Question: Dont answer (15 points) Joe Smarty, CFA, has been engaged to conduct an evaluation on the upcoming new issue of TagOn, a based business intelligenc

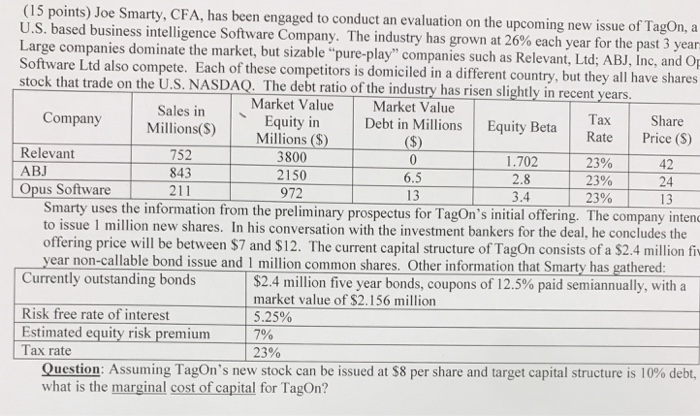

(15 points) Joe Smarty, CFA, has been engaged to conduct an evaluation on the upcoming new issue of TagOn, a based business intelligenc e Software Company. The industry has grown at 26% each year for the past 3 year ompanies dominate the market, but sizable "pure-play" companies such as Relevant, Ltd; ABJ, Inc, and Op Software Ltd also compete. Each of these competitors is do miciled in a different country, but they all have shares stock that trade on the U.S. NASDAQ. The debt ratio of the industry has risen slightly in recent years Market Value Equity in Millions (S) 3800 2150 972 Market Value Sales in Company Millions(S) Debt in Millions Equity BetaRate Price (S) Tax Share Relevant ABJ Opus Software 752 843 211 1.702 2.8 3.4 23% 23 23% 42 24 13 6.5 13 Smarty uses the information from the preliminary prospectus for TagOn's initial offering. The company intenc to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between $7 and $12. The current capital structure of TagOn consists of a $2.4 million fi year non-callable bond issue and 1 million common shares. Other information that Smarty has gathered: Currently outstanding bonds $2.4 million five year bonds, coupons of 12.5% paid semiannually, with a market value of $2.156 million 5.25% 7% 23% Risk free rate of interest Estimated equity risk premium Tax rate Question Assuming Tagon's new stock can be issued at $8 per share and target capital structure is 10% debt, what is the marginal cost of capital for TagOn? (15 points) Joe Smarty, CFA, has been engaged to conduct an evaluation on the upcoming new issue of TagOn, a based business intelligenc e Software Company. The industry has grown at 26% each year for the past 3 year ompanies dominate the market, but sizable "pure-play" companies such as Relevant, Ltd; ABJ, Inc, and Op Software Ltd also compete. Each of these competitors is do miciled in a different country, but they all have shares stock that trade on the U.S. NASDAQ. The debt ratio of the industry has risen slightly in recent years Market Value Equity in Millions (S) 3800 2150 972 Market Value Sales in Company Millions(S) Debt in Millions Equity BetaRate Price (S) Tax Share Relevant ABJ Opus Software 752 843 211 1.702 2.8 3.4 23% 23 23% 42 24 13 6.5 13 Smarty uses the information from the preliminary prospectus for TagOn's initial offering. The company intenc to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between $7 and $12. The current capital structure of TagOn consists of a $2.4 million fi year non-callable bond issue and 1 million common shares. Other information that Smarty has gathered: Currently outstanding bonds $2.4 million five year bonds, coupons of 12.5% paid semiannually, with a market value of $2.156 million 5.25% 7% 23% Risk free rate of interest Estimated equity risk premium Tax rate Question Assuming Tagon's new stock can be issued at $8 per share and target capital structure is 10% debt, what is the marginal cost of capital for TagOn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts