Question: . Dont answer with the image shown below those equations are wrong.Step 2 a . How much would you be willing to invest today? Explanation:

Dont answer with the image shown below those equations are wrong.Step

a How much would you be willing to invest today?

Explanation:

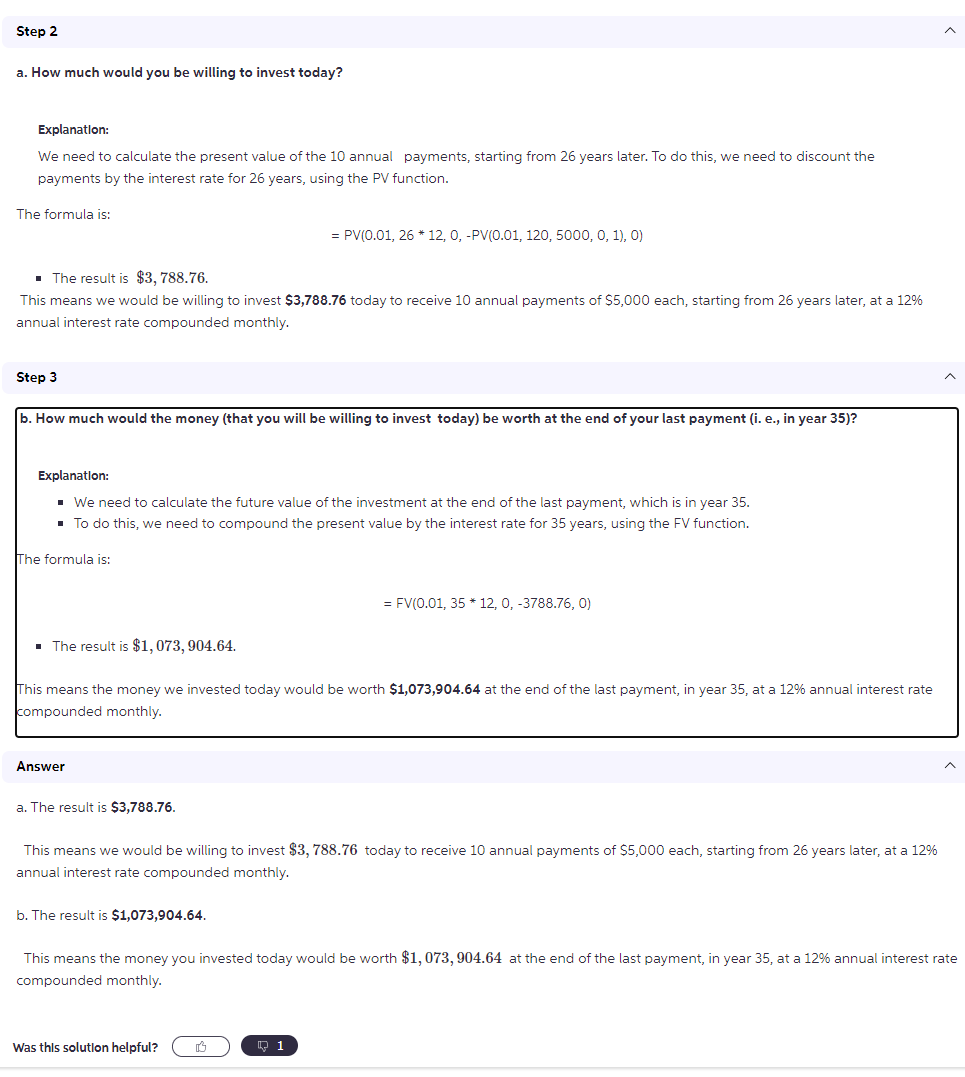

We need to calculate the present value of the annual payments, starting from years later. To do this, we need to discount the

payments by the interest rate for years, using the PV function.

The formula is:

The result is $

This means we would be willing to invest $ today to receive annual payments of $ each, starting from years later, at a

annual interest rate compounded monthly.

Step

b How much would the money that you will be willing to invest today be worth at the end of your last payment i e in year

Explanation:

We need to calculate the future value of the investment at the end of the last payment, which is in year

To do this, we need to compound the present value by the interest rate for years, using the FV function.

The formula is:

The result is $

This means the money we invested today would be worth $ at the end of the last payment, in year at a annual interest rate

compounded monthly.

Answer

a The result is $

This means we would be willing to invest $ today to receive annual payments of $ each, starting from years later, at a

annual interest rate compounded monthly.

b The result is $

This means the money you invested today would be worth $ at the end of the last payment, in year at a annual interest rate

compounded monthly.

Was thls solution helpful?

Answer the question below with excel formulas and check my work as well. Complete the question asked in yellow and show full work

You are offered the opportunity to put some money away for retirement. You will receive annual payments of $ each beginning in years. If you desire an annual interest rate of compounded monthly, answer the following two questions:

a How much would you be willing to invest today?

a

b How much would the money that you will be willing to invest today be worth at the end of your last payment ie in year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock