam y w zy vyowashu -- witch H Marganelo - Read mm G Saved Help Save & Exit The stock in

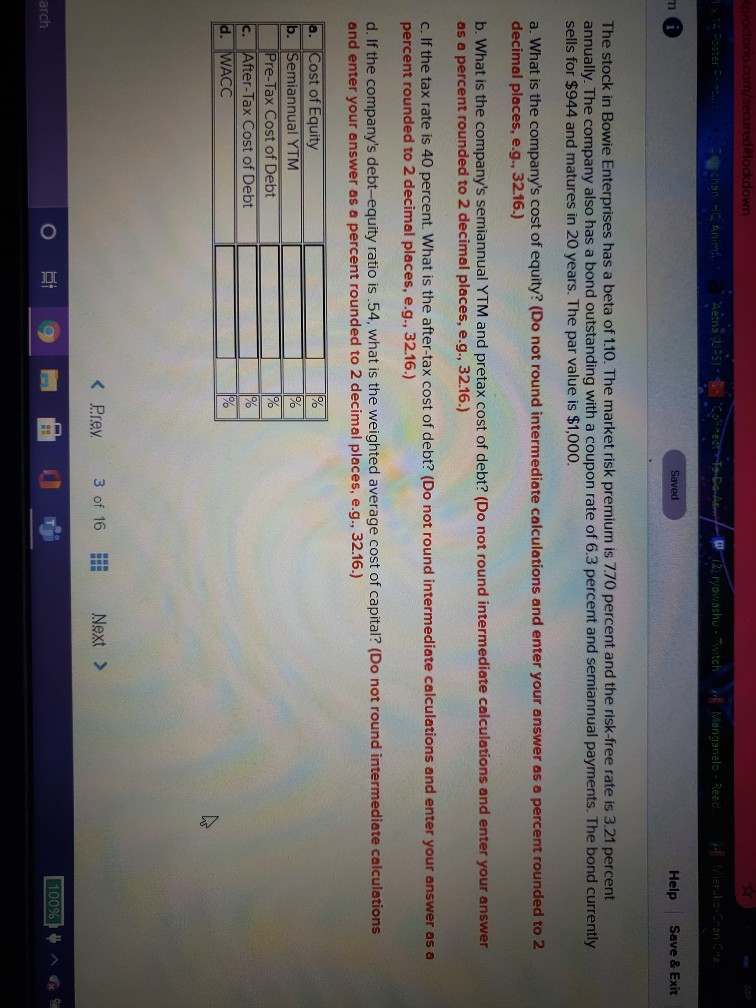

dono.com/secureditlockdown Aetna session Colnectio Dendam y w zy vyowashu -- witch H Marganelo - Read mm G Saved Help Save & Exit The stock in Bowie Enterprises has a beta of 1.10. The market risk premium is 7.70 percent and the risk-free rate is 3.21 percent annually. The company also has a bond outstanding with a coupon rate of 6.3 percent and semiannual payments. The bond currently sells for $944 and matures in 20 years. The par value is $1,000. a. What is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the company's semiannual YTM and pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. If the tax rate is 40 percent. What is the after-tax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) d. If the company's debt-equity ratio is.54, what is the weighted average cost of capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) % 1% a. Cost of Equity b. Semiannual YTM Pre-Tax Cost of Debt C. After-Tax Cost of Debt d. WACC % % % 100% arch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts