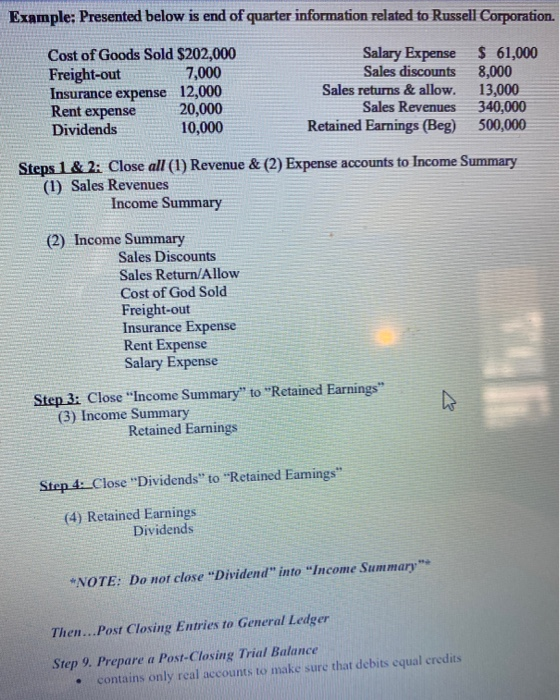

Question: dont do last step Example: Presented below is end of quarter information related to Russell Corporation. Cost of Goods Sold $202,000 Freight-out 7,000 Insurance expense

Example: Presented below is end of quarter information related to Russell Corporation. Cost of Goods Sold $202,000 Freight-out 7,000 Insurance expense 12,000 Rent expense Dividends 10,000 Salary Expense Sales discounts Sales returns & allow. Sales Revenues Retained Earnings (Beg) $ 61,000 8,000 13,000 340,000 500,000 20,000 Steps 1 & 2: Close all (1) Revenue & (2) Expense accounts to Income Summary (1) Sales Revenues Income Summary (2) Income Summary Sales Discounts Sales Return/Allow Cost of God Sold Freight-out Insurance Expense Rent Expense Salary Expense Step 3: Close "Income Summary" to "Retained Earnings" (3) Income Summary Retained Earnings Step 4:_Close "Dividends" to "Retained Eamings" (4) Retained Earnings Dividends *NOTE: Do not close "Dividend" into "Income Summary" Then...Post Closing Entries to General Ledger Step 9. Prepare a Post-Closing Trial Balance contains only real accounts to make sure that debits equal credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts