Question: Don't claim the deduction for QBI, and do not itemize dedu Accounting Periods and Methods Measure their taxable income over a tax year, and that

Don't claim the deduction for QBI, and do not itemize dedu Accounting Periods and Methods

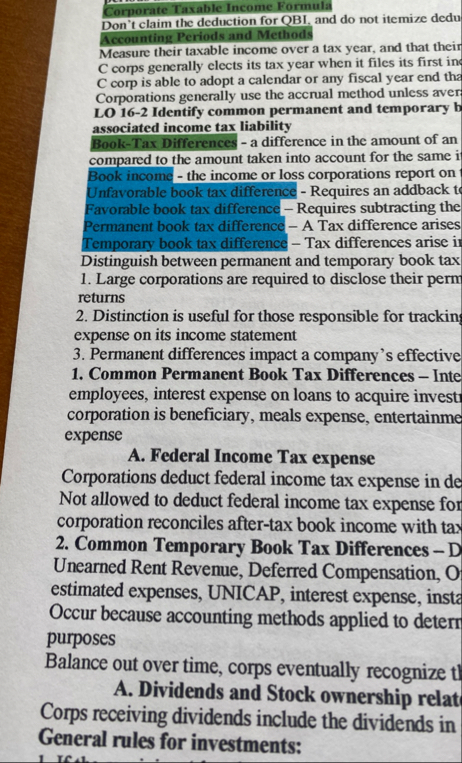

Measure their taxable income over a tax year, and that their C corps generally elects its tax year when it files its first in C corp is able to adopt a calendar or any fiscal year end tha Corporations generally use the accrual method unless aver LO Identify common permanent and temporary b associated income tax liability

BookTax Differences a difference in the amount of an compared to the amount taken into account for the same it Book income the income or loss corporations report on Unfavorable book tax difference Requires an addback t Favorable book tax differenceRequires subtracting the Permanent book tax difference A Tax difference arises Temporary book tax difference Tax differences arise is Distinguish between permanent and temporary book tax

Large corporations are required to disclose their perm returns

Distinction is useful for those responsible for tracking expense on its income statement

Permanent differences impact a company's effective

Common Permanent Book Tax Differences Inte employees, interest expense on loans to acquire invest corporation is beneficiary, meals expense, entertainme expense

A Federal Income Tax expense

Corporations deduct federal income tax expense in de Not allowed to deduct federal income tax expense for corporation reconciles aftertax book income with tax

Common Temporary Book Tax Differences D Unearned Rent Revenue, Deferred Compensation, O estimated expenses, UNICAP, interest expense, insta Occur because accounting methods applied to detern purposes

Balance out over time, corps eventually recognize th

A Dividends and Stock ownership relat Corps receiving dividends include the dividends in General rules for investments:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock