Question: Don't answer unless you know how to do it. On July 31, 2018, Jessica-Anne received land and a building from Janice as a gift. Janice's

Don't answer unless you know how to do it.

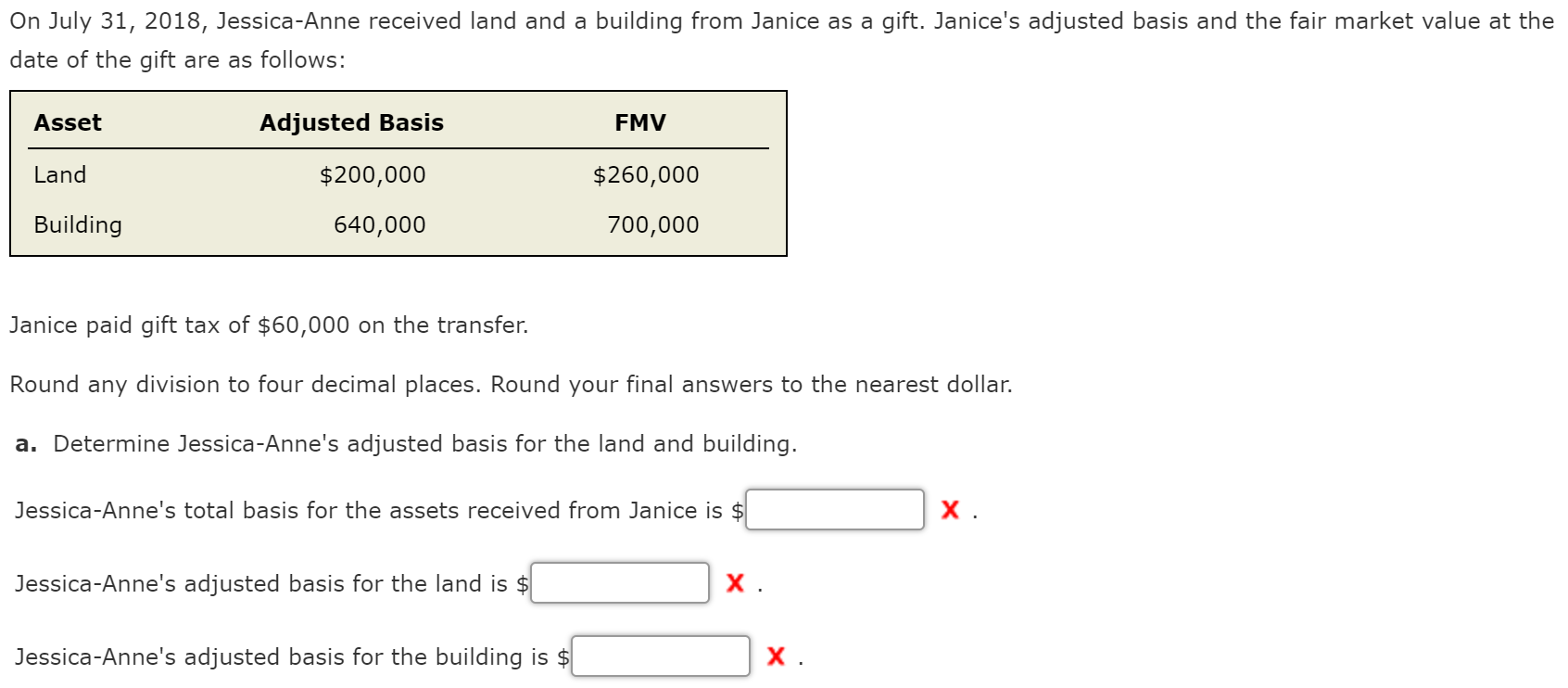

On July 31, 2018, Jessica-Anne received land and a building from Janice as a gift. Janice's adjusted basis and the fair market value at the date of the gift are as follows: Asset Adjusted Basis FMV Land $200,000 640,000 $260,000 700,000 Building Janice paid gift tax of $60,000 on the transfer. Round any division to four decimal places. Round your final answers to the nearest dollar. a. Determine Jessica-Anne's adjusted basis for the land and building. Jessica-Anne's total basis for the assets received from Janice is $ Jessica-Anne's adjusted basis for the land is $ x. Jessica-Anne's adjusted basis for the building is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts