Question: don't do it with excel please Problem 5 (7 points) The construction company CCG is entirely financed by own funds. A financial institution has just

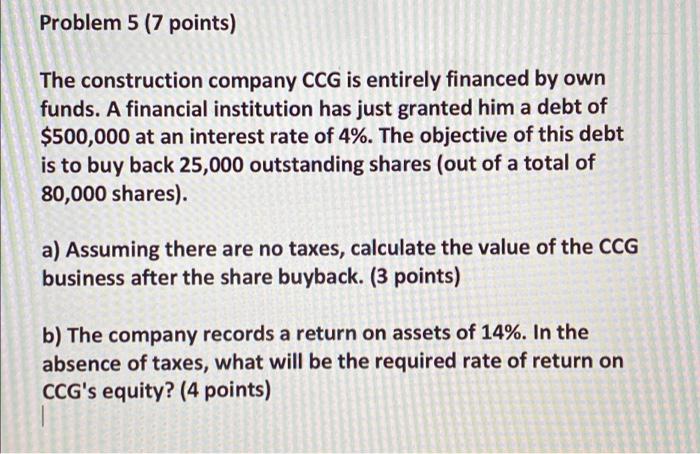

Problem 5 (7 points) The construction company CCG is entirely financed by own funds. A financial institution has just granted him a debt of a $500,000 at an interest rate of 4%. The objective of this debt is to buy back 25,000 outstanding shares (out of a total of 80,000 shares). a) Assuming there are no taxes, calculate the value of the CCG business after the share buyback. (3 points) b) The company records a return on assets of 14%. In the absence of taxes, what will be the required rate of return on CCG's equity? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts