Question: dont do first question do the seocnd one Instruction The following transactions and adjusting entries were completed by Legacy Funiture Co during a three year

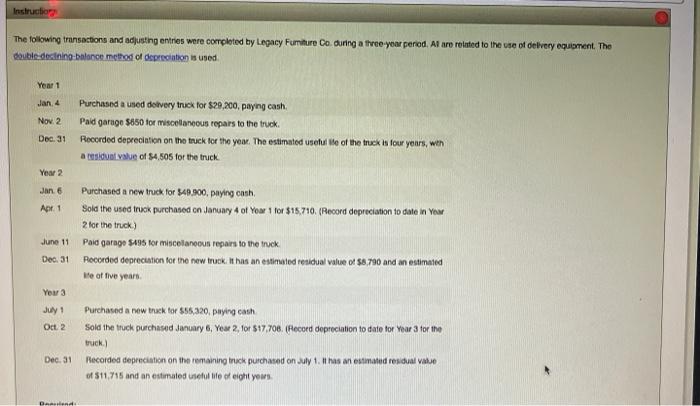

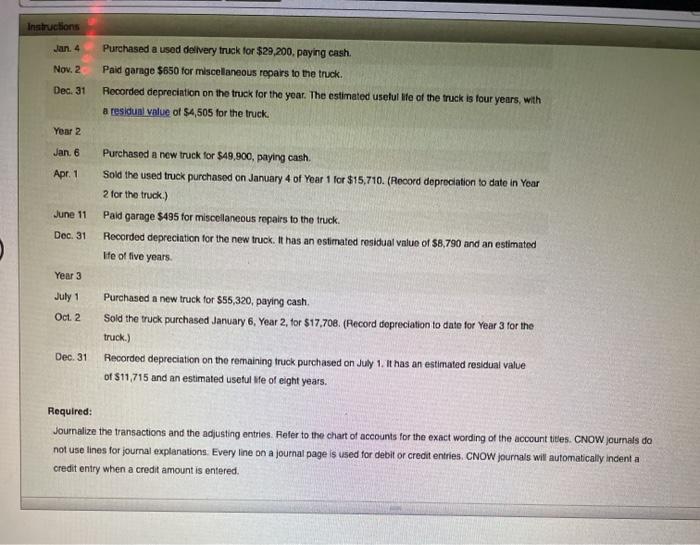

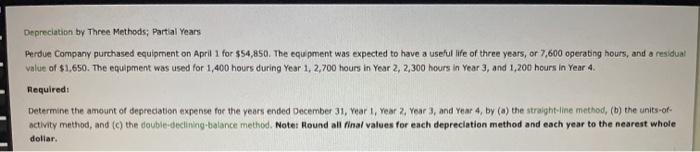

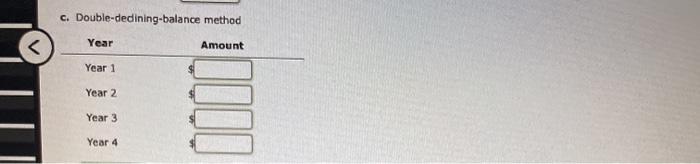

Instruction The following transactions and adjusting entries were completed by Legacy Funiture Co during a three year period. Al are related to the use of delivery equipment. The doubledecining balance method of depreciation is used Year 1 Jan 4 Nov. 2 Purchased a used delvery truck for $20,200, paying cash. Paid garage $850 for miscellaneous repairs to the truck Recorded depreciation on the truck for the you. The estimated useful We of the truck is four years, win asidalyalue of $4,505 for the truck Dec. 31 Yew 2 Jan 6 Apr 1 Purchased a new truck for $49.900, paying onth, Sold the used truck purchased on January 4 of Your 1 for $15.710. (Record depreciation to date in your 2 for the truck) Paid garage 5495 for miscellaneous repairs to the truck Recorded depreciation for the new truck. It has an estimated residual value of $8,780 and an estimated We of five years June 11 Dec 31 Yew 3 July 1 Oct 2 Purchased a new track to $55,320, paying can Sold the truck purchased January 6, Year 2. for 517,708. (Record depreciation to date for Your 3 for the truck Pecorded depreciation on the remaining truck purchased on July 1. has an estimated residual vise 01511715 and an estimated se le of eight years Dec. 31 Band Instructions Jan. 4 Nov. 2 Purchased a used delivery truck for $29,200 paying cash. Paid garage $650 for miscellaneous repars to the truck. Recorded depreciation on the truck for the year. The estimated useful le of the truck is four years, with a residual value of $4,505 for the truck. Dec. 31 Year 2 Jan 6 Apr. 1 Purchased a new truck for $49,900, paying cash. Sold the used truck purchased on January 4 of Year 1 for $15,710. (Record depreciation to date in Year 2 for the truck.) Paid garage $495 for miscellaneous repairs to the truck. Recorded depreciation for the new truck. It has an estimated residual value of $8,790 and an estimated He of five years June 11 Dec. 31 Year 3 July 1 Oct. 2 Purchased a new truck for $55,320, paying cash Sold the truck purchased January 6, Year 2 for $17,708. (Record depreciation to date for Year 3 for the truck.) Recorded depreciation on the remaining truck purchased on July 1. It has an estimated residual value of $11,715 and an estimated useful We of eight years. Dec. 31 Required: Journalize the transactions and the adjusting entries. Refer to the chart of accounts for the exact wording of the account titles. CNOW Journals de not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indenta credit entry when a credit amount is entered. Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on April 1 for $54,850. The equipment was expected to have a useful life of three years, or 7,600 operating hours, and a residual value of $1,650. The equipment was used for 1,400 hours during Year 1, 2,700 hours in Year 2, 2,300 hours in Year 3, and 1,200 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1 Year 2 Year 3, and year 4, by (a) the straight-line method, (b) the units-of- activity method, and (c) the double-declining-balance method. Noter Hound all final values for each depreciation method and each year to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts