Question: DONT ANSWER IF YOU DID BEFORE I NEED TO BE SURE OF THE ANSWER EXPLANATION PLEASE A company is thinking of investing money in a

DONT ANSWER IF YOU DID BEFORE

DONT ANSWER IF YOU DID BEFORE

I NEED TO BE SURE OF THE ANSWER EXPLANATION PLEASE

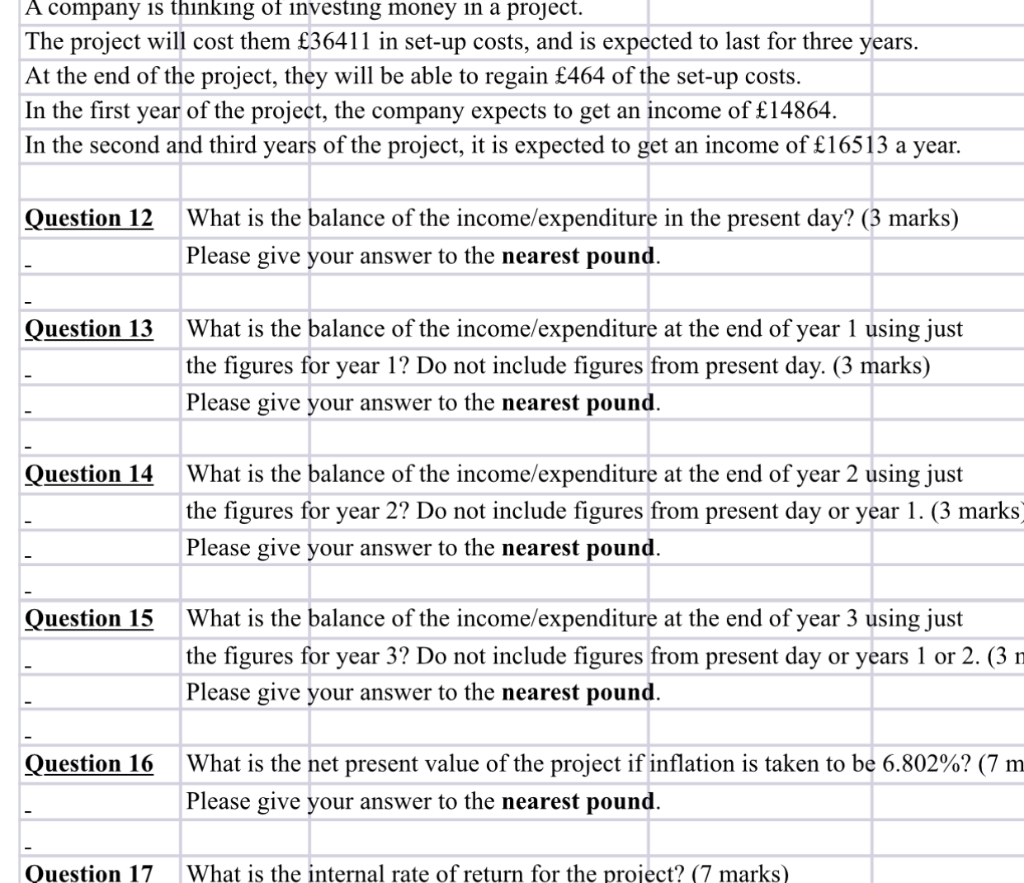

A company is thinking of investing money in a project. The project will cost them 36411 in set-up costs, and is expected to last for three years. At the end of the project, they will be able to regain 464 of the set-up costs. In the first year of the project, the company expects to get an income of 14864. In the second and third years of the project, it is expected to get an income of 16513 a year. Question 12 What is the balance of the income/expenditure in the present day? (3 marks) Please give your answer to the nearest pound. Question 13 What is the balance of the income/expenditure at the end of year 1 using just the figures for year 1? Do not include figures from present day. (3 marks) Please give your answer to the nearest pound. Question 14 What is the balance of the income/expenditure at the end of year 2 using just the figures for year 2? Do not include figures from present day or year 1. (3 marks) Please give your answer to the nearest pound. Question 15 What is the balance of the income/expenditure at the end of year 3 using just the figures for year 3 ? Do not include figures from present day or years 1 or 2 . (3n Please give your answer to the nearest pound. Question 16 What is the net present value of the project if inflation is taken to be 6.802% ? (7m Please give your answer to the nearest pound. Ouestion 17 What is the internal rate of return for the project? ( 7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts