Question: Donovan Developers Inc. is considering a new project that would require an investment of $25 million. If the project were well received, it would produce

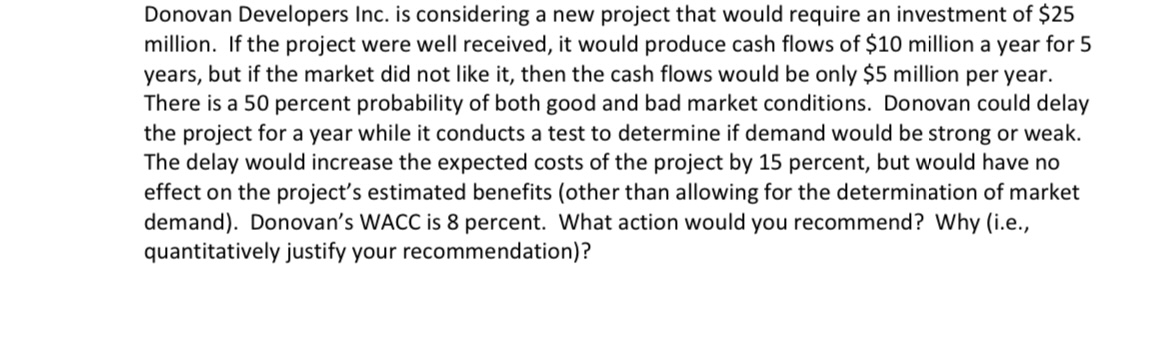

Donovan Developers Inc. is considering a new project that would require an investment of $25 million. If the project were well received, it would produce cash flows of $10 million a year for 5 years, but if the market did not like it, then the cash flows would be only $5 million per year. There is a 50 percent probability of both good and bad market conditions. Donovan could delay the project for a year while it conducts a test to determine if demand would be strong or weak. The delay would increase the expected costs of the project by 15 percent, but would have no effect on the project's estimated benefits (other than allowing for the determination of market demand). Donovan's WACC is 8 percent. What action would you recommend? Why (i.e., quantitatively justify your recommendation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts